Burkina Faso

Bureau

des Mines et de la Géologie du Burkina (BUMIGEB)

Bureau

des Mines et de la Géologie du Burkina (BUMIGEB)

01

BP 601, Ouagadougou 01

Phone: +226-50-364802/364890

Fax: +226-50-364888

bumigeb@cenatrin.bf

Phone: +226-50-364802/364890

Fax: +226-50-364888

bumigeb@cenatrin.bf

CIA Factbook

Political rights and civil liberties (Freedom House)

French-English online dictionary

Travel and accommodation

The contribution of mining to total exports in 2010 amounted to 40.7%

Burkina Faso Mining News

Source: CIA Factbook

Legend

Legend

Geology

Burkina Faso is predominantly underlain by rocks of the Guinea Rise which borders the Gulf of Guinea and extends from Sierra Leone in the west to Ghana in the east. This rise or dome feature is composed of probable Archean aged migmatites, granitic gneisses and amphibolites overlain by north to northeasterly trending greenstone belts of metasediments and metavolcanics dominated by units of the (Paleo-)Proterozoic Birrimian Supergroup .

Burkina Faso is part of the West Africa Craton which includes two principal Precambrian domains: the Réguibat Rise to the North and the Man Rise or Leo Rise in the South, separated by the late Proterozoic to Palaeozoic Taoudéni Basin. These two domains display similar organization with Archean terranes (3.5–2.7 Ga) located to the west and Palaeoproterozoic rocks (2.2–2.0 Ga) to the east (Bessoles, 1977; Cahen et al., 1984; Camil, 1984).

Situated in the heart of West Africa, the geology of Burkina Faso is dominated by Palaeoproterozoic or Birimian rocks that underlie most of the country.

Younger rocks, Paleozoic age, crop out only in the far west and southeast of the country, respectively as part of the Taoudéni and Volta sedimentary basins.

The Birimian rocks consist of predominantly northeast to north-northeast-trending greenstone belts hosting the volcano sedimentary rock sequences followed by granitoîds and complex migmatitic gneisses.

The majority of the country’s mineral occurrences is hosted by the greenstone belts divide in to several highly prolific belts: Banfora greenstones belts in the westernmost part, followed by the Houndé and Boromo greenstones belts in the West. Then the Kaya-Goren and Djibo greenstones belts respectively in the Center-North and the North. Lastly the Tenkodogo greenstone belts in the East.

Burkina Faso is part of the West Africa Craton which includes two principal Precambrian domains: the Réguibat Rise to the North and the Man Rise or Leo Rise in the South, separated by the late Proterozoic to Palaeozoic Taoudéni Basin. These two domains display similar organization with Archean terranes (3.5–2.7 Ga) located to the west and Palaeoproterozoic rocks (2.2–2.0 Ga) to the east (Bessoles, 1977; Cahen et al., 1984; Camil, 1984).

Situated in the heart of West Africa, the geology of Burkina Faso is dominated by Palaeoproterozoic or Birimian rocks that underlie most of the country.

Younger rocks, Paleozoic age, crop out only in the far west and southeast of the country, respectively as part of the Taoudéni and Volta sedimentary basins.

The Birimian rocks consist of predominantly northeast to north-northeast-trending greenstone belts hosting the volcano sedimentary rock sequences followed by granitoîds and complex migmatitic gneisses.

The majority of the country’s mineral occurrences is hosted by the greenstone belts divide in to several highly prolific belts: Banfora greenstones belts in the westernmost part, followed by the Houndé and Boromo greenstones belts in the West. Then the Kaya-Goren and Djibo greenstones belts respectively in the Center-North and the North. Lastly the Tenkodogo greenstone belts in the East.

-

Gold occurs throughout the country

-

Zinc

-

Manganese

-

Copper

-

Nickel

-

Antimony

-

Diamond

Mining

Burkina Faso's mineral resources include gold, manganese, copper, zinc, silver, limestone, marble, phosphates, pumice and salt but gold is by far the most important mineral to the economy. Mineral commodities produced in 2008 were limited to gold and various industrial and construction materials. Gold production, with the opening of the Kalsaka, Mana and Youga mines, increased by almost 250% in 2008 and Burkina Faso was ranked the eighth largest producer in Africa. Burkina Faso is set to become Africa’s fourth largest gold miner by 2012. Birimian-age greenstone belts cover large parts of Burkina Faso and host the known structurally controlled quartz vein and stockwork mineralization, Gold is recorded from 7 major districts in Burkina Faso and in addition alluvial diamonds have been recorded but to date no major discoveries have been announced. In addition to gold the country’s most significant mineral resources are zinc and maganmese. The Kiere Manganese Mine (600,000 tonnes @ 45-55% Mn) opened in December 2008 and a feasibility study on the Tambao deposit (19 Mt @ 52 % Mn) was completed and mine construction is due to start in 2009-10. The Perkoa zinc and silver mine is expected to start construction in 2010. Exploration for copper and uranium is ongoing.

Maps and images

- Burkina Faso Google Satellite Maps

- Burkina Faso Cities,Towns, Airports, Maps, Images

- Burkina Faso Geology-1

- Burkina Faso Geology-2

- Burkina Faso Geology-3

- Burkina Faso Gold exploration projects

- Burkina Faso Image-1

- Burkina Faso Image-2

- Burkina Faso Mineral Potential (Mining Journal)

- Burkina Faso Minerals

- Burkina Faso Topography-1 Ouagadougou

- Burkina Faso Topography-2 Pama

- Available Geological Maps (45)

- Available Geophysical Maps (19)

- Goldcrest Resources Ltd (Canadian, GCL.V} is exploring the Gaoua copper-gold project in Burkina Faso. The drilling of the Gaoua Cu-Au prospect is being executed under an option agreement that the company signed with Phelps Dodge Exploration Corporation, a wholly-owned subsidiary of Freeport McMoRan Copper & Gold Inc. Most of the breccia-hosted mineralization consists of hypogene chalcopyrite with which gold values appear to be closely correlated. (see Volta Resources Inc under Gold)

Gold in Burkina Faso

Gold Home

Click HERE for an overview

Click HERE for a map showing gold deposits

Click HERE for a map showing major mineral projects

Click HERE for a map showing gold deposits

Click HERE for a map showing major mineral projects

Burkina Faso aimed to produce 15-20 tonnes of gold a year by 2009 as new mines come on line after an eight-year halt in commercial output. It equates to around 480,000-640,000 oz. The last commercial mine closed in 1999 after gold prices sank below $300 an oz and foreign prospectors left.

Geology

Birimian-age greenstone belts cover large parts of Burkina Faso and host the known structurally controlled mineralization.

- Orezone Resources (Canadian, TSX:OZN.TO; Amex:OZN, and also active in Niger) is exploring a number of properties including Essakane, where Gold Fields (NYSE:GFI; JSE:GFIELDS) is the operator, earning 60%. The Essakane deposit hosts an 1,9 million oz indicated resource at 1,60 g/t Au and 1,5 million oz of inferred resource at 1,70 g/t Au (0,50 g/t Au cut-off). Further drilling by Gold Fields increased the indicated resource to 2,6 million oz at a cut-off of 1 g/t or an indicated resource of 3,3 million oz and inferred 800,000 oz of gold at a cut-off of 0,5 g/t (April, 2007). The pre-feasibility study showed that an open cast mine and a 5,4 million tonne/year carbon-in-leach plant were viable and could produce 300,000 oz of gold a year. Gold Fields sold its 60% stake in the Essakane gold prospect in Burkina Faso for $200m to its partner in the project, Canada's Orezone Resources, in September, 2007."While the Essakane project is expected to make a good return and deserves to be built, Gold Fields’ relatively small stake in the project mitigates against it becoming a Gold Fields franchise asset," said Gold Fields CEO Ian Cockerill.The prospect has four million ounces of measured and indicated resources and 1.3 million ounces of inferred resources at a 0.5 g/t cut-off. It would cost $346m and take 18 months to build a mine and CIL plant with an annual capacity of 5.4 million tonnes.The mine is envisioned to produce 292,000 oz of gold a year at a cash cost of US$356/oz.Orezone will decide whether it will pay Gold Fields $150m in cash and $50m in shares or the entire amount in cash. Gold Fields has spent $47m on the project already. Intiédougou (Golden Hill) has an inferred resource of 157 000 oz gold at 1,4 g/t Au. The Bondi deposit has an indicated resource of 162 964 oz at 2,88 g/t Au. The Sega deposit has an inferred resource of 300 000 oz at 2,8 g/t Au. The Bombore deposit has a resource of 1,1 million oz gold at an average grade of 1,5 g/t Au. Licences also cover known gold occurrences at Tomena and Seguenega. Orezone (TSX: ORE) announced in August 2012 that the company added 1.6 million ounces gold to the overall resource tally on its Bombore gold project in Burkina Faso, pushing the 3.5 million ounces gold it counted in 2010 to just over five million. Meantime, Orezone managed to kick gold grade up a notch. In 2010 Orezone reported 61 million tonnes @ 0.81 g/t gold indicated for about 1.6 million ounces gold and another 61 million tonnes @ 0.96 g/t Au, inferred, for 1.9 million ounces gold. In comparison, Orezone said on Tuesday it had 125 million tonnes @ 1.03 g/t Au for 4.13 million ounces gold in measured and indicated resources, along with 32 million tonnes @ 1 g/t Au for 1 million ounces gold in inferred resources. The improvement in gold grade owed in part to more conservative cut-off grades. In 2010 its base case cutoff for oxide resources, for instance, was 0.3 g/t Au, whereas in the latest resource Orezone went with 0.45 g/t Au. That conservatism undoubtedly reflected rising operating costs in the mining sector and pressure to maximize return for every tonne. Indeed the resource falls within a pit that has been modeled on operating estimates, all of which have risen markedly over the past two years for all miners. For example Orezone assumed mining costs of $1.90 for oxide material this time round versus $1.10 in 2010. Such cost ressure made it harder to squeeze out five million ounces. And gave Orezone a chance to brag. Pascal Marquis, Orezone's senior vice president of exploration, pointed to cost escalation in a statement, saying "Even with such increases, we were still able to reach our target of a plus-five million ounce deposit at a grade of 1 gram per tonne."The initial focus at Bombore is on oxide material that makes up 70 percent or 1.8 million ounces gold of measured and indicated resources. IAMGOLD commenced management of the Essakane project following the acquisition of Orezone Resources in February 2009.Essakane gold mine

- Goldbelt Resources Ltd (Canadian, GLDRF.PK, GLD.V) is exploring the Inata deposits, an estimated resource of 15,65 million tonnes grading an average of 1,9 g/t Au (948,000 oz gold) in the measured and indicated categories and 4,06 million tonnes grading 1,4 g/t gold (190,000 oz Au) in the inferred category, as well as known occurrences at Belahouro, Houndé, Bougouriba. (The Bougouriba belt, south of Houndé, is currently host to 20,000 artisanal miners) and at Quedrogo, Koupela region. The updated resource estimate for Iata in July, 2007, was 25.1 MT @ 1.7 g/t gold for 1,396,930 ounces of Measured and Indicated Resources (5.2 MT @ 2.3 g/t gold for 378,480 ounces of Measured Resources and 19.8 MT @ 1.6 g/t gold for 1,018,450 ounces of Indicated Resources) and an additional 7.1 MT @ 1.3 g/t gold for 297,910 ounces of Inferred Resources (includes the Sayouba and Minfo resources as previously estimated). This new estimation, calculated by Multiple Indicator Kriging using an 0.5 g/t gold cut-off grade, represents a 16% increase in the tonnage and a 16% increase in the contained gold of Measured and Indicated Resources from the previous estimate completed in March 2007. On October 4, 2007 Goldbelt announced the results of the Final Feasibility Study for the Inata Project which was coordinated and compiled by GBM Minerals Engineering Consultants Limited of London, England. The Study outlines a 2,250,000 tonnes per annum mill throughput utilizing a cyanide-in-leach process plant and cash operating costs of US$ 336/oz. The project will have a 7 year mine life with payback after 2.7 years at a US$650/oz gold price. The Internal Rate of Return for the project is 49.75% and the undiscounted Net Present Value is US$128.0 million. Goldbelt Resources Ltd. announced on December 13, 2007, that Wega Mining ASA, through its wholly-owned subsidiary Wega Mining Inc, bought a controlling interest in the company. Wega Mining ASA is an Oslo-based international mining company focused on exploring, developing and operating gold, copper and zinc deposits. Wega Mining currently holds exploration licenses in Guinea, Canada, Portugal, Ecuador, Romania and Norway, and a gold-copper development project in Canada. The Goldbelt license portfolio in southwest Burkina Faso has been expanded considerably from 7 licenses occupying 1,655 km2 to 14 licenses covering 3,184km2 due to the recent acquisition of the Barrick projects in Burkina Faso

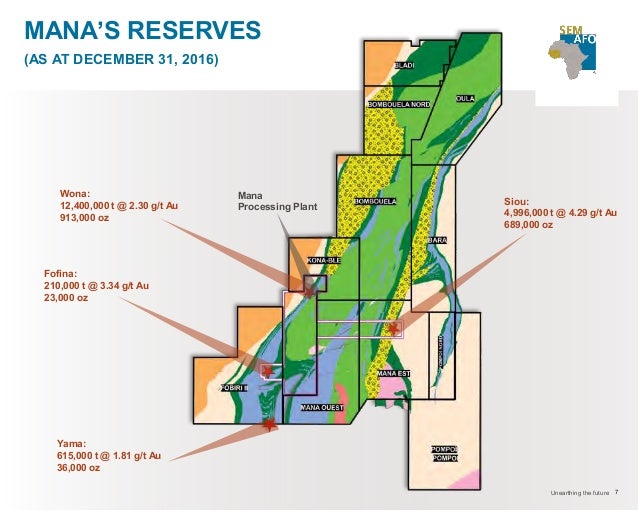

- Semafo Inc's (Canadian, TSX:SMF.TO; SEMFF.PK, and operating the Kineiro mine in Guinea and Samira Hill mine in Niger) Mana project with the Nyafé and Wona deposits totalling 9,443,000 tonnes of ore at an average grade of 2,89 g/t Au. Following the detailed drilling work done during 2007 and the updating of operating costs taking into account increased gold prices from $450 to $550 per ounce, Mana mineral reserves increased by 3% compared to 9,196,700 tonnes of ore having an average grade of 3.06 g/t and containing 902,900 oz of gold over 2006.

- Orbis Gold Ltd Natougou project has 18 Mt @ 3.4g/t Au for 2.0M ozs contained gold. Positive Scoping Study results indicate potential for low cost open pit mine production up to 213000 ozs of gold per annum over an initial 6.2 year mine life. A Definitive Feasibility Study (DFS) commenced and is scheduled for completion in mid-2015.

- Goldcrest Resources Ltd (Canadian, GCL.V} is exploring the Gaoua copper-gold and Kampti and Titao Sud gold projects in Burkina Faso. The drilling of the Gaoua Cu-Au prospect is being executed under an option agreement that the company signed with Phelps Dodge Exploration Corporation, a wholly-owned subsidiary of Freeport McMoRan Copper & Gold Inc. Most of the breccia-hosted mineralization consists of hypogene chalcopyrite with which gold values appear to be closely correlated. Canadian gold exploration companies Birim Goldfields and Goldcrest Resources have agreed to merge, they said on January 30, 2008. Both companies own property in Burkina Faso, and Birim is also exploring in neighbouring Ghana.

- Roxgold Inc is a gold exploration and development company with its key asset, the high grade Yaramoko exploration permit located in the mineral-rich Houndé greenstone region of Burkina Faso, West Africa. The Yaramoko Concession is located in North-East portion of Hounde Greenstone Belt. Paleoproterozoic (2200-2000 Ma) NNE-SSW elongated belts stretching 400 kilometres. Multiple gold and base metal deposits identified. Eastern part of belt is a 6 km thick basalt sequence bounded to west by Boni shear zone, making contact with younger Tarkwian type sediments and further west more intermediate to acid rocks. Gold most commonly hosted in quartz veins in dilation and shear zones in granitoid, felsic porphyry and volcanics. Also in sheared volcanics with no conspicuous quartz veining. Gold mineralization occurs in an WSW trending sub-vertical structures The Company recently delivered a positive Preliminary Economic Assessment and an updated resource estimate for Yaramoko's 55 Zone. A Feasibility Study is expected in Q2 2014.The Yaramoko permit covers approximately 167km2 hectares in the Province of Balé in southwestern Burkina Faso. The property is located approximately 200 kilometres southwest from the capital city of Ouagadougou. Yaramoko lies directly south of, and is contiguous to, the SEMAFO Inc. property hosting its flagship Mana Gold Mine and lies within the Hounde greenstone belt. On August 27, 2013, Roxgold released an updated resource estimate for the 55 Zone. The resource estimate is based on 99,077 metres of drilling and was prepared by AGP Mining Consultants Inc.) in accordance with National Instrument 43-101 Standards for Disclosure of Mineral Properties. The updated resource estimate returned 1,904,000 tonnes grading 13.88gpt for 850,000 contained ounces of gold in the Indicated category and 860,000 tonnes grading 9.88gpt for 273,000 ounces in the Inferred category with a 3.0gpt cut-off

- Volta Resources Inc is focusing primarily on its most advanced project in Burkina Faso, the completion of a Definitive Feasibility Study at the Company's cornerstone Kiaka Gold Project. The resource at Kiaka has recently been significantly enhanced with an updated NI43-101 compliant resource for the Kiaka deposit completed in January 2013. The Kiaka Gold Project now comprises Measured and Indicated Resources of 4.86 million ounces of gold and Inferred Resources of a further 1.01 million ounces of gold -- the largest undeveloped gold resource in the region. Over 97% of these resources are contained within a large, single open pit, with the balance found in a small satellite open pit located 700 meters to the southwest. Volta Resources also updated the NI43-101 compliant resource for the Gaoua Copper-Gold Porphyry Project in south-western Burkina Faso. Indicated Resources now stand at 139 million pounds of copper and 0.24 million ounces of gold and Inferred Resources at 2,008 million pounds of copper and 3.17 million ounces of gold. These resources are contained within two open pits, Gongondy and Dienemera, with both having the potential for extension along strike and down dip. Importantly, drilling at another two targets, Mont Biri and Boussera, has confirmed comparable porphyry-style copper-gold mineralization at potentially economic grades and widths that will warrant follow-up. In addition, in excess of 20 regional geophysical targets supported by copper and gold soil anomalism have been identified on the project footprint. Volta Resources is currently considering the best options to optimise value of this project in order to direct current resources to advancing Kiaka. Volta Resources also holds two additional early stage gold exploration projects in Burkina Faso. In 2013, work will be restricted to mapping and auger drilling utilising the Company's tractor-mounted power auger rigs, in order to refine targets for drilling follow-up later. The Nassara Gold Project is located in the south-western corner of the Gaoua group of properties while the Titao Gold Project is located at the junction of the northern end of the Hounde Belt and the Goren Belt.

- AXMIN Inc (Canadian, TSXv:AXM, and also active in the Central African Republic, Mali, Sierra Leone and Senegal) sold its interest in the Bouroum project to High River Gold Mines.

- Cluff Gold plc (CLF.L) is exploring the Kalsaka deposit located approximately 150 km north west of Ouagadougou, the capital of Burkina Faso. The orebodies identified to date at the project comprised within the exploitation decree, contain a mineral resource of 600,000 oz of gold (13,7 million t@1,4 g/t) and, at a gold price of US$400 per ounce, an ore reserve of 290,000 oz of gold (5,1 million t@1,8 g/t). Cluff wants to produce 60 000 oz of gold per year.

- Amara Mining plc's Kalsaka is a producing gold mine in Burkina Faso. The other interests in the project are held by the government of Burkina Faso (10% non-dilutable, free-carried) and a local entity IMAR-B (12%). Kalsaka and neighbouring Sega (which is due to begin production in Q3 2013), are expected to produce 50-60,000 ounces of gold in 2013. Kalsaka produced over 53,000 ounces in 2012. As at 31 December 2012, Kalsaka had an estimated 38,000 ounces of proven and probable reserves, at an average grade of 1.4g/t. Inclusive of the mineral reserves, it hosted 269,000 ounces of gold in the measured and indicated categories, at an average grade of 1.3g/t, with an additional 178,000 ounces of gold in the inferred category at 1.3g/t, in the current mine area. Kalsaka's production profile was enhanced by the recent acquisition of the neighbouring Sega project. Located 20km north of Kalsaka, Sega hosts an Indicated Resource of 450,366oz (8.3Mt at 1.69 g/t) and an Inferred Resource of 147,344oz (2.9Mt at 1.58g/t), providing an opportunity to enhance Kalsaka’s production profile with limited upfront capital expenditure. The Company plans to start mining at Sega in Q3 2013, and a preliminary economic assessment on Sega is underway.

- High River Gold Mines Ltd (Canadian, TSX:HRG.TO) has an indicated 8,6 million tonnes at a grade of 3,0 g/t Au or 827 000 oz gold at the Taparko-Bouroum project. High River Gold Mines announced commercial production at its Taparko-Bouroum gold mine, in Burkina Faso in September, 2007.The criteria established for commercial production required all components of the processing plant to operate for 30 consecutive days at 60% capacity or more.Mill throughput during the 30-day period, which ended on September 24, totalled 60 825 t, which represents an average capacity usage of 74%.High River Gold said in a statement that the mill was currently operating at over 80% capacity.The Taparko-Bouroum gold mine produced 3 623 oz of gold during the 30-day commercial production evaluation period.Gold production for 2007 was expected to total about 30 000 oz, with production for the year planned at 100 000 oz, and rising to over 140 000 oz in the third year of operation. About 214 000 t of ore remain stockpiled, ready for processing.

More information at Taparko

- Nordgold

operates nine mines in Russia, Kazakhstan, Burkina Faso and Guinea.

Nordgold has two development project, four advanced exploration

projects and a diverse portfolio of early exploration projects and

licenses in CIS, West Africa and French Guiana.The Taparko mine is

operated by SOMITA SA, a company 90% owned by Nordgold’s subsidiary

High River Gold. The remaining 10% belongs to the Government of

Burkina Faso. Mining at Taparko commenced in 2005, with the first

gold poured in late 2007. The Taparko mine has been developed with

three open pits. Mining of the Bouroum mine, which consists of three

deposits, commenced in the final quarter of 2013.

Nordgold has an interest in the Bis sa gold mine through their 100% stake in High River Gold (HRGWA). Bissa Gold SA, which owns both the Bissa mine and Bouly deposit, is 90% owned by Nordgold through HRGWA and 10% by the state of Burkina Faso.

- Jilbey Gold Exploration Ltd (now merged with High River Gold)has drilled out a measured and indicated 1,373 million tonnes grading 3,33 g/t or 147 250 oz gold at Bissa Hill.

- St Jude Resources Ltd (Canadian) is drilling a deposit at Goulagou.

- Golden Star Resources Ltd announced in October, 2007, that it will sell its 90% stake in the Goulagou and Rounga properties, in Burkina Faso, to Riverstone Resources Inc, a Canadian gold and uranium explorer. The company explained that Riverstone would spend C$4-million on exploration programmes on the properties over the next four years, before it would buy the properties for $18,6-million in cash, or in common shares. Golden Star would also receive up to two-million shares of Riverstone over the term of the option and would receive two-million common share purchase warrants of Riverstone at exercise prices of C$0,30 to C$0,45. In 2005, Golden Star acquired the 90% stake in Goulagou and Rounga through the merger with St. Jude Resources.

- True Gold Mining initially commenced operations in Burkina Faso in 2003 with the acquisition of the Rambo property.The company optioned the Goulagou and Rounga properties from Golden Star Resources Ltd in October of 2007. The Tougou and Youba permits adjoining Rambo were granted to Golden Star in 2008. In late 2011 True Gold exercised its option and in 2012 acquired Golden Star’s interest in the Goulagou, Rounga, Youba and Tougou permits. These properties are contiguous with True Gold's Rambo and Kao permits and collectively form the Karma Project. Today, True Gold’s Karma Project and Liguidi Project account for a combined total of over 1,000 square kilometres of exploration permits.

True Gold Mining Inc. (TSX-V; TGM) reported in October 2015 that mining had commenced at the Goulagou II (GGII) deposit at the Karma Gold Mine in Burkina Faso. The GGII deposit is the first of six deposits that will be mined over an 11.5 year period. The Company remains on track for gold production at the end of Q1, 2016. The GGII deposit has reserves of 273,000 leachable ounces of gold (contained in 7.6 million tonnes at 1.12 g/t gold) 1, and will be mined during the first two years of production.

- Riverstone Resources Inc has fifteen Exploration Permits and seven separate project areas, with one to four permits in each. In total, the Company controls close to 3,000 square kilometres.

Source: Riverstone Resources Inc

- Sanu Resources Ltd (Canadian, SNU.V, also active in Eritrea and Morocco) has four exploration licences (Moule, Nyieme, Loto, and Kodyel) totaling 827 km².

Goldplat entered into an agreement in December 2009 with Sanu Exploration (BVI) Limited, a wholly owned subsidiary of NGEX Resources Inc, to acquire Sanu's option over the 246 sq km Nyieme gold project in Burkina Faso . The Nyieme exploration licence includes known high-grade quartz vein structures, with drill core results showing up to 17.83 g/t gold over one metre and 11.67 g/t over five metres.

In December 2010 Goldplat announced a maiden JORC-compliant resource at the first target of the project totalling 685,000 tonnes at 2.61 g/t gold for 57,501 ounces of gold at a cut-off grade of 1.0 g/t Au for all categories.

- Birim Goldfields Inc optioned the 223 sq. km Sangolo property in April 2007. It is located within the prospective Hounde Gold Belt which hosts Semafo's Mana Project (combined gold reserves and resources of 1,045,800 oz) and is 15 km from Orezone Resources' Bondi and Golden Hill Projects (combined gold resources of 320,000 oz). Drill planning is underway on the Baobab and Acacia zones; the sites of active artisanal mining. Canadian gold exploration companies Birim Goldfields and Goldcrest Resources have agreed to merge, they said on January 30, 2008. Both companies own property in Burkina Faso, and Birim is also exploring in neighbouring Ghana.

- Etruscan Resources Inc (EET.TSX) reported on 5 October, 2007, that construction at its Youga Gold Mine located in Burkina Faso, is nearing completion with commissioning of the main plant circuits scheduled to be completed in November and first gold production in December.The Youga Gold Project will initially be comprised of open pit mining of five pits with the ore being processed though a conventional CIL/gravity plant having a design capacity of one million tonnes per annum. Mineable reserves are 6.6 million tonnes with an average grade of 2.7 grams per tonne contining 580,000 oz of gold. Etruscan expects to achieve commercial production at Youga in March or Apri, 2008,l with the facility targeted to produce between 60,000 to 70,000 oz of gold in calendar 2008. The company's exploration program will focus on the three different gold belts, namely: the Youga Gold Belt where a follow-up drilling is planned to ascertain a historic 200,000 ounce resource that was reported by Ashanti Goldfields; the Banfora Gold Belt, following up with a pitting and auger drilling programme on regional gold-in-soil anomalies that delineated four primary and eight secondary drill targets; and the Boromo Gold Belt where it is after expanding its strategic land package.

- Endeavour Mining operates the Youga Gold Mine, located approximately 180km southeast of Ouagadougou, the capital city of Burkina Faso. Youga has been in production since 2008 and produced 91,030 ounces of gold in 2012. Ore is processed through a conventional gravity-CIL plant with a design capacity of 1.0 Mtpa. Youga is a hard rock, drill and blast open pit operation that employs contractor mining. Grid power is delivered to site from Ghana via a 21 km transmission line. In early 2013, Endeavour completed a Preliminary Economic Assessment on the Ouaré deposit which is located 40km to the northeast of Youga to explore the economics of trucking the Ouaré material to the Youga plant to add three years to Youga's mine life.

Endeavour Mining Corp., through its wholly-owned subsidiary Endeavour Gold Corporation took over Avion Gold in 2012. Avion Gold acquired the Hounde Project from Avocet in October 2010. An initial indicated and inferred resource of 610,000 ounces of gold was reported, but the company hoped to increase the resource to over 1 million ounces by the end of 2011.

The Houndé project began construction in April 2016 and is progressing as planned, with more than 50% complete by the end of 2016. First gold pour is anticipated by the fourth quarter of 2017.

- AIM Resources has added to its interests in Africa, with the acquisition of prospecting rights for two gold exploration tenements in Burkina Faso. The Naboué and Bonzan tenements cover an area of 141 km2, and 151 km2 respectively, and are situated about 20 km along strike from the formerly operating Poura gold mine. he new prospecting sites were in close proximity to the company's Perkoa zinc project, in Burkina Faso, which would allow it to use personnel and equipment resources already in the area, and start gold exploration immediately.

- Taurus Gold Ltd's Daramandougou site consists of three separate permits along a 7km strike of mineralised shear hosted quartz veins and contains significant historical workings. 3D geological modelling, based on both historical and Taurus Gold data and a NI 43-101 report were completed in the first quarter of 2012. Besides this advanced project, Taurus Gold also has 13 other permits in Burkina Faso, and numerous identified anomalous targets will commence in 2013. Preparatory work for these projects has been completed, with substantial geophysical, geochemical and drilling data already in place.

- Golden Rim Resources has four grassroots projects in Burkina Faso for a total landholding of 3,800 km2. The Company’s primary focus is exploring its Balogo Project in southern Burkina Faso. The project has yielded some of the highest gold intercepts to come out of the country to date, with RC drill hole BRC071 intercepting 57m @ 40.6 g/t (1.3 oz/t) gold, incl. 8m @ 245 g/t (7.9 oz/t) gold.

The Korongou Project covers an area of 65km2.

It is located 230km NE of Ougadougou, in the highly prospective Lower

Proterozoic Birimian “Samira Hill” greenstone belt in Burkina and

is traversed by a significant NE-trending fault splay which is

connected to the major Markoye Fault system. This fault system

controls a number of major gold deposits in Burkina Faso, including

Kiaka (5.9 Moz gold), Bomboré (5.2 Moz gold) and Essakane (6.2 Moz

gold). The mineralised fault system extends into western Niger where

the 2 Moz Samira Hill is located.

More than 20 gold mineralised, parallel,

NE-trending shear structures have been identified in trenches, pits

and drilling within a 1km wide corridor in the eastern portion of

Korongou. The mineralisation lies in a package of highly altered

volcanic and volcanoclastic host rocks and is associated with a major

auger gold anomalies and a prominent 6km long dilational structural

jog along a regional NE-trending shear zone.

Epsilon has produced approximately 20,000 oz

of gold from the permit area since 1997. From 2007 - 2015, Epsilon

operated a small 10 tonne/day plant (gravity + cyanidation) at

Korongou. Oxide ore was extracted from a number of small pits to 8m

depth. The plant recovery averaged between 80% to 85%.

Since February 2013, Golden Rim has conducted

geological mapping and rock chip sampling, ground magnetics/IP

geophysical surveys, auger drilling and Reverse Circulation (RC)

drilling.

Geological mapping & rock chip sampling

program was completed over the entire 16km of strike of the

mineralised shear corridor at Korongou. A total of 450 rock chip

samples were collected. High grade rock chip gold assays included:

818 g/t gold, 142.1 g/t gold, 122.3 g/t gold.

A major auger drilling program (4,379 holes

for 19,924m) was completed at the Banoussai Prospect (NE portion of

Korongou). The auger drilling was conducted at 50m x 25m and outlined

the Guitorga gold anomaly (>50 ppb gold) over an area of 3.5km x

0.4km. The anomaly remains open to the NE and SW. The auger

sampling returned a number of high grade assays, including: 8,126 ppb

(8.1 g/t), 7,001 ppb (7.0 g/t), 6,850 ppb (6.9 g/t) and 6,822 ppb

(6.8 g/t) gold.

A 447 line km Induced Polarisation (IP) and

ground magnetic geophysical survey (100m x 25m spacing) was completed

over the 16km long x 3km wide main structural corridor at Korongou.

At least 14 chargeable and resistive anomalies are associated

with the Guitorga auger gold anomaly. Gold mineralisation is

frequently associated with disseminated sulphides (i.e. pyritisation

that increases chargeability) and silicification (increase of the

resistivity by the reduction of the porosity of the rock).

A coincident magnetic low anomaly was

identified with the Guitorga gold anomaly and this anomaly may be

related to magnetite destruction in the rocks due to hydrothermal

alteration associated with gold mineralisation. Two test lines

totalling 5km of pole-dipole IP were completed for a better

structural understanding of the auger anomaly.

Golden Rim completed 3 campaigns of RC

drilling at Korongou (April-May 2013, May 2014 and April-June

2015) for a total of 130 holes for 15,851m.

Significant gold mineralisation was

intercepted in multiple NE-trending parallel zones in the drilling at

the Banouassi Prospect. The best RC drilling intersections include:

21m at 5.6 g/t gold, 8m at 3 g/t gold, 10m at 4.5 g/t gold and 9m at

3.2 g/t gold.

An initial Exploration Target of approximately

500,000 ounces to 611,000 ounces of gold at an approximate grade

range of 1.8 g/t to 2.2 g/t gold has been identified at the Banouassi

Prospect to a vertical depth of 70m. Most of the gold zones included

in the Exploration Target are open along strike and at depth. In

particular, a 900m gap in the drilling between the Guitorga North and

Guitorga South areas offers scope to expand the Exploration Target.

- Goldrush Resources' flagship project is the

Ronguen gold deposit where, in early 2008, the company defined an

inferred gold deposit of 249,000 ounces of gold (5.9 M tonnes at a

grade of 1.31 g/t Au). Goldrush has also recently confirmed the

presence of prospective targets at its Ouavousse permit.

First Mining Finance Corp. and Goldrush Resources Ltd. entered into an agreement in 2015 whereby Goldrush became a wholly-owned subsidiary of First Mining.

Gryphon Minerals has been exploring it’s 100%-owned Banfora project in the south-west. This project is located in a major gold-producing area, with the project consisting of six exploration licences over an area of 1 200 km2.

Ampella Mining acquired five permits in the Batie West project in 2008. Aggressive exploration has revealed the multi-million ounce gold potential of this region, with six new gold discoveries.

Montreal-based Searchgold has acquired two new permits on the wholly-owned Dou-Taouremba project.

Tambao manganese deposit

Tambao is a manganese deposit and potential mine site in the Oudalan Province, located in the Sahel Region, which the far northeastern part of Burkina Faso. Tambao has been estimated to be one of the largest deposits in the region.

The Tambao manganese deposit consist of two 80 meters high hills mainly composed of manganese oxides produced by the weathering of a manganese- rich Birimian metavolcanic and volcano-sedimentary series. About 70% of the deposit derives from metacarbonates mainly composed of rhodochrosite, associated to primary oxides(manganosite and hausluannite) and manganese silicates as rhodonite and tephroite.

Its development, a major priority of the Burkinabe state, has been an on and off project since the 1990s. Barely served by roads or other infrastructure, the Tambao reserves are some 210 kilometres (130 mi) north of Kaya and 350 kilometres (220 mi) northeast of the capital, namely Ouagadougou. The Tambao Airport has been recently built to serve the deposit and the corresponding villages. For at least two decades it has been considered the most potentially lucrative mining resource in Burkina, and is believed to be the region's largest manganese deposit, estimated at 20 million tonnes at 52% to 53% Mn, The site's inaccessibility and lack of infrastructure have prevented wide scale exploitation. In 1993 InterStar Mining carried out 6 months of operations here, but were plagued by lack of supportive resources. Large scale exploitation was only again attempted by the Fompex consortium in 2004 and was quickly halted Apart from total lack of infrastructure (power, water, construction or employment base) the biggest hurdle to commercial exploitation of the Tambao reserves is the lack of an all weather roadway capable of supporting the transport fleet needed to move ore the 210 kilometres (130 mi) to Kaya, the nearest city connected to the Burkinabe road network. In 2010, the Burkinabe government carried out talks with investors from India aimed at building a 250 km railway line from Tambao to Kaya. Later that year, the Burkinabe government tendered a series of openings for mining operations in Tambao. In 2010 two consortia emerged offering to develop an integrated mining and rail system which, in some proposals, would not only mine and process ore, but build longer rail lines to feed into the Ivorian rail network for export at the port of Abidjan. Major contenders were a Singaporean/Indian joint venture, the Nice Group company, and a tie up of the Japanese firm Mitsui Rail Capital and Brazilian mining giant Vale S.A.

GNR fights Frank Timis over Burkina’s Tambao Manganese mines

The Tambao manganese deposit consist of two 80 meters high hills mainly composed of manganese oxides produced by the weathering of a manganese- rich Birimian metavolcanic and volcano-sedimentary series. About 70% of the deposit derives from metacarbonates mainly composed of rhodochrosite, associated to primary oxides(manganosite and hausluannite) and manganese silicates as rhodonite and tephroite.

Its development, a major priority of the Burkinabe state, has been an on and off project since the 1990s. Barely served by roads or other infrastructure, the Tambao reserves are some 210 kilometres (130 mi) north of Kaya and 350 kilometres (220 mi) northeast of the capital, namely Ouagadougou. The Tambao Airport has been recently built to serve the deposit and the corresponding villages. For at least two decades it has been considered the most potentially lucrative mining resource in Burkina, and is believed to be the region's largest manganese deposit, estimated at 20 million tonnes at 52% to 53% Mn, The site's inaccessibility and lack of infrastructure have prevented wide scale exploitation. In 1993 InterStar Mining carried out 6 months of operations here, but were plagued by lack of supportive resources. Large scale exploitation was only again attempted by the Fompex consortium in 2004 and was quickly halted Apart from total lack of infrastructure (power, water, construction or employment base) the biggest hurdle to commercial exploitation of the Tambao reserves is the lack of an all weather roadway capable of supporting the transport fleet needed to move ore the 210 kilometres (130 mi) to Kaya, the nearest city connected to the Burkinabe road network. In 2010, the Burkinabe government carried out talks with investors from India aimed at building a 250 km railway line from Tambao to Kaya. Later that year, the Burkinabe government tendered a series of openings for mining operations in Tambao. In 2010 two consortia emerged offering to develop an integrated mining and rail system which, in some proposals, would not only mine and process ore, but build longer rail lines to feed into the Ivorian rail network for export at the port of Abidjan. Major contenders were a Singaporean/Indian joint venture, the Nice Group company, and a tie up of the Japanese firm Mitsui Rail Capital and Brazilian mining giant Vale S.A.

GNR fights Frank Timis over Burkina’s Tambao Manganese mines

Phosphates

The northeastern

Neoproterozoic Volta Basin in Burkina Faso, Benin and Niger, contains the largest of a series of

deposits and sedimentary accumulations that occur in three Neoproterozoic

phosphogenic basins/regions distributed along the margins of the West African

craton. The other two are the Taoudeni Basin and the Anti-Atlas region.

Five main

phosphatic areas include Kodjari and Arli in flat-lying sections of the basin, Tapoa andMekrou (the

most important) in the folded portion of the basin, and Aloub Djouana in a structurally complex folded and metamorphosed

unit.

Kodjari and Arli are 60 km apart, both on the NE-SW trending

northwestern margin of the basin, whileAloub Djouana, which is 30 km SE of Kodjari, is on the eastern

side of the basin. All three are in far eastern Burkina Farso, around 485 km by

road to the east of the capital Ouagadougou. Tapoa is also on the northwestern margin of the basin, 70 km

NE of Kodjari, but in neighbouring Niger. The Mekrou series of deposits are generally 20 to 30 km south to

SE of Tapoa in Benin and Niger.

The Volta basin is

best developed in Ghana, narrowing to a fracture controlled depository that is

only around 50 km wide to the north where it contains the deposits detailed

above. The host sequence dips gently to the east where they overlie pre-1.7 Ga

crystalline Birrimian basement to the west, and become more deformed to the SE,

towards the NNE-SSW-trending Dahomeyide structural belt which is overthrust

from the east onto the Volta basin sediments at ~615 Ma. The Dahomeyides

represent a portion of the Pan-African (Cadomian) chain that extends northward

into the Hoggar chain and are interpreted to comprise metamorphosed basement.

The stratigraphic

sequence is divided into three units: (i) a ~1000 to 650 Ma Lower Voltaian Series of

sandstones and conglomerates (possibly of glacial origin), which include

hematitic claystone and conglomerate in Niger and Benin - overall regarded to

be of shallow continental origin; (ii) a middle series of mainly claystones of the

675 to 615 Ma Oti Group, and equivalent shales, silty shales, sandstones and

greywackes of the Pendjari Group in the Tapoa-Mekrou area in Benin and Niger;

and (iii) the Upper Voltaian Series of predominantly

arenaceous sediments of the Obosum Group which is Late Neoproterozoic the

Cambrian in age.

The bulk of the

mineralisation, particularly in the shallower dipping sections of the basin,

are contained within the ~100 m thick Kodjari Formation in the lower half of

the Oti Group. The type section at Kodjari commences with breccia lenses

conaining fragments of older quartzite from the underlying Lower Voltaian

deposited on a striated pavement. These are overlain by a green tillite

containing polished and striated boulders of granite, rhyolite, quartz,

sandstone, amphibolite, schist and gneiss in a matrix of clay-sand-carbonate.

The tillites are overlain in turn by 0.5 to 3 m of limestone which is dolomitic

(and baritic), often brecciated or slumped, followed by 25 to 30 m of

green-orange chert with intercalations of silty-shale and tuffaceous beds/silica-rich

volcanic ash. Overlying these are 0 to 30 m of argillaceous to micaceous

sitstone that may contain some phosphate, passing upwards and laterally into

the 0 to 15 m (generally >10 m) thick phosphate bed (20 to 30% P2O5) that comprises a fine to

very fine-grained argillaceous siltstone, that rests directly into the bedded

chert. These are all overlain by 1500 to 2000 m of green and black shale,

pyritic mudstone, clayey-siltstone, argillaceous and feldspathic sandstone with

thin intercalations of greywacke and limestone that comprises the Pendjari

Group. The succeeding Upper Voltaian Obosum Group is absent in the Kodjari

district.

The phosphorites at Kodjari are well bedded and essentially

composed of structureless grains of brown, cryptocrystalline, isotropic apatite

that range from 35 to 40, up to 200 µm, with a mean diameter of 80 µm. They are

characterised by their fine grain size and good sorting, and are commonly rich

in argillaceous and ferruginous impurities. Intraclasts and pseudo-oolites are

present but rare, but where present are composed of nucleii of brown,

cryptocrystalline isotropic apatite, encapsulated by a rim of colourless,

fibrous, crystalline apatite or chalcedony. The detrital grains are essentially

angular silt-sized quartz grains which make up ~1% of the rock. The cement,

which represents 20 to 25% of the rock, is composed of microcrystalline quartz,

crystalline and colourless apatite, small prisms of apatite, and some clay with

associated iron oxides and hydroxides.

According to Trompette et al.,

1980, these deposits contain in excess of 100 Mt of ore, including:

Kodjari - 60 Mt @ 27.5% P2O5,

Arly - 2.8 Mt @ 29% P2O5, both at a maximum 20 m

overburden.

The reserves of the deposits, cited by McClellan and

Notholt (1986), are:

Aloub Djouana - 224 Mt 15% P2O5,

Kodjari - 80 Mt @ >18% P2O5,

Arly - 4 Mt @ similar

grades.

Zinc

Click HERE for an overviewGeology

Perkoa is a volcanogenic massive sulphide (VMS) deposit. The massive sulphide Zn-Ag-Ba deposit is located in western Burkina Faso (12°22'N, 2°36'W), west Africa.

It is hosted by the Paleoproterozoic Birimian Supergroup of west Africa and comprises a main orebody, containing >90 percent of the reserves, with various satellite bodies, and is hosted by andesitic dykes, sills, breccias, tuffs, tuffite and dioritic to granitic dikes, structurally overlain by andesite, cumulate rich basic rocks and carbonaceous schist.

The main orebody is

semitabular with dimensions of 400x450 m, with an average thickness of 10 m.

The satellite orebodies have an average thickness of 4 m.

The immediate hosts

are tuffaceous, and are intruded by a 2175±1 Ma quartz diorite in the

structural footwall (stratigraphic hanging wall). The main orebody is

subparallel to, and is on average 15 m from, the steeply dipping intrusive

contact. The satellite orebodies are discontinuous but also show a preferred

orientation subparallel to the intrusive contact, on average 75 m

stratigraphically below the intrusion.

The massive

sulphide ore is predominantly composed of Fe-rich sphalerite (30%), pyrite

(25%), barite (10%), hexagonal pyrrhotite (5%), magnetite (5%), and white mica.

Quartz is mainly present as host rock relics. Significant quantities of

hydrothermal quartz were developed in the structural footwall of the deposit,

where the main orebody is close to the quartz diorite (0.5 m away). Albite,

(Ba, K) feldspar, Ba rich biotite, chlorite, tourmaline, andradite rich garnet,

ilmenite, rutile, titanite, and galena are subordinate. Trace amounts of

chalcopyrite, arsenopyrite, Ag rich tetrahedrite, and molybdenite are also

found within the massive sulphide ore. A strongly altered quartz-microdiorite

dyke containing disseminated zinc spinel + magnetite ± Fe-poor sphalerite

occurs adjacent to the massive, Fe-rich sphalerite ore of one of the satellite

orebodies.

The magmatic rocks

in the Perkoa area have a juvenile character according to the Nd-Sm isotopic

data, like most Birimian rocks, although the Perkoa basalts show the influence

of a subduction component in various discrimination diagrams. Birimian basalts

from other areas have geochemical signatures of MORB or oceanic, within-plate

basalts. The massive sulphide ore has been metamorphosed during a regional

thermal event under predominantly isotropic stress, probably 100 to 200 m.y.

after the emplacement of the quartz diorite. Sphalerite and magnetite were

remobilized, whereas pyrrhotite formed at the expense of pyrite. Peak

metamorphic temperatures of >460°C at pressures of >1 kbar are indicated

by almandine rich garnet, the presence of andradite, and geothermometers

involving arsenopyrite and pyrrhotite. Due to the metamorphic modifications of

the ore and host rock, however, it is not possible to establish the age

relationships between the main ore forming event and granitoid intrusions. As a

result, it is not known whether ore deposition took place close to a palaeo sea

floor or in a subvolcanic environment (i.e., a skarn).

The estimated ore

reserves are 5.7 Mt @ 18.2% Zn, 10% BaSO4, 0.06% Pb, and 26 g/t Ag (50 ppm Cu).

- AIM Resources (Australian) is developing the Perkoa zinc project which has a proven and probable reserve of 6,3 million t with a grade of 14,5% zinc at a 9 % cut-o ff , making the deposit, which is open to a depth of 600 m, equate to 907,700 t of contained zinc.

Perkoa close to production - Blackthorn

By: Esmarie Swanepoel

Published: 26th September 2012

PERTH (miningweekly.com) -

ASX-listed Blackthorn Resources Ltd was expecting first concentrate from its Perkoa joint venture (JV), in Burkina Faso, by the end of October or early November.

The company said on Wednesday that the cold commissioning process at the plant, which was currently under way, was expected to take four weeks. Commissioning of the front-end of the processing plant started in the first week of September, and around 4 000 t of waste rock has since been crushed.

Meanwhile, Blackthorn said that focus underground remained on advancing the decline development as much as possible, to establish the lower level stopes, with ore production in the first year coming primarily from the open pit operation. The open pit was also progressing well, with a total of 13-million cubic meters excavated from the open pit, exposing the orebody. Two separate stockpiles have been established to stockpile the oxide ore and the soil for reuse during rehabiliation work. “In mid-2008, at the start of the global financial crisis, construction at the Perkoa JV was slowed down to a very slow pace,” said MD Scott Lowe.

“In late 2010, we completed the JV transaction with Glencore and handed over management of the project to them. We are now very pleased for our shareholders, JV partner and for the people of Burkina Faso that the commissioning phase of the project has begun and that production will begin in the following months.” In the first year, the feed to the plant was expected to be predominantly lead and silver ore from the open pit, supplemented by underground zinc ore production. During the second year of operation this would change to around a 50/50 ratio of lead and silver ore versus zinc ore. From year three onwards, the majority of the feed would be zinc ore, with some silver and lead from the underground operation.

The project has a mineral resource of 12.17-million tons, at 10.3% zinc and 53.9 g/t silver. Measured and indicated resources stood at 7.15-million tons, at 11% zinc and 53.8 g/t silver.

Economic geology of nonmetal deposits

- Stratigraphic and structural controls of late Precambrian phosphate deposits of the northern Volta Basin in Upper Volta, Niger, and Benin, West Africa

- West African Infracambrian phosphorites; Proterozoic-Cambrian phosphorites

Economic geology of ore deposits

- Albitites et listvénites : sites de concentration aurifère inédits dans les ceintures de roches vertes birmiennes du Burkina Faso.

- Apercu sur le Precambrien de l'Afrique occidentale et de ses mineralisations. The Precambrian of western Africa and its mineralizations; Resumo das Comunicacoes, Simposios e Conferencias; Conferencias

- Burkina Faso, in Mining Annual Review.

- Burkina Faso.

- Burkina Faso. Exploration at the heart of West Africa.

- Carte des potentialités métallifères du Burkina Faso

- Chronique africaine, Nouvelles minères du continent africain : Guinée équatoriale, Togo, Ghana, Côte d'Ivoire, Mali, Burkina Faso et Niger,

- Diamantführende Ultrabasite in Obervolta.

- Early proterozoic ore deposits and tectonics of the Birimian orogenic belt.

- Etude pétrologique et métallogénique de la région de Gongondy, Diénémara et Malba.

- Evolution mineralogique du manganese dans trois gisements d'Afrique de l'Ouest; Mokta, Tambao, Nsuta. Mineralogic evolution of manganese in three deposits in West Africa; Mokta, Tambao, Nsuta

- Geochemical behavior of galena under semi-arid climatic conditions, in western Africa

- Geochemical behavior of galena under semi-arid climatic conditions; an example from Upper Volta, western Africa

- Geological and structural framework of the Paleoproterozoic basement in Burkina Faso: mapping and geochronological constraints

- Géologie du Burkina Faso à la lumière de nouvelles données géochimiques et géochronologiques

- Gold in Birimian Greestone Belts of Burkina Faso, West Africa.

- Influence de la geomorphologie sur la genese des bauxites lateritiques. Influence of geomorphology on the genesis of lateritic bauxites

- La manganosite (MnO) du gite de manganese de Tambao (Haute-Volta). Manganosite (MnO) from the Tambao manganese deposit, Upper Volta

- Le potentiel minier de la Haute-Volta.

- Les Gisements du Type "Porphyry Copper"; geologie, prospection, economie et decouvertes recentes en Afrique de l'Ouest. Deposits of the "porphyry copper" type; geology, exploration, and economics of recent discoveries in western Africa

- Les minéralisations aurifères de l'Afrique de l'Ouest. Leur évolution lithostructurale au Protérozoïque inférieur. Notice et Carte à 1/2 000 000.

- Les mineralisations en cuivre et molybdene liees aux porphyrites post-ophiolitiques du Birrimien (Precambrien moyen d'Afrique occidentale); peut-on parler a leur sujet de cuivre porphyrique?. Mineralization of copper and molybdenum in the Birrimian post-ophiolitic porphyrites (middle Precambrian of western Africa); can one speak on the subject of porphyritic copper?

- Les minéralisations en or de Bouroum-Sud (NE du Burkina Faso) dans leur contexte géologique et structural : approche métallogénique.

- Les mines de fer mondiales et la préparation des minerais - Afrique

- Mission Kaya; prospection aurifere dans la region Kaya-Boussouma-Korsimoro; Campagne 1973/74. Mission Kaya; prospecting for gold in the Kaya-Boussouma-Korsimoro region; 1973-1974 survey

- Nouveau type de gisement aurifère dans les ceintures de roches vertes birimiennes du Burkina Faso: les albitites de Larafella.

- Porphyry copper-type mineralization in early Proterozoic greenstone belts, Upper Volta, West Africa

- Preliminary data on PGE distribution in the Late Kibaran layered igneous Rocks from Burundi

- Recherches géologiques et minières dans les sillons de Houndé et de Boromo. Rapport final technique de synthèse.

- The vanadiferous magnetite deposits of the Oursi region, Upper-Volta

Economic geology, general

- Evolution des concepts en alterologie tropicale et consequences potentielles pour la prospection geochimique en Afrique soudano-sahelienne. Evolution of concepts on tropical weathering and possible consequences for geochemical prospecting in the Sudan-Sahel region of western Africa; Developpements en methodologie de la prospection miniere geochimique et geophysique au BRGM

- Géologie du Burkina Faso.

- Quatre annees de recherche geologique et miniere en Haute-Volta. Four years of geologic and mining research in Upper Volta

- The mineral industry of other African areas

- The Mineral Industry of Other African Areas

- The mineral industry of other areas of Africa

- Upper Volta

Economic geology, general, deposits

- La Geologie au service du developpement economique; projet majeur regional sur la geologie appliquee au developpement economique. Geology serving economical development; major regional project on applied geology to economical development

- Minéralisations du Burkina Faso et traitements multicritères

- Reconnaissance des bauxites blanches de la région de Kongoussi.

Economic geology, general, economics

- A discourse on earth resources and poverty in the Central Africa region

- Chronique africaine, Nouvelles minères du continent africain : Guinée équatoriale, Togo, Ghana, Côte d'Ivoire, Mali, Burkina Faso et Niger,

- Dynamique et nouveaux enjeux de la filière artisanale de l’or au Burkina Faso

- Economic data on Perkoa (Burkina Faso).

- Financing African mining developments; Mining activity survey

- Les mines de fer mondiales et la préparation des minerais - Afrique

Economic geology, geology of ore deposits

- Cartographie minérale et implications métallogéniques au Burkina-Faso

- Conditions structurales et minéralogiques du filon aurifère de Poura (Province du Mohoun, Burkina Faso).

- Contribution à la connaissance des minéralisations aurifères de Poura (Haute-volta).

- Eléments de synthèse sur l'évolution géostructurale et la métallogénie de la ceinture birrimienne de Boromo (Protérozoïque inférieur, Burkina Faso).

- Géochimie et géochronologie isotopiques : âge Pb/Pb à 2120 ± 41 Ma des corps sulfurés massifs à Zn-Ag de Perkoa (Burkina Faso).

- Gold resources of Africa

- L'environnement géologique de la minéralisation antimonieuse de Mafoulou (degré carré de Kaya) et les caractères du volcanisme basique régional.

- Le gisement d'amas sulfuré (Zn-Ag) de Perkoa dans la Povince du Sangyé (Burkina Faso, Afrique de l'Ouest) : Cartographie, Etude pétrographique, géochimique et métallogénique.

- Le projet aurifère de Kalsaka.

- Les minéralisations en or de Bouroum-Sud (NE du Burkina Faso) dans leur contexte géologique et structural : approche métallogénique.

- Proterozoic tourmalinite-hosted Au-As mineralization of Essakane, Burkina Faso

- Relations entre cristallisation de quartz et concentrations aurifères (exemple des filons Birimiens du Burkina Faso, Afrique de l'Ouest).

- Ressources Minérales du Burkina Faso.

- The geology of the Perkoa zinc deposit, Burkina Faso. Workshop VMS potential in the Birimian.

- The geology of the Taparko gold deposit, Birimian greenstone belt, Burkina Faso, West Africa,

- The Guibaré and Fété Kolé gold-bearing tourmaline-quartz-veins in the Birimian greenstone belts of Burkina-Faso.

- The vanadiferous magnetite deposit of Oursi region, Upper-Volta.