Namibia

Phone: +264-61-2848111

Fax: +264-61-249144

Fax: +264-61-249144

gschneider@mme.gov.na

http://www.mme.gov.na/gsn/

Namibia Diamond Act

Namibia Petroleum Act 1991

Namibia Petroleum Laws Amendment Act 1998

Chamber of Mines

http://www.mme.gov.na/gsn/

Namibia Diamond Act

Namibia Petroleum Act 1991

Namibia Petroleum Laws Amendment Act 1998

Chamber of Mines

Source: CIA Factbook

Legend

Legend and ore deposit name

Legend

Legend and ore deposit name

Geology

The geology of Namibia encompasses rocks of Paleo-, Meso- and Neoproterozoic age found mainly in the western half of the country and dominated by metasediments of the Damara Group to the north and older crystalline basement, including the Namaqua Metamorphic Complex, in the south. Paleozoic to Cenozoic sediments occur in the south and north western areas and include deposits of the Karoo Supergroup. Extensive Cenozoic surficial sediments blanket the north and eastern parts of the country.

MINING

Its economy is heavily dependent on the extraction and processing of minerals for export and mining accounted for 12.4% of GDP providing more than 50% of Forex earnings. Namibia is one of the world’s major producers of diamonds 95% of which are of gem quality; it is the sixth largest diamond producer in Africa (2.5% of total output) and diamond mining alone accounted for 5.8% of GDP. Namibia is the fourth largest exporter of non-fuel minerals in Africa, the world's fifth largest producer of uranium and a major producer of lead, zinc, silver, manganese and fluorspar. In 2008 Namibia’s uranium production rose by 51.6% making the country the leading producer in Africa and accounting for 10 per cent of world production. It is the seventh ranked producer of fluorspar accounting for 2.2 per cent of world production. Namibia is Africa’s sole producer of white arsenic, leading producer of zinc (58.8%), third largest for fluorspar (19.7%) and salt (16.3%), fourth for lead (6.4%), fifth for silver (2.3%) and sixth for mined copper (0.9%). Copper and lead production rose by 51.7 per cent and 33.3 per cent respectively in 2008.

- Namibia 250k topographical maps

- Namibia Google Satellite Maps

- Namibia Cities,Towns, Airports, Maps, Images

- Namibia Geology

- Namibia Geological Survey

- Namibia Gravity

- Namibia Image-1

- Namibia Image-2

- Namibia Image-3 Navachab Gold Mine (AngloGold)

- Namibia Image-4 Rössing Uranium Mine (Rio Tinto))

- Namibia Image-5 Skorpion and Rosh Pinah Zinc mines

- Namibia Magnetics

- Namibia Mineral Maps (Namibian Geological Survey)

- Namibia Mineral Resources: Uranium chapter

- Namibia Minerals

- Namibia Radiometrics

- Available geological maps (75)

- Available geophysical maps (1)

Click HERE for an overview

| Year | Production | Unit of Measure | % Change |

|---|---|---|---|

| 2002 | 18012 | Metric tons | NA |

| 2003 | 16175 | Metric tons | -10.20 % |

| 2004 | 11174 | Metric tons | -30.92 % |

| 2005 | 10900 | Metric tons | -2.45 % |

| 2006 | 6262 | Metric tons | -42.55 % |

| 2007 | 8500 | Metric tons | 35.74 % |

| 2008 | 8300 | Metric tons | -2.35 % |

- Weatherly International plc operates the Tsumeb West, Tschudi, Otjihase and Matchless mines as well as the Tsumeb custom smelter. The company has a current resource base of 690,000 tonnes of contained copper (JORC) and is targeting 20,000 tonnes of copper on an annualised basis in 2008 from its own mining operations.

WINDHOEK – Umbrella union body, the National Union of Namibian Workers, is set for ownership in Weatherly’s copper mining operations, after Mineworkers Union of Namibia abandoned talks less than six months into negotiations.

Weatherly is about to reopen two copper mines, Matchless and Otjihase, and is exploring for an additional copper mine at Tschudi and a zinc/lead mine at Berg Aukas.

National Union of Namibian Workers, through its commercial arm Labour Investment Holdings, is now in discussions with Weatherly International for equity shareholding in all mining assets of Weatherly Namibia.

Chief Executive Officer for Labour Investment Holdings, Cleophas Mutjavikua, confirmed negotiations, saying “these are on-going and are at a very sensitive stage right now.”

Weatherly International dropped a bombshell late last month, when, in a London update to shareholders, it spoke of advanced negotiations with a Namibian black economic empowerment partner.

Surprisingly, the update did not name Nam-mic, Mineworkers Union of Namibia’s commercial arm, who since late 2009 has been in discussions with Weatherly International for partnership in local mining operations.

Seemingly, the discussions between the two started on a bad footing. Nam-mic (Namibian Mineworkers Investment Company) are said to have walked out of discussions.

“We have suspended the negotiations until at a later stage,” Nam-mic’s chief executive Josia Kaitungwa told New Era. Nevertheless, Kaitungwa says they would continue monitoring developments at Weatherly with possibility of resuming discussions at a later stage. “But for now we have suspended the discussions,” emphasised Kaitungwa.

Weatherly hinted that negotiations with new trade union partners would help curb possible industrial unrest in the future.

“The company [is] in negotiations with a black economic empowerment partner which will mitigate future industrial trouble and create greater commitment by local stakeholders in the successes of the project,” said Weatherly International in its London update to shareholders.

Trade unions have been pushing for direct ownership in Namibian mining companies, and repeated the demands when Weatherly Namibia shut down copper mines during the global financial crisis of 2008.

Weatherly International has since bounced back through a series of several asset sales and refocusing of operations.

Weatherly International told shareholders that it “is now back in business at a very opportune time”. At one point the company was knee-deep in debt and gasping for air, going as far as offering to sell half of its ownership to Chinese state-owned company East China Exploration Company. The discussions for the sale were subsequently terminated and the company opted to instead sell the Tsumeb copper smelter to Canadian mining company Dundee Precious Metals for N$44,4 million.

“The company is looking to benefit from the current copper price by reopening two of the mines and accelerating development of a third new copper mine,” says Weatherly.

The plans for reopening of Otjihase and Matchless mines are complete and the company is now working on equity structure and funding. A feasibility study is out on the possibility of mining operations at Tschudi.

Otjihase Copper Mine

Source: http://weatherlyplc.com

- Kombat Copper Inc. holds an 80% interest in five Mining Licenses and five Exclusive Prospecting Licenses ("EPLs") in the Otavi Mountainlands. The mining licenses contain three past-producing mines (Kombat, Gross Otavi, and Harasib) and extensive mining infrastructure including an 800m exploration and production shaft sunk by Murray & Roberts at a cost of $30 Million USD. The shaft has a 90,000 tonne per month hoisting capacity and was first opened in 2006. Among the three past-producing mines is the flagship Kombat Mine, which opened in 1962 and historically produced approximately 8.7 million tonnes of ore grading an average of 3.3% Cu. Other significant minerals present include Silver, Lead, and Zinc. The Company also holds an 80% interest in five Exclusive Prospecting Licenses ("EPL's") covering an area of 1,550 sq.km within the mineral-rich Otavi Mountainlands. The Company has developed a series of priority exploration targets, which it believes have significant potential due to their geological characteristics and/or their proximity to Tsumeb and the Tschudi Copper Project recently permitted and financed by Weatherly PLC.

- Sabre Resources Ltd focus on the exploration and development of the Otavi Mountain Land Base Metals project in northern Namibia. The two licence areas cover more than 800 km2 and contain over 60 known copper, lead, zinc & vanadium occurrences. Sabre's prospect areas range from grassroots geochemical targets through to resource delineation at the Guchab mining centre and a move to feasibility on the zinc-lead deposits on the Pavian and Hoek Trends.

In 2012 Sabre acquired an 80% holding in the Otavi Valley lease area (EPL 3540), which covers 220 km2 and over 40 km of the strike extents of the Kombat Copper Trend. This trend hosts the Gross Otavi and Kombat mines (which are not assets of the Company) as well as the Guchab Mining Centre. Sabre’s exploration has focused on the area to the east of the Kombat mine around the Guchab Mining Centre, a distance of some 10 km. The Company met with immediate success at Guchab and continues to define further exploration targets through the Kombat East area including Schlangental, Schlenters, Nehlen & Rendezvous.

The Guchab Mining Centre (‘GMC’ or ‘Guchab’) lies 10 km to the east of the Kombat copper mine and was discovered in the early 1900s. The mining centre was worked as a series of open pits, box cuts and underground adits targeting near-surface, high-grade weathered copper sulphide & carbonate mineralisation, at more than 10% copper. These ores were later hand-sorted to create an exportable ore grading more than 33% copper. Mining ceased in 1925 following a collapse in the copper price, with only sporadic mining and exploration in the 1950s and 1970s due to ‘spikes’ in the price of copper. Ironically, Guchab actually produced more (and at a higher grade) ore than the Kombat mine in the early 1900s. A concerted exploration effort was made at Kombat from the 1950s onward due largely to ease of access. Kombat sits on the flats at the base of the mountains, whereas Guchab sits on the mountainside, which has left Guchab untouched by modern exploration. Sabre began exploration of the GMC after acquiring the property in June 2012. Initial targeting and evaluation showed that the copper mineralisation at Guchab extended over more than 4 km of strike, with values of up to 1% copper in soil samples and over 10% copper in surface samples. Initial channel sampling across the GMC yielded a number of highly encouraging results, including:

GCTR0002 16 metres @ 10.16% Copper & 64.00 gpt Silver

GCTR0023 25 metres @ 6.70% Copper & 59.00 gpt Silver

Drilling in the Guchab Canyon, which takes in the area from Eastern Adits into the High Valley, commenced in July 2012, with outstanding results. Subsequent exploration shows the GMC to be the eastern extensions of the Kombat Mine Stratigraphy.

The Schlangental prospect is located on the western side of the Guchab Mining Centre (‘GMC’), on the flats of the Schlangental valley. The prospect was discovered by Sabre in the course of exploration of the GMC and is defined by a number of shallow open pits dating back to the early 1900s. The pits had been excavated to a depth of 3-4 metres, with recent channel sampling by Sabre returning results of:

SCCS0001 15 metres @ 4.21% Copper & 28.06 gpt Silver

SCCS0003 42 metres @ 3.58% Copper & 18.34 gpt Silver

A program of shallow percussion drilling has now been completed across the Schlangental valley. The drilling was designed to penetrate below the soil and sand cover across the prospect area and outline the mineralised halo surrounding the open pits, thereby allowing the effective targeting of a program of deeper RC and diamond drilling.

The Eisernhut prospect is located on the top of a mountain, over 1900 metres above sea level, with a commanding view of the Otavi Mountain Land. The prospect was discovered in the course of prospecting and mining through the GMC in the 1900s. The prospect was located by Sabre in late 2012 in the course of mapping of the area. Subsequent detailed mapping and sampling of the prospect discovered a number of old pits and shafts, where high grade ore had been extracted over more than 30 metres of elevation down the mountainside. The mineralisation at Eisernenhut appears to be hosted by a breccia pipe and takes the form of a ‘quartz-malachite-chalcocite stock work’ that is overlain by an iron–rich, silica gossan at surface.

Rodgerberg is located to the east of the Guchab Canyon, on the eastern end of the GMC. Rodgerberg was worked in the 1920s with small parcels of ore, grading up to 36% copper, being extracted from the mine workings. The mine is famous for producing some of the best known examples of the copper mineral dioptase. Sabre’s exploration program at Rodgerberg has included mapping, rock chipping and channel sampling. Better results have included:

RUUG0001 3 metres @ 10.88% Copper & 473 gpt Silver

RUUG0003 13 metres @ 5.32% Copper & 192 gpt Silver

Rodgerberg is currently a ‘second tier target’ for Sabre in the GMC due to difficulty of access. Exploration will continue on the prospect as the work program advances across the Guchab area.

The Kombat East exploration area takes in the area from the Kombat Copper Mine in the west, through to the Rodgerberg mine in the east. This area covers more than 14 kilometres of highly prospective strike, interpreted to be the extensions of the Kombat Mine stratigraphy. Sabre’s focus remains the Guchab Mining Centre, but the Company is presently evaluating the area to the west of the GMC. Aside from the Guchab, Rodgerberg and Schlangental prospect areas, the Kombat East area holds a number of other targets including:

Rendezvous

This geochemical copper target is also reinforced by the presence of old mine workings within the prospect area. Recent surface sampling has confirmed the target area and a program of channel sampling is being planned prior to drill testing later in the year.

Nehlen

The Nehlen target is located immediately to the east of the Kombat mine lease and was listed as a priority target for Goldfields when they held the area in the 1990s. It was not drill tested at that time due to access issues. However, these issues appear to have been overcome, and Sabre hopes to be drilling at Nehlen during the second half of 2013.

Schlenters

Schlenters is located to the northeast of Nehlen and is presently being investigated.

The Guchab Mining Centre (‘GMC’ or ‘Guchab’) lies 10 km to the east of the Kombat copper mine and was discovered in the early 1900s. The mining centre was worked as a series of open pits, box cuts and underground adits targeting near-surface, high-grade weathered copper sulphide & carbonate mineralisation, at more than 10% copper. These ores were later hand-sorted to create an exportable ore grading more than 33% copper. Mining ceased in 1925 following a collapse in the copper price, with only sporadic mining and exploration in the 1950s and 1970s due to ‘spikes’ in the price of copper. Ironically, Guchab actually produced more (and at a higher grade) ore than the Kombat mine in the early 1900s. A concerted exploration effort was made at Kombat from the 1950s onward due largely to ease of access. Kombat sits on the flats at the base of the mountains, whereas Guchab sits on the mountainside, which has left Guchab untouched by modern exploration. Sabre began exploration of the GMC after acquiring the property in June 2012. Initial targeting and evaluation showed that the copper mineralisation at Guchab extended over more than 4 km of strike, with values of up to 1% copper in soil samples and over 10% copper in surface samples. Initial channel sampling across the GMC yielded a number of highly encouraging results, including:

GCTR0002 16 metres @ 10.16% Copper & 64.00 gpt Silver

GCTR0023 25 metres @ 6.70% Copper & 59.00 gpt Silver

Drilling in the Guchab Canyon, which takes in the area from Eastern Adits into the High Valley, commenced in July 2012, with outstanding results. Subsequent exploration shows the GMC to be the eastern extensions of the Kombat Mine Stratigraphy.

The Schlangental prospect is located on the western side of the Guchab Mining Centre (‘GMC’), on the flats of the Schlangental valley. The prospect was discovered by Sabre in the course of exploration of the GMC and is defined by a number of shallow open pits dating back to the early 1900s. The pits had been excavated to a depth of 3-4 metres, with recent channel sampling by Sabre returning results of:

SCCS0001 15 metres @ 4.21% Copper & 28.06 gpt Silver

SCCS0003 42 metres @ 3.58% Copper & 18.34 gpt Silver

A program of shallow percussion drilling has now been completed across the Schlangental valley. The drilling was designed to penetrate below the soil and sand cover across the prospect area and outline the mineralised halo surrounding the open pits, thereby allowing the effective targeting of a program of deeper RC and diamond drilling.

The Eisernhut prospect is located on the top of a mountain, over 1900 metres above sea level, with a commanding view of the Otavi Mountain Land. The prospect was discovered in the course of prospecting and mining through the GMC in the 1900s. The prospect was located by Sabre in late 2012 in the course of mapping of the area. Subsequent detailed mapping and sampling of the prospect discovered a number of old pits and shafts, where high grade ore had been extracted over more than 30 metres of elevation down the mountainside. The mineralisation at Eisernenhut appears to be hosted by a breccia pipe and takes the form of a ‘quartz-malachite-chalcocite stock work’ that is overlain by an iron–rich, silica gossan at surface.

Rodgerberg is located to the east of the Guchab Canyon, on the eastern end of the GMC. Rodgerberg was worked in the 1920s with small parcels of ore, grading up to 36% copper, being extracted from the mine workings. The mine is famous for producing some of the best known examples of the copper mineral dioptase. Sabre’s exploration program at Rodgerberg has included mapping, rock chipping and channel sampling. Better results have included:

RUUG0001 3 metres @ 10.88% Copper & 473 gpt Silver

RUUG0003 13 metres @ 5.32% Copper & 192 gpt Silver

Rodgerberg is currently a ‘second tier target’ for Sabre in the GMC due to difficulty of access. Exploration will continue on the prospect as the work program advances across the Guchab area.

The Kombat East exploration area takes in the area from the Kombat Copper Mine in the west, through to the Rodgerberg mine in the east. This area covers more than 14 kilometres of highly prospective strike, interpreted to be the extensions of the Kombat Mine stratigraphy. Sabre’s focus remains the Guchab Mining Centre, but the Company is presently evaluating the area to the west of the GMC. Aside from the Guchab, Rodgerberg and Schlangental prospect areas, the Kombat East area holds a number of other targets including:

Rendezvous

This geochemical copper target is also reinforced by the presence of old mine workings within the prospect area. Recent surface sampling has confirmed the target area and a program of channel sampling is being planned prior to drill testing later in the year.

Nehlen

The Nehlen target is located immediately to the east of the Kombat mine lease and was listed as a priority target for Goldfields when they held the area in the 1990s. It was not drill tested at that time due to access issues. However, these issues appear to have been overcome, and Sabre hopes to be drilling at Nehlen during the second half of 2013.

Schlenters

Schlenters is located to the northeast of Nehlen and is presently being investigated.

The Lucas Post Trend lies on EPL 3542 (SBR 70%) and covers more than 25 kilometres of strike, immediately to the north of the Hoek Zinc-Lead Trend. The Lucas Post Trend takes in a number of highly prospective copper targets, including Rooikat in the west through to Jagers in the east. These copper targets include a number of historical mining areas, as well as conceptual targets generated by Sabre. The trend hosts some rare styles of mineralisation, including late stage lead-vanadium mineralisation in the near-surface environment, which shows a strong association with earlier, deeper seated, sulphide mineralisation. The central portion of the trend is dominated by the recent Kaskara discovery.

Kaskara was highlighted by conceptual targeting undertaken by Sabre and its consultants, in particular Douglas Haynes. Kaskara is a mineralised lithological & structural target, which appears to be similar to the nearby Tsumeb copper deposit (24.9 Mt @ 5.5% Cu 11.8% Pb & 171 gpt Ag), located less than 40 km to the north. Kaskara is a large mineralised system, including extensive surface mineralisation and significant mineralised intercepts in drilling. The deep IP target at Kaskara remains only partially tested and requires down hole geophysics, together with digital modelling, to help better target the source of the anomaly at depth prior to exploration recommencing on the prospect.

Kaskara was highlighted by conceptual targeting undertaken by Sabre and its consultants, in particular Douglas Haynes. Kaskara is a mineralised lithological & structural target, which appears to be similar to the nearby Tsumeb copper deposit (24.9 Mt @ 5.5% Cu 11.8% Pb & 171 gpt Ag), located less than 40 km to the north. Kaskara is a large mineralised system, including extensive surface mineralisation and significant mineralised intercepts in drilling. The deep IP target at Kaskara remains only partially tested and requires down hole geophysics, together with digital modelling, to help better target the source of the anomaly at depth prior to exploration recommencing on the prospect.

The Pavian & Hoek Zinc-Lead Trends are found on Sabre's EPL 3542 (SBR 70%). These two trends each cover more than 25 kilometres of strike and host significant zinc-lead resources. The resources at Border (16.2 Mt @ 2.1% Zn+Pb) on the Pavian Trend, and Driehoek (3-6 Mt @ 2-5% Zn+Pb) on the Hoek Trend, were Sabre's primary driver for the acquisition of the Otavi Mountain Land project in 2007.

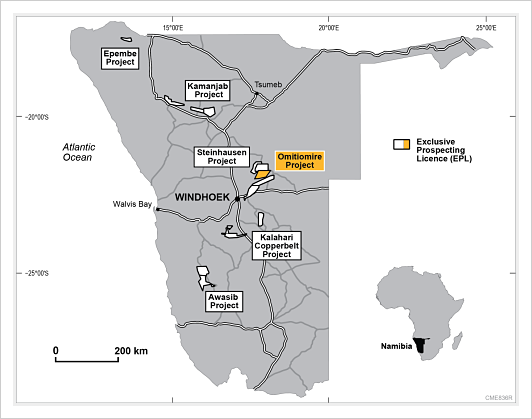

- Omitiomire is an unusual large low grade copper deposit in central Namibia. Craton Mining and Exploration (Pty) Ltd, a subsidiary of Sydney-based International Base Metals Limited, has drilled 250 holes to define a resource of 98 million tonnes at 0.51% Cu (500,000 tonnes contained copper) over an area of 2200 x 700 metres. Banded mafic rocks, which host the disseminated chalcocite, consist mainly of quartz, plagioclase, biotite and amphibole with minor chlorite, epidote, sphene, K-feldspar and magnetite. Low levels of gold and platinoids are associated with copper. Metallurgical testwork has shown excellent recoveries. Known extensions indicate that a target of + 1 million tonnes contained copper is achievable. Extensive geochemical anomalies suggest that Omitiomire could be part of a significant new copper district. In seeking analogies, there are similarities with the Lumwana copper-cobalt deposits (700 Mt at 0.7% Cu) in northwestern Zambia and perhaps with copper deposits in the Carajas district of northern Brazil. The Company has commenced a Definitive Feasibility Study (‘DFS’) on the Phase 1 oxide copper project. Johannesburg-based Basil Read Matomo has been awarded a contract to manage the DFS, which is planned for completion by September 2013. The Steinhausen Project, surrounding the Omitiomire Project, contains numerous known copper occurrences which have not been explored since the 1970s, as well as other targets to be tested. The Kalahari Copperbelt stretches discontinuously for 800 km from central Namibia to northern Botswana. The belt is of similar age to, and has similar styles of copper mineralisation as, the Central African Copperbelt of Zambia and the Congo (DRC). Craton holds three EPLs, totalling more than 1,700 km2 in the area. For the past several years, Craton has been focussing its exploration on the potential for copper in the lower part of the Damara Sequence. This was thought to be geologically analogous to the situation in the Zambian Copperbelt. Based on this exploration concept, Craton applied for, and was granted, EPLs 3372, 4296, 4297 and 4431, covering a large strike length (over 100 km) where lower Damara strata onlap onto the Kamanjab Inlier basement high. The Company has identified a small copper deposit at Tzamin in EPL 4431. A comprehensive exploration programme in EPL 3372 Kopermyn (now relinquished), involving geological mapping, geochemical and geophysical surveys, and drilling on targets, showed widespread but low grade copper mineralisation in the target rock units. The work gave no indication of the likely presence of a significant copper deposit. Accordingly, the potential for discovery within the lower Damara Sequence has been down-graded substantially.

The bulk samoling pit at Omitiomire

Source: http://www.interbasemetals.com

- Helio Resource Corporation (Canadian, HELOF.PK, HRC.V) holds a number of exclusive prospecting licenses in northern Namibia over known copper-gold occurrences.

Diamond

History

The find that constituted the discovery of diamonds in the Namib Desert was made in April 1908 at a railway siding near Lüderitz. Zacharias Lewala, one of the men employed to keep the railway track free of drift sand and who had previously worked on the Kimberley diamond fields, picked up a stone and recognised it as a diamond. This discovery led to the August 1908 proclamation of the Sperrgebiet, or forbidden territory, a region that today stretches some 360 kilometres along the coast and reaches 100 kilometres inland. According to the terms of the proclamation, nine companies obtained rights to prospect and mine in the Sperrgebiet. After the outbreak of World War One, South Africa invaded the German protectorate of South West Africa (SWA, now Namibia) and assumed administration of the country. Five years later, Sir Ernest Oppenheimer, acting on behalf of Anglo American Corporation, acquired control of the nine mining companies and in February 1920, amalgamated them into the Consolidated Diamond Mines of South West Africa (CDM). In 1923, the SWA Administration and CDM concluded the Halbscheid Agreement, which accorded CDM mining rights in the Sperrgebiet. Through negotiation, CDM's rights in the restricted area were extended to 31 December 2010. In 1931, De Beers Consolidated Mines bought Anglo American's interest in CDM, later making CDM a wholly owned subsidiary in 1975. In spite of previous exploration attempts, diamonds were only discovered on the north bank of the Orange River in 1928. This led to the establishment of Oranjemund in 1936 and the eventual transfer of the company's headquarters from Lüderitz to Oranjemund in 1943. Based in Switzerland, De Beers Centenary AG was formed in 1990 to head a group of companies that incorporated the international interests previously held by De Beers Consolidated Mines Limited. CDM was one of those companies. In 1994, in terms of an accord concluded with the Namibian government, CDM was reconstituted as Namdeb Diamond Corporation (Pty) Limited, an equal partnership between the government and De Beers Centenary AG.

Diamonds were first discovered on the south bank of the lower Orange River by Dr Ernst Reuning in 1957. Following this discovery, prospecting on the Northern Bank started in 1968. Exploration and sampling for Auchas deposit started in 1986. Auchas mine started production in June 1990 and closed in June 2000. Daberas mine started in October 1999 and it was officially inaugurated on the 30 May 2002. As of 2006, Daberas has a 4 years life of mine left. A pre-feasibility study for the Sendelingsdrif area which was completed in 2004 indicated a potential seven year life of mine. A full feasibility study will be undertaken during the first quarter of 2008. (Source: De Beers)

"Celebrating a Century of Pretty Stones" (Source: New Era)

Three major, long-standing transport pathways - which can be likened to conveyor belt systems - have been instrumental in moving diamondiferous sediment from source localities to sink areas: Fluvial conveyor - principally the Orange-Vaal River drainage system, marine conveyor - in this passive margin setting, the Atlantic wave regime is vigorous with a strong north-bound longshore drift driven by a prevailing southerly wind regime, desert conveyor - the arid climate and prevailing southerly wind regime of the Namib Desert facilitates onshore movement of marine-derived sediment back into a land-based sink. En route, and over geological time, diamonds have been concentrated in a number of different placer types that span terrestrial and marine settings. Following the discovery of diamonds to the north of the Orange River mouth in 1928, an ore body was delineated, which is today known as Mining Area 1. The area consists of raised beaches over a distance of approximately 100km north of Oranjemund, to Chameis Bay along the present day coastline. Bordered in the east by a geological boundary known as the "east cliff", this strip of land is nearly 3km wide in the south, narrowing to about 200m in the north. A typical beach consists of a layer of gravel between ancient high and low water marks, a storm beach or ridge and a marine platform or shelf containing gravel. Diamonds may be found in any portion, but occur most abundantly in the beach and shelf gravel found upon and within the deeply gullied and highly contorted bedrock. Ore deposits are about 2m thick, while the overburden thickness can reach a thickness of 20m in places. (Source: De Beers)

- Namdeb Diamond Corporation (Pty) (De Beers 50%, Government 50%) is currently producing less diamonds from onshore operations than that being produced by De Beers Marine Namibia (De Beers 70%, Nambeb 30%), which produced a total of 922 000 carats in 2005. Since 1908 more than 100 million carats have been produced from the dwindling and, in many instances, depleted reserves (see video)

- Diamond Fields International Ltd (Canadian), through its subsidiary Diamond Fields Namibia, owns a 100% interest in a mining license offshore (71,600 hectares). It has recovered more than 110,000 carats to date.

- Trans Hex has three shallow marine licenses in the Cape Fria area, four in the Toscanini (both north of Walvis Bay) and two south of Hollandsbird Island (north of Luderitz Bay). The company also has a resource of 30 million cubic metres of diamondiferous gravel at the Northbank project located in block 9, on the Orange River.

- Afri-Can Marine Minerals Corporation (Canadian) is exploring an offshore block covering an area of 994 sq. km, 105 km. north of Luderitz.

- Rusina Mining NL (Australian) investigated and abandoned the onshore area from Cape Fria northwards to the Angola border.

- Reefton Mining NL (Magna Mining) is exploring a 220 km onshore stretch from Möwe Bay to Cape Fria.

- Mount Burgess Mining NL has been exploring the Tsumkwe project, which is located 450 km northeast of Windhoek on the Botswana border and covers some 8,000 square kilometres held under 9 Exclusive Prospecting Licences seven of which are in joint venture with Kimberlite Resources (Pty) Ltd. Motivation for the project includes that it is located on the southern margin of the Congo-Angolan Craton, just south of Limpopo-Botswana dyke swarm, at a distance similar to the Orapa-Letlhakane kimberlite province in neighbouring Botswana, over a long-lived, stable basement high with Pre-Damaran basement dated >2,000 my, just south of the Sikereti kimberlites and south west of the Nxau-Nxau kimberlite field in Botswana; and in an area where 8 macrodiamonds, together with significant numbers of G9 and G10 garnets have been discovered, delineating discrete anomalies which the company believes have been sourced locally.

- 's Kavango Project (24 Exclusive Prospecting Licenses encompassing 2,09 million hectares) in northeast Namibia, using high resolution magnetics, has resulted in the discovery of eight kimberlites. With the exception of two (which have less than 10 m of cover), the kimberlites are covered by approximately 50 m of overburden sediments of the Kalahari formation. Gravity profiles over the confirmed kimberlites suggest that these bodies range from 300 to 500 m in diameter.

- Bonaparte Diamond Mines NL Namib Project:The Namib project is located offshore in the vicinity of Hollamsbird Island, some 250km north of the port of Luderitz on the coast of the Republic of Namibia. Active marine diamond mining operations occur off Luderitz and extend some 100 km further north of Hottentot Bay. The Namib Project comprises Exclusive Prospecting Licence (EPL) EPL3241 (Tsauchab Licence), and EPL3323 (Meob Licence) which are not contiguous but lie in close proximity. More recently the project area has been expanded by the inclusion of an EPL application, EPL 3533 (Tsauchab East Licence) which lies adjacent and inshore of the Tsauchab Licence. These tenements are held in Joint Venture with a Namibian Company, Tungeni Investments cc and represent “grassroots” projects off the Namibian coast.The Tsauchab and Tsauchab East leases lie within the submerged trajectory of the Tsauchab River palaeo channel and also within a south facing coastal embayment. Studies have shown that such features present favourable environments for diamond entrapment and improvement of diamond distribution. On a regional basis, there is evidence of alluvial diamond occurrence along the coastline east of the Meob and Tsauchab leases and reconnaissance seabed sampling over nearby leases by other explorers has identified marine diamond occurrences both to the north and south of the Tsauchab Lease.In the vicinity of the Tsauchab Lease, 5.09 carats have been recovered to the north of the area in 2002 and 15.69 carats have been recovered to the south of the area in 2003 where the largest stone recovered was 0.49carats.Luderitz Project:The Luderitz Project incorporates two Joint Operations Agreements (JOA) between Bonaparte's 100% owned Namibian subsidiary, Bonaparte Diamond Mines (Namibia) (Pty) Ltd (BDN) and Diamond Fields (Namibia) (Pty) Ltd (DFN), a 100% owned subsidiary of Diamond Fields International Ltd. The EPL1607b JOA gives Bonaparte exclusive rights to use the Bonaparte Seabed Sampler (BoSS) to explore for diamonds in Exclusive Prospecting Licence area EPL1607b for an initial period of 3 years in return for 50% interest in mining of resources identified by Bonaparte. The project area covers approximately 140 km2 and is located 55 km north northeast of Luderitz, in close proximity of mining licence areas held by Namibia's three leading marine diamond producers, Namdeb, Samicor and Diamond Fields. Previous exploration work conducted in the tenement by Diamond Fields during the late 1990's includes a complete geophysical survey from which a number of prospective targets have been identified as well as a limited amount of seabed sampling which confirmed the presence of diamonds in the property.The ML111 JOA allows Bonaparte to use the BoSS to carry out a program of resource development sampling in DFN's Mining Licence area ML111 in terms of this agreement. Bonaparte will have exclusive access for 6 months to two designated resource development areas (Diaz Prospect 1 and Diaz Prospect 2) covering a total area of approximately 1,600,000m2 in ML111. Bonaparte will carry out seabed sampling to define areas of Indicated Resource (in compliance with JORC guidelines) in which Bonaparte will then retain a 30% interest in any subsequent mining thereof by DFN.Bogenfels Project:The Bogenfels project lies approximately 100km north of the Orange River and comprises an area covering approximately 2,700 km2 off the coast of southern Namibia situated adjacent to the current producing marine mining licence areas held by Namdeb (De Beers/Namibian Government partnership). It comprises three licences; EPL3407, EPL3403 and EPL3404. The agreements are subject to approval by the Minister of Mines and Energy, Namibia. The Exclusive Prospecting Licence for EPL3407 (Mirror Mountain) was granted in November 2005 and applications for EPL's 3403 and 3404 are pending approval by the Namibian authorities. The project is held in Joint Venture with two Namibian companies, BV Investments cc and Mirror Mountain Mining cc for exploration and development of highly prospective marine diamonds, where Bonaparte retains an 80% interest.Boegoe Hills Project:The Boegoe Hills project comprises EPL3104 and covers an area of approximately 280 km2 which lies adjacent to the onshore mining licence area held by Namdeb, approximately 100km north of the mining settlement town of Oranjemund. The area is considered prospective for alluvial diamonds and lies approx 18 km to the east of Chamais Bay, where commercial diamond production has been carried periodically since the mid 1960's. The project is a JV between Bonaparte and Nassed Enterprises (Pty) Ltd, a Namibian Company, where Bonaparte can earn an interest of 75%. A geomorphological assessment of the data and a geological model for the evolution of the area shows several possible ancient river channel deposits (palaeochannels) as well as a possible ancient shoreline. These features present prospective targets for follow-up.

- Dahava Resources announced in January, 2008, that it had started limited production activities at its Lower Orange river property in Namibia. The company has obtained the right to prospect and mine on Block 4 of EPL 2610. Previous prospecting of the gravels indicated a grade of 1.3 to 1.78 carats per hundred tonnes

Gold in Namibia

Gold Home

Click HERE for an overview

| Year | Production | Unit of Measure | % Change |

|---|---|---|---|

| 2002 | 2815 | Kilograms | NA |

| 2003 | 2508 | Kilograms | -10.91 % |

| 2004 | 2205 | Kilograms | -12.08 % |

| 2005 | 2703 | Kilograms | 22.59 % |

| 2006 | 2790 | Kilograms | 3.22 % |

| 2007 | 2496 | Kilograms | -10.54 % |

| 2008 | 2126 | Kilograms | -14.82 % |

| 2009 | 2022 | Kilograms | -4.89 % |

Source:USGS

The Navachab deposit is hosted by Damaran greenschist-amphibolite facies, calc-silicates, marbles and volcano-clastics. The rocks have been intruded by granites, pegmatites and (quartz porphyry dykes) aplite and have also been deformed into a series of alternating dome and basin structures. The mineralised zone forms a sheet-like body which plunges at an angle of approximately 20° to

the north-west. The mineralisation is predominantly hosted in a sheeted vein set (±60%) and a replacement skarn body (±40%). The gold is very fine-grained and associated with pyrrhotite, and minor trace amounts of pyrite, chalcopyrite, maldonite and bismuthinite. Approximately 80% of the gold is free milling.

- AngloGold Ashanti (NYSE:AU; JSE:ANG) operates the open-pit Navachab mine which produced 81 000 oz of gold in 2005 from ore grading 2,05 g/t Au. Proved and probable ore reserves amounted to 10,1 million t at a grade of 1,67 g/t Au or 16,9 t of gold.

- TEAL Exploration & Mining Incorporated (Canadian, TSX:TL; JSE:TEL) is exploring the the Otjikoto deposit (see B2 Gold below) which has an inferred resource of 25,581 million t at a grade of 1,06 g/t Au or 873 000 oz of gold. In 2007, Teal Exploration & Mining agreed to sell an initial 10% of Avdale Namibia, the subsidiary of Teal holding its Otjikoto gold project, to Nambia’s EVI Mining, which has an option to buy a further 5% once a definitive feasibility study has been completed on the project. EVI will pay $5.5 million, for the intitial 10%, all of which will be used to advance the ongoing exploration drilling program and to upgrade and expand the inferred mineral resource at Otjikoto, which is estimated at 1,76 million ounces of gold, to higher confidence levels. Teal announced in November, 2007, that an independent person had supported the conversion of 460 000 oz of gold at its Namibian Otjikoto project into the indicated mineral resource category. The indicated resources were at a grade of 1,21 g/t. Total contained gold increased from 1,76-million oz to 1,78-million oz.

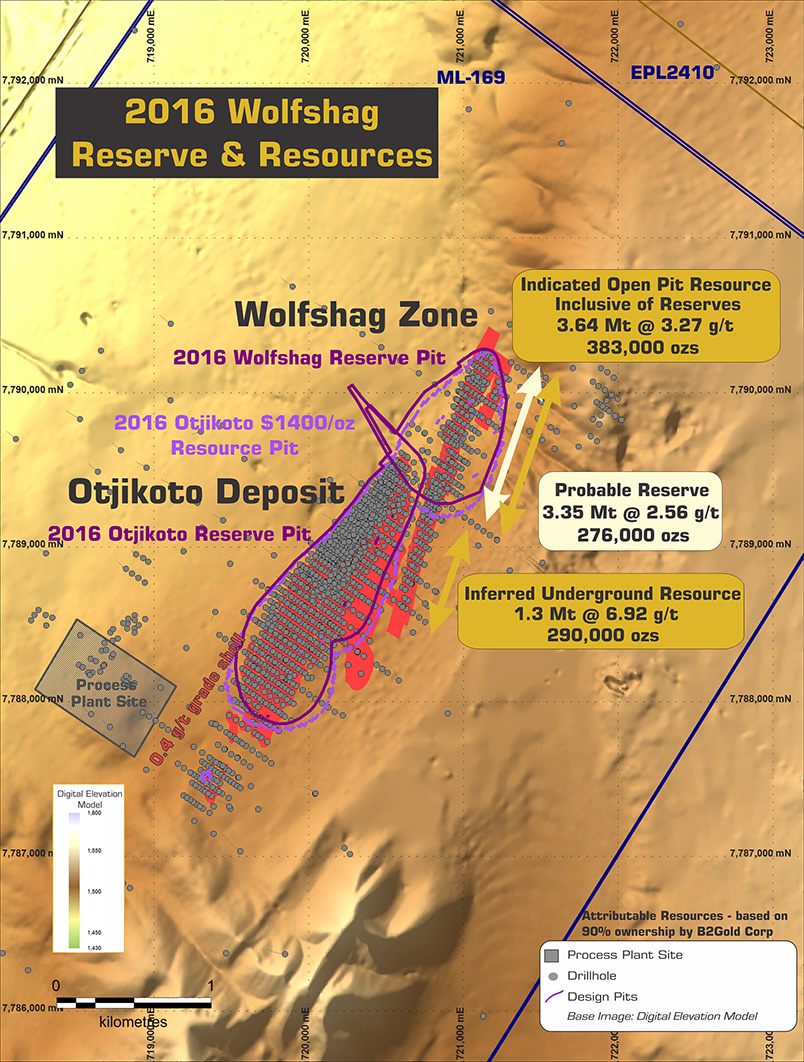

- B2Gold Corporation is a Vancouver based gold producer with three operating mines (two in Nicaragua and one in the Philippines) and a strong portfolio of development and exploration assets in Nicaragua, Colombia, Namibia and Uruguay. B2Gold is projecting gold production in 2013 of 360,000 – 380,000 ounces and approximately 400,000 ounces in 2014 from La Libertad, Limon and Masbate Mines. With the first full year of gold production from the Otjikoto project in Namibia scheduled for 2015, and increased production projected from La Libertad Mine, the Company is projecting 2015 gold production of approximately 540,000 ounces, based on current assumptions. Finally, with the successful completion of the Gramalote project (B2Gold 49% / AngloGold Ashanti Limited 51%) in Colombia, gold production could increase to approximately 750,000 ounces in 2017. Late in 2011, the Company completed the acquisition of a 92% interest in the Otjikoto project in Namibia, by completing a business combination with Auryx Gold whereby B2Gold acquired all of their shares in exchange for B2Gold shares. The Otjikoto gold project is located 300 km north of Namibia’s capital city of Windhoek. Construction commenced in the first quarter at the Otjikoto gold project.and is scheduled for completion in the fourth quarter of 2014 when mill production is expected to begin and the first gold production from the Otjikoto gold project is scheduled. The current mine plan is based on probable mineral reserves of 29.4 million tonnes at a grade of 1.42 g/t gold containing 1.341 million ounces of gold at a stripping ratio of 5.59:1 to be mined over an initial 12 year period. Based on the previously released Feasibility Study by the Company, the current average annual production for the first five years is estimated to be approximately 141,000 ounces of gold per year at an average operating cash cost of $524 per ounce and for the life of mine approximately 112,000 ounces of gold per year at an average operating cash cost of $689 per ounce. The Otjikoto gold project has excellent exploration potential. Subsequent to quarter end the Company announced additional positive drilling results on the new high grade Wolfshag zone near the current planned Otjikoto open pit. Of note, step-out diamond drill hole number WH12-345 returned 35.70 metres grading 4.82 g/t gold, including 15.30 metres grading 7.93 g/t gold, from the recently discovered Wolfshag zone. These positive drill results from the Wolfshag zone indicate the potential to outline additional resources that could lead to the expansion of production at the Otjikoto gold project. Three diamond drill rigs are currently active on the property, focused on the exploration and definition of the Wolfshag zone and parallel structures. An initial inferred resource estimate for the zone is expected by the fourth quarter of 2013. The Otjikoto exploration budget for 2013 is $8.0 million.

- In January 2014 the company announced that construction of the open pit Otjikoto Mine in Namibia remains on time and on budget. Construction is expected to be completed and production is scheduled to commence in the fourth quarter of 2014. In the first five years of its twelve year mine life, the Otjikoto Mine is expected to produce approximately 141,000 ounces of gold per year at an average cash operating cost of $524 per ounce. Pre-development cost estimates of $244 million and deferred stripping estimates of $33 million remain in line with original pre-feasibility study estimates. In addition to these costs, the Company had planned to lease finance mobile mining equipment and power plant costs in the amount of $60 million. However, as a result of Namibian regulations governing the securitization of certain assets, the Compa ny now plans to lease only the mobile mining fleet for a total of $41 million. The balance of the power plant costs has been funded from the Company’s existing cash flows and credit facilities. Leasing arrangements for the mining fleet were concluded in the fourth quarter of 2013 and are expected to be fully drawn and utilized by the end of 2014/early 2015 On November 5, 2013, the Company announced additional positive drilling results from the exploration program at the Otjikoto project. These drill results from the Wolfshag zone, adjacent to the planned Otjikoto pit, further indicate the potential to outline a higher grade resource that could lead to additional future expansion of production and an increase in the mine life. The Company plans to release the initial inferred resource estimate for the Wolfshag zone shortly. The Otjikoto 2014 exploration budget is $8 million. The program will focus on infill drilling the Wolfshag zone and further testing the potential to the south which remains open. Based on the positive drill results from the Wolfshag zone to date, the Company plans to expand the Otjikoto Mine in 2015, increasing ore throughput from 2.5 million tonnes per year to 3 million tonnes. The increased throughput will be achieved through the installation of a pebble crusher, additional leach tanks and mining equipment at a total cost of approximately $15 million. Once the expansion is completed at the end of 2015, annual gold production from the main Otjikoto pit would increase to approximately 170,000 ounces

The total exploration budget for Namibia in 2017 is $5.1 million mainly

for 5,000 metres of diamond drilling on the Otjikoto licence area, and

12,000 metres of diamond drilling and 5,000 metres of RAB drilling on

the Ondundu joint venture project. Drilling at Ondundu in 2016 has

defined a distinct North South zone of mineralization with holes

containing up to 3.10 g/t gold over 68.4 metres drilled in hole

ON-16-092 and 2.58 g/t over 52.1 metres (true width approximately 50% of

drilled width) drilled in hole ON-16-96. An additional 5,000 metres of

diamond and RC drilling are committed to new targets in and around the

Otjikoto area.

- Helio Resource Corporation's Damara Gold Project consists of 3 licenses in Central Namibia, located between 20-100km to the east and northeast of, and in the same geological terrain as AngloGold Ashanti's Navachab mine and approximately 150km southwest of B2Gold's Otjikoto mine. Results from the Gold Kop target returned 50m @ 2.1g/t Au, 0.8% Cu and 14g/t Ag, incl. 7m @ 9.0g/t Au, 4.4% Cu, 73g/t Ag. Other highlights include 12m @ 6.8g/t Au, 14m @ 3.1g/t Au, 7m @ 3.6g/t Au, 4m @ 11.6g/t Au, 5m @ 6.0g/t Au, 6m @ 5.3g/t Au, and 1m@ 32.8g/t Au. Almost 10,000m of drilling on 100m-200m spaced lines confirms potential to locate a sizeable gold target at Gold Kop.

- Etruscan Resources Inc has licences covering a total of 8,970 km2 that were granted between November 2005 and June 2006, and will target the Kamanjab Project where field crews encountered a range of mineralized occurrences of gold and base metals and identified several zones of alteration that may be associated with IOCG type mineralization and the Witvlei Project where a number of historic copper occurrences are known.

- Teck Cominco Ltd (Canadian, NYSE:TCK; TSX:TCK-A) holds several exclusive prospecting licences in the central and northern parts of Namibia ans is involved in early stage exploration.

- Aflease Gold Ltd has a 100% interest in Etendeka Prospecting and Mining Company, a Namibian-based exploration company.

- Solvay SA operates the Okorosu Mine, an open pit fluorite mine located north of Otjiwarongo. It is part of an alkaline igneous-carbonatite ring dike complex where fluorite has replaced pegmatitic carbonatite. The Early-Cretaceous alkaline rocks/sövite complex intruded Late Precambrian Damara series (quartzites, marbles and biotite schists). The metasedimentary rocks have been fenitized in the vicinity of the intrusion. Fluorite also replaces host-rocks (marbles and biotite schists). REE-bearing minerals occur in beforsitic carbonatite dikes and carbonate-fluorite-bearing metasomatites. Their HREE content is significant.

Graphite

Namibia Rare Earths files maiden Lofdal resource, confirms HREE

Namibia Rare Earths Inc had filed a maiden resource for its Lofdal rare earths elements project, confirming the presence of high levels of heavy rare-earth enrichment (HREE) in certain areas of the project. The National Instrument 43-101-compliant resource estimate, covering Area 4 of the project located in the north-west of Namibia, pointed to “exceptional” levels of HREE of between 75% and 93% HREE, depending on the cut-off grade, with corresponding total rare earth oxide grades (TREO) ranging from 0.27% to 1.26%. What distinguishes the project from many other juniors that have entered the market in response to China’s reduction of exports over the past four years – the country produces over 95% of the world’s rareearth’s supply – is its concentration of what are called heavy rare earths. “Given current rare-earth prices, over 90% of the value in this deposit lies in the four critical heavy rare

"Namibia's red hot uranium winners"

There are two types of graphite occurrences in Namibia. One type is found in altered granite of the Namaqualand Metamorphic Complex, and has been mined, and the other occurs in schists and marbles of the Swakop Group, Damara Sequence.

The Aukam Graphite Mine

NextGraphite, Inc. is an exploration development stage company targeting

the Aukam Graphite Project. Aukam contains a special form of graphite

known as “lump” or vein graphite. The Company anticipates revenue

from its existing inventory of unprocessed graphite to commence in

the third quarter of 2016, based on a Letter of Intent to initially

purchase 5,000 tonnes of graphite. This sale of unprocessed graphite

from the site will precede the Company going into production of its

high-grade, processed lump graphite in 2017-18. The Company entered

into a joint venture agreement in 2015 with a mining partner

committed to building and paying for a graphite processing circuit

facility at Aukam. Construction is scheduled to commence the first

quarter 2017. Production of high-grade processed graphite could begin

as early as the end of 2017.

The only mine in Namibia which has produced graphite is situated on the farm Aukam

104, Bethanien District, some 55 km southwest of the Goageb siding. The ore body lies on the eastern slope of a prominent range of hills which rises 120 to 150 m above the level of the surrounding sandcovered valleys. The country rock consists almost entirely of greyish, medium- to coarsegrained granite and gneissic rocks of the Namaqualand Metamorphic Complex. The graphite-bearing zone, which strikes

Year Production (t)

1940 64

1941 172

1942 182

1943 1759

1944 1974

1945 1319

1946 1193

1947 1640

1948 1627

1949 2265

1950 1380

1951 2627

1952 1184

1954 104

1955 917

1956 227

1964 251

1965 359

1966 363

1967 436

1968 398

1969 386

1970 336

1971 494

1972 440

1973 368

1974 137

Graphite-bearing schist and marble are widely distributed within the Swakop Group of

the Damara Sequence (Reimer, 1984).

Okanjande 145

Graphite occurs on the farms Okanjande 145, Good Hope 298 and Highlands 311, about 20 km southwest of Otjiwarongo, in the form of sparsely disseminated flakes and small lenticular bodies within gneissose and schistose rocks of the Swakop Group (Schwellnus, 1941). The ore body is kidneyshaped and extends 600 m on its long axis with maximum surface widths exceeding 350 m; the depth extend is at least 70 m . The host rock is a highly deformed sequence of graphite enriched, quartzo-feldspathic gneisses with folded and boudinaged quartzite bands. Over 85% of the graphite occurs as well crystallised, undeformed flakes, disseminated throughout the rock along grain boundaries with an average flake size of 6 mm. Some clusters of graphite contain flakes of up to 2 mm in diameter. A minimum reserve of 36 million t grading 4.3% carbon as graphite has been established. Provisional mining reserves using a 3% cut-off are estimated as 12 million t grading 6.1% carbon, giving a waste to ore ratio of 0.18:1. A pilot plant is currently in operation (Rossing Uranium Ltd, 1991).

Black Range 72

A bedded, syngenetic, low-grade, bulk tonnage flake-graphite deposit was found on the farm Black Range 72 in 1987. Black Range 72 is located 40 km west of Usakos and the deposit straddles the road to Henties Bay. A small portion of the deposit was examined in detail. Geological reserves with a cut-off. grade of 2 % carbon as graphite amount to 13.75 Million t at 4.52 % C as graphite. Detailed mineralogical testwork was carried out on a 60 t bulk representative sample which was obtained by pitting. Recovery of graphite was very difficult as individual flakes are closely associated with mica. A recovery of 60

Windhoek and Rehoboth Districts

On the northeastern and southern portions of the farm Lichtenstein 366 and on the farm Melrose 368 in the Windhoek District, well-developed graphite schists of fairly pure quality extend over a strike length of some 6 to 8 km (Cooke, 1965). They consist of several lenses and bands alternating with sericitic and amphibolitic schist. Similar occurrences near the Hakos Mountains around the farm Portsmut 664, Windhoek District, and north of the farm Aroams 315 in the Rehoboth District, unfortunately contain abundant mica, quartz and clay. Two samples of this material assayed 46 and 37% carbon.

References

Cooke, R. 1965. Brief notes on the graphite occurrences of Melrose 368, Windhoek

District. Unpubl. rep., geol. Surv. Namibia, 2 pp.

DeKock, W.P. 1935. The Graphite Prospect at Aukam 104, District of Bethanie. Unpubl. rep., geol Surv. S. Afr. 2 pp.

Reimer, T.O. 1984. Graphite in Precambrian rocks of southern Africa: Implications on the carbon content of metamorphic rocks. Precambr. Res. 26, 223-234.

Rossing Uranium Ltd. 1991. Okanjande Graphite - A development of Rossing Uranium. 8 pp.

Schwellnus, C.M. 1941. The Graphite Deposits Southwest of Otjiwarongo, South West Africa. Unpubl. rep., geol. Surv. S. Afr., 5 pp.

Iron Ore

- Deep Yellow Limited’s wholly-owned Namibian subsidiary, Reptile Uranium Namibia (RUN), discovered Shiyela in 2008 when an IOCGU target hole made a 340 metre magnetite rich intercept from surface. In 2010 a decision was taken made to drill test two magnetic anomalies (M62 and M63) at Shiyela. It was recognised that if the two anomalies proved to be significant magnetite deposits a mining operation at Shiyela would have a number of natural competitive advantages, namely:Infrastructure ~ 45 km by road from Walvis Bay port,10 km from the main C14 road that leads to Walvis Bay,10 km from the Kuiseb electricity substation which currently supplies Langer Heinrich Uranium Mine, Potential source of water in the Tubas channel to the north of the project area., Exploration upside associated with a regional aeromagnetic anomaly over a 20 km strike length. Potential to produce a high-quality concentrate grading above 68% iron (Fe). Initial metallurgical testwork on the 2008 drill core returned a high-grade magnetite concentrate assaying 70% Fe with very low silica content and no deleterious elements (Al2O3, P, S). Golder Associates Pty Ltd (Perth) completed a maiden JORC Mineral Resource estimate for Shiyela (ASX 6 December 2011) returning an Inferred Mineral Resource estimate of 78.7 Mt at 18.88% Fe at 10% DTR cut-off for the M62 and M63 magnetite deposits with an average DTR magnetite content of 16.17%. The Shiyela Iron Project, is the only known commercially viable iron deposit in the country. Once operational, the project will initially produce two million tonnes per annum of a high quality, coarse grained magnetite expected to attract a premium price in the export market. Depending on the Walvis Bay port capacity, ongoing exploration success and overall market economics, the project could ultimately be expanded to around 7.5 million tonnes per annum of magnetite product.

- CHINESE company Eastern China Non-Ferrous Metals Investment Holding (ECE) in 2012 discovered a deposit of 3 268 billion tonnes of iron ore at the Orumana village, some 30 kilometres south of Opuwo in the Kunene Region, and is planning to construct a multi-billion dollar industrial complex near Opuwo. ECE executive chairman Yi Shao said if everything goes well, the projects would contribute US$700 million (about N$6,2 billion) to Namibia's gross domestic product (GDP), and employ about 5 000 Namibians.

- Lodestone Namibia (Pty) Ltd's Dordabis Iron Ore Project is situated approximately 21km north of the town of Dordabis and 75km south of the Hosea Kutako International Airport in Namibia. The Dordabis Project holds the following Exclusive Prospecting Licences (EPLs); EPL 3112 (5,913 ha), EPL 3938 (7,274 ha), and EPL 4265 (25,287 ha). Lodestone began a third Phase of exploratory drilling activities in March 2013 which is scheduled to be completed in July 2013. This phase concentrates primarily on EPLs 3112 and 4265 on the Tsatsachas and Elizenhöhe farms. Minrom Namibia is currently conducting the third phase of drilling on the contiguous ore bodies and is conducting and overseeing the cataloguing and extraction of bulk samples. Metallurgical test work results indicated that the ore is feasible for the extraction of a high grade (67% Fe) hematite/magnetite (minor) blend. The geological block model indicated that the total resource tonnage for the north and the south ore body total 60mt at and average of 36.35% Fe utilising a 15% cut-off grade.

| Year | Production | Unit of Measure | % Change |

|---|---|---|---|

| 2003 | 18782 | Metric tons, lead content | NA |

| 2004 | 14338 | Metric tons, lead content | -23.66 % |

| 2005 | 14320 | Metric tons, lead content | -0.13 % |

| 2006 | 11830 | Metric tons, lead content | -17.39 % |

| 2007 | 10543 | Metric tons, lead content | -10.88 % |

| 2008 | 14062 | Metric tons, lead content | 33.38 % |

| 2009 | 14100 | Metric tons, lead content | 0.27 % |

Source:USGS

The only source of lithium in Namibia to date has been pegmatites, where it typically occurs and was recovered with beryllium, cesium, rare earths and tantalite (Diehl, 1992).

- Namaqualand Metamorphic Complex

The pegmatites are intruded into gneisses and ultramafic rocks of Mokolian age in southern Namibia (Diehl, 1992).

Lepidolite pegmatite

The pegmatite is located between the farms Umeis 110 and Kinderzitt 132 about 0.75 km southwest of the Signaalberg. It has intruded peridotite, pyroxenite and troctolite of the Tantalite Valley Complex. The body is 200m long and up to 10m wide. The body is zoned and consists of a border and wall zone of quartz, perthite, albite and minor muscovite. There are two intermediate zones that are more differentiated and consist of massive lepidolite, albite, quartz and accessory minerals including spodumene, amblygonite, rubellite, tantalite and microlite (Diehl, 1992).

Sandfontein-Ramansdrift Pegmatites

The pegmatites are located on the farms Sandfontein 131, Sandfontein West 148, Sperlingsputz 259, Witputz 258, Hochfeld 112 Norechab 129, Haakiesdoorn 137, Gaobis 138, Gaidip 146 and Ramansdrift 235. The pegmatites contain niobium-tantalum, lithium, beryllium and rare earth mineralisation. The pegmatites are intruded into the metavolcanic rocks of the Huab Formation and the plutonic rocks of the Vioolsdrif Suite. They range in width from 3 to 30m and are 100 to 250m long. The mineral composition includes quartz, microcline, microcline-perthite, schorl, biotite, magnetite, sphene, beryl, tantalite-columbite and microlite (Diehl, 1992).

Karibib-Usakos Pegmatite District

The most significant pegmatitic lithium deposits within Namibia occur in the Karibib-Usakos pegmatite district in the Damara Succession (Diehl, 1992). These pegmatites are associated with granites intruded into the Damara sequence. The area hosts numerous mineralized rare earth pegmatites which could be an important source of lithium, cesium, rubidium, beryllium, niobium, tantalum and bismuth. The pegmatite field is approximately 200km long and 100km wide. It is one of the most extensive pegmatite fields in the world (Baldwin, 1989). The pegmatites exhibit a typical geochemical pattern where Li, Na and K phases are well developed. The common minerals found include lepidolite, petalite, amblygonite, Li-Mn-Fe phosphates, spodumene, muscovite, beryl and tourmaline (Balwin,1989 and Diehl, 1992).

- BlackFire Minerals Ltd (Australian) has acquired the exploration rights to the more important defunct lithium workings (Rubikon, Helikon) from Australian private company Sunrise Minerals Pty Ltd. The acquisition was facilitated via Black Fire purchasing Sunrise’s private Namibian subsidiary, Starting Right Investments Ninety Four (Pty) Ltd, which is the holder of Exclusive Prospecting Licences EPL 3750 and EPL 3751.

Rubikon Pegmatite

The pegmatite is the largest of the Rubikon pegmatite swarm and is located 30km southeast of Karibib on the farmOkongava 72. The pegmatite belongs to the group of internally zoned Li-Cs-Be-Rb pegmatites. It has reached the highest degree of alkali fractionation. It has been the major source of lithium within Namibia. The deposit was exploited by open pit and room-and-pillar stoping to a depth of 30m (Diehl, 1992).

The pegmatite consists of two ellipsoidal, well zoned, lithium bearing orebodies that are surrounded by quartzo-feldspathic pegmatite. It is intruded into quartz monzodiorite and pegmatitic two-mica granite of Pan African age (Diehl and Schneider, 1990). The first ore body is 320m long and 25 to 35m wide and dips 45° to the northeast but flattens to 18 to 25° at depth. The second ore body dips 30° to the northeast and flattens to 8 to 12° at a depth of 20m.

Mineralogically the ore body can be divided from the footwall into the following zones (Diehl and Schneider, 1990):

Border Zone

Wall Zone

Outer Intermediate Zone

Inner Intermediate Zone

Outer Core Zone

Beryl Zone

Petalite Zone

Low-grade Lepidolite Zone

High-grade Lepidolite Zone

Inner Core Zone

Perthite-Quartz Core

Petalite Zone

Quartz-Core

The exploitable lithium minerals are confined to the outer and inner core zones. Economic quantities of beryl are also found in the bodies (Diehl, 1992).

Pinkish petalite crystals in the upper portion of the Rubikon pegmatite, Namibia

Helikon Pegmatites

The pegmatites are located 30km southeast of Karibib on the farm Okongava Ost 72. There are two pegmatites, Helikon I and Helikon II. The pegmatites are rare metal bearing and lithium rich. They both have been mined for lepidolite, amblygonite, petalite, mica and by- products that include beryl, pollucite, quartz and columbite-tantalite (Diehl, 1992).

Dernburg Pegmatite

The pegmatite is located west-southwest of Karibib on the farm Karibib Townlands 57. The pegmatite intruded into the Chuos Formation quartzites. The pegmatite strikes west-northwest and dips steeply to the southwest (Diehl, 1992). It is considered a lithium-beryllium rare earth metal pegmatite. There are a number of symmetrical zonations that are discontinuous along strike (Diehl, 1992). The zones are as follows:

Border zone (quartz, muscovite, albite)

Wall zone (albite, quartz, muscovite)

Outer intermediate zone (perthite, quartz,

muscovite, albite)

Inner intermediate zone (albite, quartz, muscovite, beryl, amblygonite)

Outer core zone (spodumene, amblygonite,

cleavelandite, muscovite)

Inner core zone (massive quartz)

Amblygonite is found as nodular crystals within the inner intermediate zone. The amblygonite is associated with irregularly distributed quartz masses. Cleavelandite, beryl, topaz and spodumene occur along the margin of inner core zone (Roering, 1963).

Karlsbrunn Pegmatite

The pegmatite is located 6.5km south-southwest of the railway siding at Albrechtshohe. The pegmatite is 30 to 150m wide and has a strike length of 330m. It has intruded the Karibib Formation marbles (Diehl, 1992). The pegmatite exhibits zoning and is divided as follows:

Border zone

Wall zone

Inner intermediate zone (perthite, quartz, albite-cleavelandite, muscovite, beryl)

Outer core zones (petalite-amblygonite and lepidolite)

Core margin zone (albite, beryl, columbite, apatite)

Inner core zone (massive quartz)

Albrechtshohe (Brockmann) Pegmatite

The pegmatite is located in the Albrechtshohe-Kaliombo area, 5km southeast of the Albrechts siding. The pegmatite is lense-shaped with an east-west strike. It is 255m long and dips steeply to the north (Diehl, 1992). According to Roering (1963) the pegmatite is divided into the following zones:

Border zone (weathered material)

Wall zone (albite-quartz-muscovite-tourmaline)

Outer intermediate zone (albite-quartzmuscovite, spodumene)

Inner intermediate (economic) zones

Lepidolite-albite zone

Lepidolite-albite-alkali-feldspar zone

Amblygonite-rich zone

Quartz core zone

Berger Pegmatite

The pegmatite is located 6.5km south-southeast of the Albrechshohe siding on the farm Kaliombo 119. The pegmatite is described as a steeply dipping, east-west striking dyke. It is 160m long. The pegmatite has intruded the Karibib Formation marbles (Diehl, 1992). The pegmatite was divided into the following zones (Roering, 1963):

Border zone (albite-quartz-tourmaline)

Wall zone (albite-quartz-muscovite)

Outer intermediate zone (complex albite-quartz-muscovite)

Inner intermediate zone

Beryl zone

Lepidolite zone

Clay mineral zone

Core zone (quartz)

Euhedral aquamarine and beryl are associated with the outer intermediate zone. The main beryl mineralisation is confined to the inner intermediate zone (Roering, 1963).

Kaliombo Pegmatite (Berger’s Claims)

The pegmatite is located 1.8km south of the Berger pegmatite and is found on the farm Kaliombo 119. The pegmatite has previously been worked. Columbite-tantalite, lepidolite, amblygonite and beryl have been extracted from small lenses within the zoned rare metal pegmatite, which occurs in pegmatitic granite. The lenses are irregularly distributed and vary in compostion from albite- quartz rocks with lepidolite to quartz-rich albite-amblygonite pegmatite. The mineralisation is generally concentrated in the discontinuous quartz core which is partially replaced by cleavelandite- lepidolite- amblygonite assemblages (Diehl, 1992).

Gamikaubmund (Brockmann’s claims)

The pegmatite is located 8km southeast of the Swakop River on the farm Tsaobismund 85. It has intruded the Lower Nossob quartzites. The pegmatite has been exploited for beryl, lithium minerals and columbite-tantalite (Smith, 1965).

Otjua (Becker’s) Pegmatite

The pegmatite is located 33.5km east- southeast of Karibib on the farm Otjua 37. It has been exploited for tourmaline, lepidolite, amblygonite, beryl and smoky quartz. The inner intermediate zone was exploited (Diehl, 1992).

Ricksburg Pegmatite

The pegmatite is located on the farm Okakoara 43. It is a columbite-tantalite lithium-bearing pegmatite (Diehl, 1992). No further information is available

Mon Repos Pegmatite

The pegmatite is located on the farm Navachab 58. Lithium and tantalite minerals were found in this zoned rare metal pegmatite (Diehl, 1992).

Okatjimukuju (Meyer’s Camp, Frickers’s) Pegmatite

The pegmatite is located on the farm Okatjimukuju 55. It is a zoned rare metal pegmatite containing lepidolite and amblygonite. The lithium mineralisation is associated with a muscovite-cleavelandite unit found along the margin of the quartz core (Diehl, 1992).

Etusis (McDonald’s) Pegmatite

The pegmatite is located on the farm Etusis 75. It is a zoned lithium rich rare metal pegmatite. The pegmatite intruded the metasedimentary rocks of the Karibib Formation. It has been mined for amblygonite, petalite, lepidolite, beryl and bismuth minerals (Diehl, 1992).

Habis Pegmatite

The pegmatite is located 15km south of Karibib on the farmHabis 71. It is described as a lepidolite-beryl rare metal pegmatite (Diehl, 1992).

Daheim Pegmatite

The pegmatite is located on the farm Daheim 106. Petalite mineralisation was found.

Friedrichsfelde Pegmatite

The pegmatite is located on the farm Okakoara 43.

Dobbelsberg Pegmatite

The pegmatite is located on the farm Dobbelsberg 99. Montebrasite- amblygonite mineralisation was found.

Etiro Pegmatite

The pegmatite is located 20km north of Karibib on the farmEtiro 50. The pegmatite forms part of a pegmatite swarm. The pegmatite is 850m long and 4 to 28m wide (Miller, 1969). The pegmatite is a lithium-beryllium rare metal pegmatite. It has well-developed internal zonation. The pegmatite was exploited for feldspar, beryl, mica, columbite-tantalite and bismuth (Diehl, 1992).

REFERENCES

- Ansett, T.F., Krauss, H.U., Ober, J.A. and Schmidt, W.H., 1990: International Strategic Minerals Inventory Summary Report- Lithium: Circular, United States Geological Survey, 930-l.

- Baldwin, J.R., 1989: Replacement phenomena in tantalum minerals from rare- metal pegmatites in South Africa and Namibia, Mineralogical Magazine, 53, pp. 571- 581

- Bullen, W.D., 1998: Lithium in The Mineral Resources of South Africa (M.G.C. Wilson and C.R. Anhaeusser, eds): Handbook, Council for Geoscience, 16, pp. 441- 443.

- Diehl, M., 1992: Lithium, Beryllium and Cesium in The Mineral Resources of Namibia: First Edition, Geological Survey, 6.15

- Diehl, B.J.M. and Schneider, G.I.C., 1990: Geology and mineralisation of the Rubikon pegmatite, Namibia. Open file rep., geol. Surv. Namibia, pp.20.

- Evans, R.K., 2008: An Abundance of Lithium.http://www.worldlithium.com/An_Abundance_of_Lithium_1_files/An%20Abundance%20of%20Lithium.pdf

- Galaxy, 2009: Lithium Market Outlook and Offtake Update. ASX Announcement/Media Release.

- Garrett, D.E., 2004: Handbook of Lithium and Natural Calcium Chloride: Their Deposits, Processing, Uses and Properties, Elsevier Ltd, London, UK, pp.476

- Industrial Minerals, 2009a: SQM to cut Li to $2.3-2.4/lb..http://www.indmin.com/Article/2351265/Channel/19558/SQM-to-cut-Li-to-23-24lb.html

10. Industrial Minerals, 2009b: Price cuts give lithium a rude awakening. http://www.indmin.com/

11. Madison Avenue Research Group, 2009: Lithium Demand, Pricing, and Supply Forecast Considered as Li-ion in Automotive Use to Surge. . www.marketoracle.co.uk/Article9722.html

12. Miller, R. McG., 1969: The geology of the Etiro pegmatite, Karibib District, S.W.A. Ann. Geol. Surv. S. Afr., 7, 131-137

13. Oosterhuis, W.R., 1998: Salt in The Mineral Resources of South Africa (M.G.C. Wilson and C.R. Anhaeusser, eds): Handbook, Council for Geoscience, 16, pp. 584- 586.

14. Roering, C. 1963: Pegmatite investigations in the Karibib District, South West Africa. Unpubl. Ph.D thesis, Univ. Witwatersrand, pp 130.

15. Schneider, G.I.C and Genis, G., 1992: Soda Ash in The Mineral Resources of Namibia: First Edition, Geological Survey, 6.23

Oil and Natural Gas

Exploration History

The initial offshore exploration phase took place from the late 1960’s to the early 1970’s and one well was drilled during this time, Kudu 9A-1, which was the discovery well for the giant Kudu gas field. No further exploration for hydrocarbons was done by international operators until after Namibia became independent in 1990. In 1987-1988 Swakor, the predecessor company of the present National Oil Company, NAMCOR, drilled a further 2 wells in the Kudu field. The Kudu-2 well was not tested but Kudu-3 proved the existence of a major gas field. The proven hydrocarbons were an asset in Namibia’s first licensing round.

The first exploration licensing round was held in 1991-1992 with five licenses being awarded at this time, the operators of these being Norsk Hydro, Ranger, Sasol, Chevron and Shell. The second round in 1995 resulted in 2 new licences being awarded, both to Shell. One of these was an extension to the existing license that Shell had over the Kudu field. As a result of these licence awards over 28,000 km of 2-d seismic was acquired in addition to the 60,000 km of multi-client data, which is available. The Third Licensing Round in 1998-99 resulted in no applications being received, partly because of the low oil price at the time as well as the numerous international company mergers that were ongoing. The mini-4th Round in 2004 eventually resulted in the award of 2 blocks to BHP-Billiton west and south of Kudu.

To date 14 wells have been drilled off shore Namibia, including 7 in the Kudu gas field. In addition data is available from DSDP and ODP wells and also academic seismic data from earlier work. The data that has resulted is a modern, comprehensive and digital set that is easily accessible. In June 2000 a license was awarded in northern Namibia to Vanco Energy. In 2002 Shell withdrew from the Kudu Block and the license was taken over by the then partners, Chevron, Texaco and Energy Africa. Recently many other licences have been awarded for exploration both onshore and offshore Namibia. The map shows all of the current licences in Namibia.

In addition to the seismic data NAMCOR acquired 28,000 km of aeromagnetic data in 1998 covering the whole of offshore Namibia. This data set has elucidated the structural setting of the Namibian margin, especially when used in conjunction with the regional and high-resolution data from onshore Namibia.

- Natural gas proved reserves: 62.3 billion cu m (1 January 2005 est.)

Source: Tullow Oil

- HRT Participações em Petróleo S.A ("HRT") announced on Friday July 18, 2013 that the Murombe-1 well, the second offshore well in their exploratory drilling campaign has been concluded and is considered as a dry hole. This well was targeting the Murombe Prospect, located in Petroleum Exploration License 23 in the Walvis Basin. Although the well was dry and presence of poor reservoir in the main target, the results reconfirmed the presence of Aptian source rock in the oil window, which was also encountered during the drilling of the Wingat-1 well. The Murombe-1 exploration well was drilled to a total depth of 5,729 meters with the objective of penetrating two targets. The primary target, Murombe, a Barremian Age turbidite fan system and a secondary target, the Baobab, a shallower Santonian Age structure were both penetrated. The average porosity was 19% and no reservoir was encountered. Gil Holzman, Chief Executive Officer of Eco Atlantic commented: "The results of the Murombe-1 well announced by HRT late last week was disappointing for HRT from a commercial perspective, however they provide valuable information on the basin and the geological structures of the region. The well reconfirmed the evidence of source rock which complements that which was established by the Wingat-1 well drilled in May. In that well, samples of high quality light sweet crude were recovered, and a working petroleum system in the Walvis Basin was established." Earlier this month, Eco Atlantic was granted a one year extensions of its Exploration Phase of the Sharon and Guy licenses, extending the obligation period for both 3D seismic and drilling by a further 12 months into 2016. "Repsol recently announced the anticipated drilling of its Welwitschia-1 prospect in February 2014, which is contiguous to Eco Atlantic's Cooper Block in the Walvis Basin." Added Holzman, "HRT has also confirmed the imminent drilling of its third exploration well on the Moosehead prospect in the Orange Basin. Our Strategy is to continue with ongoing exploration during the extended term as approved by the Ministry, which comfortably allows the Company sufficient time to work obligations. Our team continues to gather information from ongoing exploration work which is allowing us to further define our prospects and targets. We and the E&P industry are well aware of the statistics of early dry holes drilled in the major fields around the world in order to bring them on line. We are being very conservative in our budgetary moves at this early stage and remain confident in the prospectivity of our offshore Namibia licenses."In the last years, Namibia has attracted the global oil industry attention due to the similarities of its offshore basins with two rich Brazilian basins: the Santos Basin, where the pre-salt layer discoveries can more than double the national reserves, and the Campos Basin, which is responsible for more than 80% of the national hydrocarbon production in the country. The Namibian coast is consisted of four continental sedimentary basins – Namibe, Walvis, Lüderitz and Orange. All of them are considered frontier areas, that is to say, little-explored areas on hydrocarbon accumulations, thus with potential for large oil and natural gas accumulations. The studies made by HRT`s specialists indicate that Namibia is a Brazil-conjugate margin in the South Atlantic since they share a common geological history. Through the acquisition of assets in the African country, the company became to be the major holder of offshore areas under concession, with 12 exploration blocks covering an extension of 68.800 km2, being the operator of 10 of them. In these assets, the consulting firm D&M estimates that the company has 6.9 billion BOE in net risked prospective resources. The largest 3D seismic survey ever performed in the West African coast has been conducted by HRT. Such survey covers approximately 10 thousand km² in prospects previously mapped in 2D seismic. The geological and geophysical investigations have been increasing the expectations concerning the Namibia`s potential. In seven prospects mapped by the company`s specialists, they estimate 28.5 billion BOE in P(10) unrisked prospective resources.