Zimbabwe

Zimbabwe Geological Survey

Zimbabwe Geological SurveyP.O. Box 210, Causeway, Harare

Phone: +263-726342

Fax: +263-4-739601

zimgeosv@africaonline.co.zw

Mines and Minerals Act

Chamber of Mines

Gold Miners Association of Zimbabwe

Travel and accommodation

The contribution of mining to total exports in 2010 amounted to 26.8% Mineral exports accounted for 52% of the country’s total exports worth $2.4bn as of end-October, 2014.

Zimbabwe Mining News

The contribution of mining to total exports in 2010 amounted to 26.8% Mineral exports accounted for 52% of the country’s total exports worth $2.4bn as of end-October, 2014.

Zimbabwe Mining News

Source: CIA Factbook

Legend

Gold deposits

Geology

Legend

Gold deposits

Geology

Zimbabwe is underlain by a core of Archean Basement known as the Zimbabwe Craton, which is intruded by the famous Great Dyke, a SSW-NNE-trending ultramafic/mafic complex. The Craton is bordered to the south by the Limpopo Belt, to the northwest by the Magondi Supergroup, to the north by the Zambezi Belt and to the east by the Mozambique Belt. The Craton is principally composed of granitoids, schist and gneisses and incorporates greenstone belts comprising mafic, ultramafic and felsic volcanics with associated epiclastic sediments and iron formations. It is overlain in the north, northwest and east by Proterozoic and Phanerozoic sedimentary basins. The Zimbabwe Craton is separated from the Kaapval Craton to the south by a zone of penetrative deformation and metamorphism – the Limpopo Mobile Belt with a polyphase history spanning Archean to Mesoproterozoic times. The Great Dyke is a long, narrow body of inward-dipping peridotites, with chromite bands, pyroxenites and norites representing activity from several intrusive centres aligned along a NNE-SSW striking graben structure. It extends for over 500 km and is more accurately considered as an elongate stratiform igneous complex rather than a dyke.

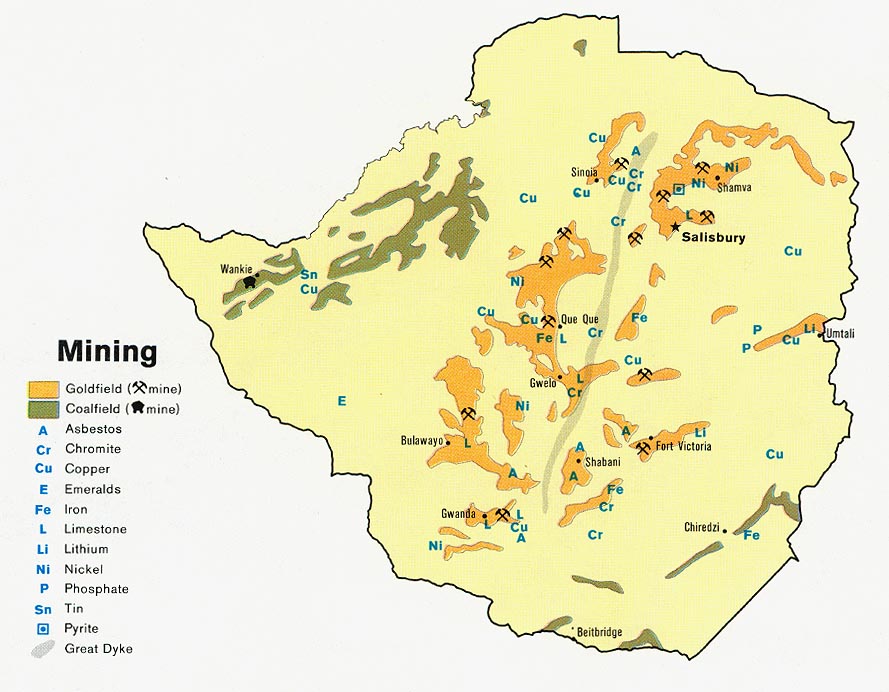

Zimbabwe is rich in mineral resources including coal, chromium ore, asbestos, gold, nickel, copper, iron ore, vanadium, lithium, tin, platinum group metals and diamonds and nationally about 40 minerals and mineral-based commodities have been produced. It is the world’s seventh largest producer of lithium (2%), and sixth largest producer of chrysotile asbestos (4%) and vermiculite (2%). Gold, platinum group metals (PGM’s) and chrome form the principal endowments. Zimbabwe is estimated to have 13% of the world’s chromium reserves, mainly in the Great Dyke. Chromite production declined by 27% in 2008 with Zimbabwe accounting for 4.7% of total output from Africa. In the last two years the country has slipped from the world’s fifth to eighth largest chromite producer. In the African continent Zimbabwe has the second largest reserves and is the second largest producer of PGM’s after South Africa. In 2008 it registered a 4.2% increase in platinum production. In terms of world production the country is ranked fourth for platinum (2.3%) and fifth for palladium and other PGM’s (1.7%). Gold production, which was the traditional mainstay and foreign currency earner, has plummeted over the past five years with the closure of several mines. 2008 production was half that of 2007 and was one sixth of the 2004 output. Zimbabwe is now ranked the tenth largest gold producer in Africa with the main contribution derived as a by-product of PGM production. In 2008 production decreases were also registered for ferrochrome by 24.4%, mined nickel (25.4%), asbestos (44.7%), phosphate rock (57%) and coal (19%). Iron ore production remained unchanged but pig iron and steel production ceased. Diamonds were one of the few mineral commodities with a production increase (14.7%) and in 2008 Zimbabwe was rated as the seventh largest producer in Africa.

Oil & Gas

No commercial deposits of petroleum have been discovered, although the country has substantial reserves of coal (>500Mt), utilized for power generation, and coal-bed methane (largest gas field in Southern or Eastern Africa) which is yet to be fully exploited.

Maps and images

- Zimbabwe 250k topographical maps (Link for maps listed below)

- Zimbabwe Google Satellite Maps

- Zimbabwe Cities,Towns, Airports, Maps, Images

- Zimbabwe Geology

- Zimbabwe Geological Survey

- Zimbabwe Gold Deposits

- Zimbabwe Base metal and industrial mineral deposits

- Zimbabwe Image-1

- Zimbabwe Image-2

- Zimbabwe Minerals

- Zimbabwe Topography -01 Plumtree Scale 1:250 000

- Zimbabwe Topography-02 Mphoengs

- Zimbabwe Topography-03 West Nicholson

- Zimbabwe Topography-04 Beitbridge

- Zimbabwe Topography-05 Mana Pools

- Zimbabwe Topography-06 Kanyemba

- Zimbabwe Topography-07 Nyamandhlovu

- Zimbabwe Topography-08 Gweru

- Zimbabwe Topography-09 Mhangura

- Zimbabwe Topography-10 Mount Darwin

- Zimbabwe Topography-11 Harare

- Zimbabwe Topography-12 Mutoko

- Zimbabwe Topography-13 Chegutu

- Zimbabwe Topography-14 Mutare

- Zimbabwe Topography-15 Shurugwi

- Zimbabwe Topography-16 Chimanimani

- Zimbabwe Topography-17 Kariba

- Zimbabwe Topography-18 Kazungula

- Zimbabwe Topography-19 Binga

- Zimbabwe Topography-20 Wankie & Victoria Falls

- Zimbabwe Topography-21 Copper Queen

- Zimbabwe Topography-22 Kamativi

- Zimbabwe Topography-23 Kwekwe

- Zimbabwe Topography-24 Dzivanini

- Zimbabwe Topography-25 Malipati

- Zimbabwe Topography-26 Malvernia

- Zimbabwe Topography-27 Bulawayo

- Zimbabwe Topography-28 Masvingo

- Zimbabwe Topography-29 Chipinge

- Zimbabwe Topography-30 Mwenezi

- Zimbabwe Topography-31 Chiredzi

- Available Geological Maps (106)

Zimbabwe used to produce antimony as a by-product of its gold mining operations.

Chrome

Click HERE for an overview

- Zimbabwe Mining and Smelting Company (ZIMASCO) produces high carbon ferrochrome from mines and smelters in Shurugwi, Mutorashanga and Kwekwe. Sinosteel Corporation agreed to buy Zimasco Consolidated Enterprises Ltd, the holding company for Zimbabwe's largest ferrochrome producer, for an undisclosed amount, Sinosteel said in September, 2007. Zimasco produces 210 000 tonnes of high carbon ferrochrome annually, accounting for about 4 percent of global ferrochrome production, said its website. State-owned Sinosteel and Zimasco inked the deal on September 19, following preliminary agreements earlier this year, according to the Sinosteel website. Sinosteel has been one of China's more proactive state-owned firms in investing overseas. It has invested in iron ore mining and exploration in Australia, plans to build a steel mill in India, has uranium exploration ventures in Australia and Niger and has entered a ferro-chrome joint venture with South Africa's Samancor Chrome.

- On June 15, 2006, the Zimbabwe Mining Development signed an agreement to form a chrome mining joint venture with private Chinese company Star Communications; the deal is to be funded by the China Development Bank. It is likely that this joint venture is the result of aprevious communications deal.

Coal

Coal has been the dominant energy mineral for Zimbabwe. The country boasts of vast reserves of coal particularly in the north-west and southern parts of the country. Wankie Colliery Company, the only coal producing mine at present, has adequate capacity to meet the country’s needs in terms of energy requirements for domestic heating, agricultural heating, industrial energy as well as power stations. However, the quality of Wankie coal in terms of sulphur and phosphorous content is not suitable for metallurgical purposes and therefore such coal is imported mainly from South Africa. Other resources are being evaluated to determine viability of establishing a new power station to meet the country’s growing requirements.

Coal-bed Methane(CBM) recently discovered in the north-west of the country provides an alternative energy source to coal. The discoveries are considered to be comparable to those in the USA (according to Paul Tromp, an American who was involved in early exploration for CBM in Zimbabwe). Several exploration companies have reported viable resources awaiting further development and investment. This resource could be used for power generation, production of pharmaceuticals, ammonia-based fertilisers and other chemicals. Many downstream industries could be developed resulting in greater employment levels and a variety of new products.On December 16, 2003, state-owned utility Zimbabwe Electricity Supply Authority (ZESA) announced that it would sign a memorandum of understanding with China National Aero-Technology Import and Export Corporation (CATIC) for a coal mining project at Hwange. The government of Zimbabwe and ZESA were represented by company chairman Dr. Sydney Gata. On October 16, 2007, Pingdingshan Coal (Group) Company, Ltd. and China National Aero-Technology Import and Export Corporation announced plans to mine coal in Zimbabwe alongside the state-owned Zimbabwe Power Company. Specifically, Pingdingshan International Mining Investment Company, Ltd., a subsidiary of Pingdingshan Coal (Group) Company, Ltd., will contribute 45% of the investment in the venture. The mining will occur at the Sinamatella Coal Fields. The plans were announced by the Vice General Manager of Pingdingshan, Liu Yinzhi. The current status of this project is unknown, as well as the exact price of the deal.

THE US$2 billion coal and methane gas project expected to ease electricity woes in the country and create about 4 000 jobs, in the Gwayi area of Lupane will start in January 2013.

The joint venture project between Oldstone Investment and Shan Don Sunlight Energy Company of China would see the companies embarking on coal extraction and power generation projects next year.

Ultimately, ailing industry and commerce are expected to be rejuvenated, as about 1 800 megawatts of electricity is set to be generated from thermal power stations to be set up by the firms.

In a speech read on his behalf by Defence Minister Emmerson Mnangagwa at a groundbreaking ceremony for the venture in Gwayi yesterday, President Mugabe said it was the first time the country had undertaken a project to alleviate power shortages since they became apparent five years ago.

"I consider this project as beneficial to Matabeleland North Province and the nation as a whole and a well-timed one, for the country has been in short supply of energy since 2007.

"The success of this project will no doubt provide the necessary impetus for the development of our economy, which has been crippled by the power deficit and illegal sanctions," said the President.

Benefits of the project, he said, include employment creation, construction of social amenities, infrastructure development and expansion of agriculture through fertiliser production.

"All these benefits will start here in Matabeleland and cascade to other parts of the country.

"It is only through innovation such as this that we can pull the country out of the woods in the face of illegal sanctions and limited lines of credit. It is indeed high time that we have a paradigm shift in our approach to development and realise that the traditional way of financing such projects from the fiscus loans is not feasible at the moment."

He said the national debt was high and it was time to consider alternatives like joint ventures and Build Operate and Transfer models.

The President said such initiatives were attractive, as technical partners would come in as investors, not contractors, thereby bringing foreign direct investment accompanied by the necessary technology and skills to ensure they guarantee the performance of investment.

"It is therefore important to note that these alternative funding models are based on wealth creation and don't increase the country's debt burden," he said.

President Mugabe said such significant national projects required co-ordination from all ministries and departments.

He said it would be a shame if political bigotry stifled such important initiatives.

"We should rise above such naivety and pull together when it comes to achieving national development and safeguarding our national interests."

The President said the Minister of Defence had extended his appreciation to the Ministry of Environment and Natural Resources, Ministry of Water Resources Management and Development and the Ministry of Mines and Mining Development for working together, although it presented conflict of interest for the ministries.

"Where our ministry policies are at variance and appear to jeopardise this project, it is the interests of the project that remain paramount.

"Of course, it is expected that the project should comply with all regulations, especially to safeguard the environment. In this regard, it is important to strike a balance between environmental protection and national interests of overall national development, such that at the end the project benefits are realised with minimum damage to the eco-system," he said.

The President extended his appreciation to China for being always a friend to Zimbabwe, saying the project cemented further, the friendship and paved way for more beneficial economic cooperation between the two countries.

Reading a speech on behalf of Minister Mnangagwa, the Minister of State for State Security in the President's Office, Dr Sydney Sekeramayi said any event that threatened the growth of any sector of the economy, jeopardised national security.

"Any process which does not contribute to securing these interests will naturally constitute a threat and would obviously provoke a response from the Ministry of Defence, whether benign or otherwise," said Minister Mnangagwa.

He said the development of other sectors of the economy depended on the adequate supply of power to the extent that event well meaning investors have been hesitant to invest in the country.

The acting Minister of Mines and Mining Development, who is also the Minister of Environment and Natural Resources Management, Francis Nhema said the project would be a timely boost as it came at a time when the energy sector was hugely depressed due to high demand for electricity, which is central to industrial development of any economy.

Chinese Ambassador Mr Lin Lin said next year, China would increase its cooperation with developing countries including Zimbabwe to achieve national benefit.

The chairman of the China Africa Sunlight Energy, Mr Wang Xinjia said he foresaw unprecedented levels of development in Matabeleland North and the whole of Zimbabwe due to the project.

"Several downstream businesses such as fertiliser and tyre products manufacturing, brick moulding, and liquid gas processing for several use shall be done here," said Mr Wang.

China Africa Sunlight was given the green light to start operations after obtaining an Environmental Impact Assessment EIA) from the Environmental Management Agency (EMA) in October.

The event was witnessed by Zimbabwe Defence Forces commander, General Constantine Chiwenga, Minister of Agriculture, Irrigation and Mechanisation Development Dr Joseph Made, Matabeleland North Governor Thokozile Mathuthu and her Bulawayo counterpart Cain Mathema, heads of Government departments, traditional leaders and scores of villagers.

Copper

- Mhangura Copper Mine (Defunct and owned by ZMDC)

The Mhangura Copper Mine is located 190 km northwest of Harare and 60 km from Chinhoyi, where the Alaska smelter of Lomagundi Mining and Smelting Company is situated. It is served by the main road from Harare to the border with Zambia at Kariba and a tarred road of 46 km to Mhangura.

Extensive infrastructure facilities, including a secure power supply and plentiful water sources, which have been in place for many years, exist.

About 53 million tonnes at an average of 1% Cu were produced from a number of ore bodies over a forty-year period from 1957 to 2000. Initially production was from an open pit, but workings moved underground in the late 1950's.

Messina Transvaal Development Company opened and operated the mines until 1984, after which ZMDC mined until 2000. In the late 1980's production steadied at 1,1 million tonnes and 8 000 tonnes of copper in concentrate per annum, but during 1996 only 855 000 tonnes of ore were mined at a grade of 0,63% Cu to produce 5 000 tonnes of copper in concentrate.

Remaining proved and probable reserves are estimated at 7, 7 million tonnes at around 1% Cu.

However, the ore milled during the 1990’s has consistently been under 1% Cu, ranging from 0,66% to 0,94% Cu.

The absolute minimum to enable mine production to continue was estimated at US$ 4,2 million in 1997 and is probably at least twice that figure today due to neglect and deterioration of the shafts and the plant.

The ore metallurgy ar Mhangura is simple and high recoveries with high concentrate grades were achieved in the processing plant. The percentage recovery for the period 1993 to 1996, varied from 92,35% to 93,80% and it can safely be assumed that this efficiency was maintained throughout most of the operatiing lifetime of the mine. It is thus very unlikely, given the low grade of the ore, that the slimes dams contain a significant amount of copper.

Zimbabwe's diamond industry commenced with the discovery of alluvial diamonds in 1903 followed by the discovery of the first diamondiferous kimberlite pipe, Colossus, in 1907. There are more than eighty known kimberlite bodies in Zimbabwe, most discovered by Rio Tinto and De Beers. Zimbabwe's first diamond mine, River Ranch, commenced production in the early 1990's.

The bulk of Zimbabwe's diamond production used to come from Rio Tinto's Murowa diamond mine before the alluvial deposits at Marange were exploited.. By mid-December 2006, around 10,000 illegal artisanal miners were working very small plots at Marange. From 2004 to 2007 Zimbabwe’s diamond exports increased by 2600 %.

Year Exports (cts)

2003 26,870

2004 18,481

2005 261,538

2006 264,585

2007 489,170

Source: Kimberley Process

The bulk of Zimbabwe's diamond production used to come from Rio Tinto's Murowa diamond mine before the alluvial deposits at Marange were exploited.. By mid-December 2006, around 10,000 illegal artisanal miners were working very small plots at Marange. From 2004 to 2007 Zimbabwe’s diamond exports increased by 2600 %.

Year Exports (cts)

2003 26,870

2004 18,481

2005 261,538

2006 264,585

2007 489,170

Source: Kimberley Process

- RioZim owns 22 percent of Murowa diamond mine, while Rio Tinto, the former parent company, owns the remaining controlling stake. The mine saw 2006 production down to 240 026 carats from 251 000 carats of diamonds in 2005. RioZim told shareholders the fall was a result of a weaker surface ore body and worsening power cuts. RioZim said the diamond dip had been expected. Rio Tinto, which has been in Zimbabwe's mining sector for 50 years, has spent $100m expanding its Murowa Diamonds since the discovery of diamonds 14 years ago.The operation, which is 77,8% owned by Rio Tinto, is capable of producing 300,000 carats/year of diamonds.

- SouthernEra had a joint venture agreement with Rockover Resources Limited over the Tsholotsho Diamond Project in Zimbabwe and involved in early stage exploration. The Tsholotsho Diamond Project is situated in western Zimbabwe and consists of 21 granted and a further 7 under application prospecting permits covering an area in excess of 14,000 km² underlain by basement Archaean granite-gneiss of the Kalahari Craton. The Botswana/Zimbabwe border forms the western boundary of the permit area. This project area is considered prospective for primary diamondiferous kimberlite deposits and lies within what is known as the Orapa Kimberlite Track, which is a southwest – northeast trending kimberlite emplacement corridor extending from Botswana into Zimbabwe.

- African Consolidated Resources plc (ACR) said in March, 2007, that Zimbabwe's government has ignored a high court ruling to allow staff back on to the premises at the expropriated Marange diamond mine. Police guarding the mine have not let staff back on site. The government was to negotiate an agreement over the expropriaton, but had failed to do so. African Consolidated is thought to have lost up to $2m when diamonds it had produced and had on site were seized by the government and auctioned by Mineral Marketing of Zimbabwe. African Consolidated Resources announced a loss in revenues in excess of US$1 billion as a result of illegal extraction and trade activities following the company's expulsion from the Marange mine in Zimbabwe early in 2007.

Since ACR was expelled from Marange it is believed that more than 7,000 carats valued at approximately US$1 billion have been lost as a result of diamond smuggling which allegedly involves security forces, according to local news source The Financial Gazette (Harare).

Zimbabwe Mining Development Corporation (ZMDC), which has started mining at Marange, has been criticized by Central Bank Governor, Gideon Gono for what are seemingly mechanized panning activities. Critics have stated that in order to derive a genuine benefit from diamond mining in Marange, ZMDC will have to employ a technical partner that has the appropriate equipment and technical knowledge.

The dispute over the ACR diamond claims against the government now involve Amos Midzi, Mines Minister; the Mineral Marketing Corporation of Zimbabwe, the ZMDC, the Mining Commissioner and Police Commissioner Augustine Chihuri.

It was reported that in 2012 the World Bank said Marange diamonds, believed to be accounting for 25% of the world’s diamonds, are cheaper to mine because they are alluvial. The bank said overall diamond production in Zimbabawe could reach 15,2 million carats a year by 2018. A local research firm Equity Communications said Zimbabwe accounted for 8,9% of global rough diamond production in 2011, producing 11,1 million carats out of 125,6 million carats produced globally.

Compannies active in the Marange area in September, 2013 were:

Fluorspar

It was reported that in 2012 the World Bank said Marange diamonds, believed to be accounting for 25% of the world’s diamonds, are cheaper to mine because they are alluvial. The bank said overall diamond production in Zimbabawe could reach 15,2 million carats a year by 2018. A local research firm Equity Communications said Zimbabwe accounted for 8,9% of global rough diamond production in 2011, producing 11,1 million carats out of 125,6 million carats produced globally.

Compannies active in the Marange area in September, 2013 were:

- Anjin Investments

- Marange Resources

- Mbada Diamonds

- Diamond Mining Company (DMC).

Government, which in 2015 had 50% shareholding in diamond companies operating in Marange through the Zimbabwe Mining Development Corporation, wants all diamond mining firms in the country to be merged into one entity, the Zimbabwe Consolidation Diamond Corporation, to plug leakages and enhance transparency. Seven mining companies operating in October 2015 in Chiadzwa were:

- Mbada,

- Anjin Investments,

- Diamond Mining Company,

- Gye Nyame,

- Jinan Mining, Kusena

- Marange Resources.

- Premier African MineralsLtd is investigating a 1,350-hectare area (9 Mineral Claim Blocks) centred on the dormant Tinde Fluorspar Mine, located in the northeast corner of the Kamativi Basement Complex Inlier and overlain to the north by gently north-dipping Karoo sediments. The mine reportedly produced 1,360 tonnes of fluorspar. The Basement complex hosts numerous mineralised vein systems, ranging from short, close spaced swarms to long, thin sinuous bodies up to 8 kilometres in length. The project site has been the subject of historical exploration. In 1970, Messina Rhodesia Ltd (MRD) estimated a non-compliant SAMREC conceptual Exploration Target for Vein 1 as: 54,000 tonnes comprising 34,000 tonnes of 33.3% CaF2 and 20,000 tonnes of 25-33.3% CaF2 at a depth of 15 metres. Preliminary flotation tests indicate that concentrates of up to 97.8% CaF2 are achievable. Premier intends, funds permitting, to drill a fence line of shallow boreholes (1,000m drilling) to confirm the continuity with depth of the better grade veins and test the inter-vein areas.

The Zimbabwe craton hosts more than 6,000 gold occurrences and over 790 recorded gold mines, most of which have some current or historic gold production.

Gold Home

Gold Home

Gold Projects in Zimbabwe

(Source: Trevor Pearton - Caledonia Mining Corporation-Abstract of paper Gold Day, Johannesburg, 13 April 2011

Zimbabwe is underlain for the most part by an Archean greenstone terrain known as the Zimbabwe Craton. Archean terrains worldwide are recognised for their gold potential and in this respect the Zimbabwe greenstones are no exception. Zimbabwe’s gold mining history in modern times goes back to the late 1800s when a wave of prospecting discoveries found gold in almost every corner of Zimbabwe’s ancient greenstone terrain. By the early 1900s some 6 000 occurrences had recorded production although only 290 of these would develop into mines with a production in excess of 10 000 oz (311 kg). Production has continued uninterrupted from that time until today. However, most of the “big” mines of yesteryear are dormant today, in some

cases unnecessarily. There is much revitalised interest in Zimbabwe gold particularly from junior miners who have not had previous exposure to Zimbabwe gold mining. These relatively new entrants, who quite rightly see the potential of the Zimbabwe Archean terrain, are often not aware of the depth of history that is the backdrop to the current mining scene.

Production in most greenstone terrains is dominated by a few large mines which have been able to weather the storms to achieve their full potential (e.g. Sheba Mine is 126 years old) while in Zimbabwe the grand old ladies such as Cam & Motor and Globe & Phoenix have closed down. It is probable that many of these mines closed prematurely since they had reached the limits of their development and required substantial capital input to expose their deeper potential and at that time this investment was considered too high a risk. Having been closed and flooded for many years, restarting these mines is a major challenge that can only be undertaken in a stable socio-economic environment. By way of example, recent deep drilling (1 500 – 2 000 m) in the Canadian Archean has yielded numerous high grade gold discoveries at depth.

Zimbabwe’s annual gold production peaked in 1999 at 28 000 kg and almost immediately started a rapid decline in line with the political upheavals that beset the country. Nine years later

production bottomed at 3 100 kg in 2008 when the economy collapsed and the Zimbabwe Reserve Bank stopped paying mines for gold deliveries. Following the establishment of a Government of National Unity and the granting of permissions for mines to export their gold for refining and sale, the production has started to climb rapidly again. The estimated production for 2010 is 8 000 kg and so far this year production appears set to increase by 30% to 40%. The main gold producers are Caledonia (Blanket Mine), Metallon (How, Mazowe, Shamva, Arcturus, Redwing), Rio Tonto (Renco), Mwana Africa (Freda Rebecca), Duration Gold (Vubachikwe), and New Dawn (Falcon, Olympus, Dalny, Turk, Old Nic). All these operations are in a build up phase and therefore production statistics are fluid. In addition to the above, the Gold Miners Association of Zimbabwe (GMAZ) with a membership of 3 000 holds 67% of known gold claims but much of the production is likely to be unofficial.

All Zimbabwe gold mines require significant capital inputs, way beyond that which can be sourced locally in Zimbabwe. Funding therefore has to be sourced from external capital providers in order to sustain or grow production from current levels. Attempts to restart the Zimbabwe economy have seen government placing an increasing burden on the mining industry, e.g. three hikes in the royalty rate in one year. The recent announcements regarding “indigenisation” of the mining industry shows the extent to which government is ignoring economic fundamentals in an attempt to capture all sources of revenue. While the regulations published on 25 March 2011 are, by all opinions, clearly invalid, all sources of foreign investment capital have dried up instantly. The country is once again at a cross road. Will it this time make the wise decision and foster growth by inviting capital into the country or will it once again ‘eat its seed grain’?

The western world to some extent provides ammunition for governments like Zimbabwe to lobby their own cause. For example, the majority of citizens do not understand accounting terminology (GAAP) and hence government officials are able to present a picture that gives the impression of “theft” of resources and revenues by foreign mining companies. It is essential that mining companies establish a platform for clear communication with communities so that the benefits and disadvantages of mining can be made clear to all.

Geological references:

Geological references:

- Blenkinsop T G, Oberthur T, Mapeto O 2000 - Gold mineralization in the Mazowe area, Harare-Bindura-Shamva greenstone belt, Zimbabwe: I. Tectonic controls on mineralization: in Mineralium Deposita v35 pp 126-137

- Foster R P, Mann A G, Stowe C W, Wilson J F 1986 - Archaean gold mineralization in Zimbabwe (Full paper): in Anhaeusser C R, Maske S, (Eds.), 1986 Mineral Deposits of South Africa Geol. Soc. South Africa, Johannesburg v1 pp 43-112

- Klemm D D, Krautner H G 2000 - Hydrothermal alteration and associated mineralization in the Freda-Rebecca gold deposit - Bindura District, Zimbabwe: in Mineralium Deposita v35 pp 90-108

- Oberthur T, Blenkinsop T G, Hein U F, Hoppner M, Hohndorf A, Weiser T W 2000 - Gold mineralization in the Mazowe area, Harare-Bindura-Shamva greenstone belt, Zimbabwe: II. Genetic relationships deduced from mineralogical, fluid inclusion and stable isotope studies, and the Sm-Nd isotopic composition of scheelites: in Mineralium Deposita v35 pp 138-156

Gold News

Zimbabwe: New Dawn Warns of More Mine Closures

8 September 2013

TORONTO Stock Exchange-listed New Dawn says it might be forced to close its mining operations in Zimbabwe as a result of a fall in gold prices and its failure to obtain approval on an indigenisation plan.

The warning comes after the junior gold mining company, shut down Dalny Mine in Kadoma which employs 900 workers.

Besides Dalny, New Dawn runs Turk-Angelus Mine, Old Nic Mine, Camperdown Mine, Golden Quarry Mine and Venice Mine.

In a notice to stakeholders, New Dawn said the fall in gold prices resulted in serious liquidity challenges with the power utility threatening to switch off operations.

"... the risk exists that the company may have to take actions more severe than steps taken so far or currently envisaged, including the temporary or permanent closure of the company's other mining operations," New Dawn said.

"... the company is currently unable to predict the consequences of an ability to conclude or implement an acceptable plan of indigenisation with government authorities with which engagement will continue."

The company said a major underlying factor contributing to the Dalny Mine's current difficulties had been the more than two year delay in the still incomplete approval process for the company's proposed Plan of Indigenisation.

"A timely approval of the plan of indigenisation had been expected to provide the company with access to sufficient investment capital to fully fund the development of a cost-efficient operation at the Dalny Mine," New Dawn said.

"After years of underdevelopment, had an investment programme in the Dalny Mine been implemented and completed as originally anticipated, the mine would have been positioned to maintain profitable operations in today's environment of lower gold prices and increasing costs."

It said the Zimbabwean subsidiaries were facing negative working capital position and an increasingly difficult legislative, regulatory and economic environment in Zimbabwe.

New Dawn said there was heightened uncertainty surrounding the implementation of the indigenisation policy in Zimbabwe subsequent to the July 31 harmonised elections, with the potential for an increasingly negative effect on the company and its stakeholders. "The evolving policy on indigenisation now appears to be focussing on seizing 51% controlling interests in foreign controlled mines with compensation deemed to be the value of the minerals in the ground," New Dawn said.

Under the empowerment legislation, at least 51% shareholding in businesses with a net asset value of US$500 000 or more should be in the hands of locals.

8 September 2013

TORONTO Stock Exchange-listed New Dawn says it might be forced to close its mining operations in Zimbabwe as a result of a fall in gold prices and its failure to obtain approval on an indigenisation plan.

The warning comes after the junior gold mining company, shut down Dalny Mine in Kadoma which employs 900 workers.

Besides Dalny, New Dawn runs Turk-Angelus Mine, Old Nic Mine, Camperdown Mine, Golden Quarry Mine and Venice Mine.

In a notice to stakeholders, New Dawn said the fall in gold prices resulted in serious liquidity challenges with the power utility threatening to switch off operations.

"... the risk exists that the company may have to take actions more severe than steps taken so far or currently envisaged, including the temporary or permanent closure of the company's other mining operations," New Dawn said.

"... the company is currently unable to predict the consequences of an ability to conclude or implement an acceptable plan of indigenisation with government authorities with which engagement will continue."

The company said a major underlying factor contributing to the Dalny Mine's current difficulties had been the more than two year delay in the still incomplete approval process for the company's proposed Plan of Indigenisation.

"A timely approval of the plan of indigenisation had been expected to provide the company with access to sufficient investment capital to fully fund the development of a cost-efficient operation at the Dalny Mine," New Dawn said.

"After years of underdevelopment, had an investment programme in the Dalny Mine been implemented and completed as originally anticipated, the mine would have been positioned to maintain profitable operations in today's environment of lower gold prices and increasing costs."

It said the Zimbabwean subsidiaries were facing negative working capital position and an increasingly difficult legislative, regulatory and economic environment in Zimbabwe.

New Dawn said there was heightened uncertainty surrounding the implementation of the indigenisation policy in Zimbabwe subsequent to the July 31 harmonised elections, with the potential for an increasingly negative effect on the company and its stakeholders. "The evolving policy on indigenisation now appears to be focussing on seizing 51% controlling interests in foreign controlled mines with compensation deemed to be the value of the minerals in the ground," New Dawn said.

Under the empowerment legislation, at least 51% shareholding in businesses with a net asset value of US$500 000 or more should be in the hands of locals.

"Zim gold output hits 90-year low"

"Zimbabwe: Gold Mines Close Shop"

Click HERE for Zimbabwe: Gold Mining Falls to 'Pathetic Levels' (AllAfrica)

Click HERE for Zimbabwe: Mugabe Dithers On Mining Law (AllAfrica)

Click HERE for Zimbabwe: Vast Mineral Wealth Sparks New 'Scramble for Africa' (AllAfrica)

"Zimbabwe: Gold Mines Close Shop"

Click HERE for Zimbabwe: Gold Mining Falls to 'Pathetic Levels' (AllAfrica)

Click HERE for Zimbabwe: Mugabe Dithers On Mining Law (AllAfrica)

Click HERE for Zimbabwe: Vast Mineral Wealth Sparks New 'Scramble for Africa' (AllAfrica)

Gold deposits in Zimbabwe (Source: Southern African Development Community, Mineral Resources Survey Programme No 4, 2001)

The gold-mining industry is possibly the oldest mining industry in the SADC region. Gold deposits in Zimbabwe were worked for centuries before the arrival of the European settlers in the second half of the 1800s, and the bulk of the country's production during the 20th century has been based on mines working deposits originally discovered by the early miners In 1997, Zimbabwe's total recorded gold production since the arrival of the Europeans was nearly 2 400 t (77 Moz).

Gold production levels in 1996 were above 25 t, making Zimbabwe one of the ten largest producers of gold in the world. The majority of gold deposits in Zimbabwe occur in greenstones of the Bulawayan Group. Lately, about 25 per cent of Zimbabwe's gold production has been derived from panning operations. The Small Scale Miners Association has more than 5 000 members and employs up to 100 000 people on an irregular basis.

This report will not attempt to list all of the approximately 6 000 gold deposits in Zimbabwe, but will be restricted to currently producing mines and deposits which have yielded more than 1 000 kg Au in the past. For further details the reader is referred to Bartholomew (1992) and Foster (1989).

Stratigraphy and general geology

Approximately 98 per cent of Zimbabwe's gold has been derived from the Archaean craton which occupies the central and eastern part of the country. Three major sequences of supracrustal rocks have been recognised (Foster, 1989):

1. The Sebakwian Group of komatiitic and basaltic volcanics, banded iron formation and minor clastic sed-iments laid, down on ancient sialic crust;

2. Basalts, high Mg basalts, felsic volcanics and mixed chemical and clastic sediments of the Lower Bulawayan Group; and

3. The extensive Upper Bulawayan and Shamvaian Groups comprising a sedimentary—>komatiitic—> tholeiitic—>calc-alkaline succession.

Gold occurs within all three of these sequences.

Two late Archaean granitoid events are evident:

1. The earlier (ca. 2,7-2,6 Ga) Sesombi Suite of trond-hjemite-tonalite-granodiorite which forms small (2-30 km) plutons that intrude the greenstone belts;

2. A slightly later (ca. 2,6 Ga) Chilimanzi Suite of granites which partly intruded the greenstone belts, but primarily stabilised much of the central and eastern part of the craton.

At the southern limit of the craton, the complex Cu-Au-Bi-Te mineralisation of the Renco Mine is hosted by granulites of the Limpopo Mobile Belt. Small deposits have also been mined within Palaeoproterozoic rocks of northern Zimbabwe, but their contribution to the total gold output, together with that from Tertiary and Recent alluvial operations, has been very small.

Gold mineralisation

Three major types of gold deposits can be identified:

1. Lode deposits (veins and ductile shear zones)

2. Banded iron-formation-hosted deposits

3. Volcaniclastic-hosted deposits

The three deposit types have yielded gold in Zimbabwe in the following percentages (Foster, 1989): lode 82 per cent, banded iron formation 13 per cent and volcaniclastics almost 5 per cent.

Lode deposits range in morphology from large tabular quartz veins, through quartz-cemented breccias, to sulphide impregnations in schistose zones. Vein-type lodes range in thickness from a few centimetres up to 20 m. Quartz is the most common gangue mineral. Carbonate minerals are usually minor, but integral, components of the veins, mostly occurring as calcite where isolated from the wall rocks. Individual lode deposits rarely extend along strike for more than 1-2 km. The Dalny group of ore bodies is one exception, extending intermittently over a strike length of 7 km. Sulphide minerals are a minor component (1-4 wt per cent) of the quartz veins, but are proportionally more abundant in the ductile shear zones.

Pyrite is the dominant sulphide phase. Gold as coarse grains of the native metal within fractures in the vein quartz, as disseminated grains in the quartz and partially intergrown with the sulphide minerals.

Banded iron formation is common throughout the Archaean volcanosedimentary sequences of Zimbabwe, with the exception of the Shamvian Group and the calc-alkaline unit of the Upper Bulawayan Group. The iron formations range from mesobanded magnetite-chert units, through carbonate and silica-rich varieties, to laminated sulphide argillite units. The style of mineralisation ranges from sulphidisation of magnetite bands adjacent to quartz veins, to complex shear-zone arrays of quartz veins, to extensive brecciation.

A small number of Archaean deposits in Zimbabwe comprise gold-pyrite-base-metal mineralisation, disseminated in felsic sediments of volcanogenic origin. This type of mineralisation is confined to calc-alkaline volcanogenic sequences of the Shamvaian Group.

Midlands Greenstone Belt

This greenstone belt is in central Zimbabwe and extends north from Shurugwi to Chegutu.

- Cam and Motor Mine Ownership in 2001: Rio Tinto Zimbabwe Ltd 100 per cent Cam and Motor, located about 10 km east-northeast of Kadoma, was Zimbabwe's largest gold producer (more than 155,5 t gold). Mining began in the 1890s. Numerous lodes were mined from two groups: Cam and Motor. Steeply dipping quartz veins occur along the con¬tact of basaltic flows and a metasedimentary sequence of arkose, conglomerate and graphitic slates (Elevatorski, 1995). Mineralisation is controlled by a shear zone. Mining reached a depth of 2 000 m. Quartz lodes contain significant stibnite, arsenopyrite and iron pyrites. The mine is no longer in production, but dump retreatment is done by Rio Tinto Zimbabwe.

- Globe and Phoenix Mine Ownership in 2001: Delta Gold Ltd 100 per cent. The Globe and Phoenix Mine, the second largest historical gold producer in Zimbabwe, operated from 1894-1977 and production was 123 931 kg (Bartholomew, 1992) of gold from vein-type ores, averaging 27,6 g/t. There are two reefs on this mine, the Globe Reef (strike 125°, dip 47° northeast) and the main Phoenix Reef (strike 015°, dip 50° east). The gold-bearing quartz veins of the reefs are in shears and hosted in carbonatised ultramafics at the contact with Archaean gneiss. Prior to closure in 1977, the main ore bodies were mined to a depth of 1 460 m. Ores were of auriferous quartz with considerable stibnite and small amounts of pyrite, arsenopyrite, galena, sphalerite, tetrahedrite and gersdorffite.

- Collision Mine. Ownership:in 2001:Consolidated African Mining Corporation 100 per cent. Historically, the area (formerly known as Golden Ridge) was divided into five mining claims which Consolidated African Mining and its predecessors consolidated. Active mining started in 1929 and continued at four main operations until 1960; and since then only intermittent, small-scale mining has occurred. The mine produced 1,1 Mt of ore, grading 2,5 g/t Au. Gold mineralisation is within brecciated shear or shatter zones up to 4 m wide, which are parallel or subparallel to the Munyati Shear. The zones are near vertical, dipping steeply to the north-northwest or south-southeast and form discrete bodies of either silicified banded iron for¬mation which has been shot through with quartz blebs and veins, or soft, gossanous iron formation (Resource Information Unit, 1999). In mid-1998, reserves at the Collision property were confined to the tailings dumps and a small area of primary ore located at the western end of the old workings. The tailings amounted to a total of 754 000 t containing 902 kg Au. Consolidated African Mining estimated a potential for over 77,7 t Au mineable by open-cut and deeper bulk-underground mining (Resource Information Unit, 1999).

- lndarama Mine Ownership in 2001: Trillion Resources Ltd 100 per cent. Trillion Resources acquired the Indarama Mine, 12 km north of Kwekwe, in 1998 from Pan African Mining which had a recorded production from quartz-carbonate-stibnite veins of more than 21,7 t Au and 1 592 t of stibnite. Narrow veins in metabasalt dip between 20° and 45°. Indarama produces 466,5 kg Au annually, but Trillion plans an initial expansion in production to 933 kg per annum and then to 2 488 kg per year. Reserves are reported to be 13,4 Mt of ore, grading 3,3 g/t Au.

- Dalny Mine Ownership in 2001: Falcon Gold Zimbabwe Ltd 100 per cent Mining began on ancient workings in 1892. The Dalny Mine is located about 45 km north of Kadoma. From ores grading 7,8 g/t Au, 53 358,09 kg were recovered. The reef comprises a series of attenuated lenses and ribbons of quartz in a shear zone, 1,3-10 m wide, striking north¬east and dipping 67° (Resource Information Unit, 1999). Host rocks are carbonated greenstones of the Bulawayan Group. Associated minerals include pyrite, arsenopyrite, scheelite, chalcopyrite and sphalerite. Sericitisation and carbonatisation are intense adjacent to the veins. Falcon Gold closed the Dalny Mine in February 1998 because of the poor gold price and rising operating costs, but treatment of the ore dump is continuing.

- Wanderer Mine. The Wanderer Mine operated from 1899-1952 and, from ores averaging 4,1 g/t Au, cumulative production was 36 474 kg. It was the first gold mine in Zimbabwe to work low-grade ore on a large scale. Ten ore bodies, with a very shallow dip, occur in a banded iron formation (Elevatorski, 1995), with an average thickness of approximately 100 m, in contact with conglomerates. Although some of the ores contain free gold, the majority of the gold is contained in pyrite. To date, this has been the largest banded iron formation gold deposit to be mined in Zimbabwe.

- Golden Valley Mine. Production commenced in 1903. The Golden Valley reef strikes 010° and dips between 30° and 35° to the west. It has been traced for about 1 524 m. Massive quartz veins and pyritic gold veins occur along the contact of mafic basalt with schists that are intruded by granite (Elevatorski, 1995). Ores averaged 22,3 g/t Au and yielded 31 056,57 kg. About 463 t of scheelite were also produced.

- Connemara Mine. Ownership: First Quantum Minerals Ltd 95 per cent This opencast mine is situated at the eastern edge of the Midlands Greenstone Belt. Recorded production began in the 1890s and about 16,6 t Au were recovered. Between 1945 and 1969 it was Zimbabwe's largest gold mine. Mineralisation is closely associated with brecciated zones in banded iron formation of the Redcliff Jaspilite Formation. Mineralisation includes pyrite, pyrrhotite and stibnite. At deeper levels, dolerite intrusions are common. The main ore body was up to 20 m thick, extending over a 3 500-m length (Elevatorski, 1995). Shearing controls the mineralisation. The mine was re-opened in 1995 by International Ballater Resources to process heap-leachable ores from a number of open cuts. First Quantum Minerals acquired the mine in December 1997. The most recent resource estimation is 15,8 t Au (509 000 oz) contained within 6,5 Mt grading at 2,43 g/t (African Mining, 1999c).

- Gaika Mine. Mining began in the 1890s and 22 234 kg Au has been recovered. The deposit is located about 1 km south of Kwekwe. Gold-bearing veins and stockworks occur in shears of altered carbonatised ultramafics, largely of talcose schist (Elevatorski, 1995). Most of the ores are in close proximity to a pyritic carbonated porphyrite. Sulphide minerals present include pyrrhotite, stibnite, chalcostibite and jamesonite.

- Chaka Mine. Ownership in 2001: Delta Gold Ltd 100 per cent. The Chaka trail Mine is one of Delta Gold's projects in Zimbabwe being established to test-mine a small high- grade resource located just over 5 km from the Globe and Phoenix mining area. Gold occurs in a banded iron formation near the bottom of the Shamvaian Group, and the ore has been subjected to supergene enrichment in the weathered zone which extends to a depth of 60 m (Mining in Southern Africa, 1997d). The ore body has an inferred resource of 6,8 Mt, at an average grade of 3,2 g/t Au (Mining in Southern africa, 1999b).

- Tebekwe Mine. Ownership in 2001: Ngezi Mining Company. Also known as the Old Stuff Mine, it was first worked in the late 1890s. From ores averaging 9,8 g/t Au, recorded production was 19 966 kg. Quartz veins in a series of subparallel north—south fissures, dipping 70° to the west (Bartholomew, 1992), are hosted in arkose and grits of the Wanderer Formation, intruded by granite. Ngezi Mining Company is currently operating Tebekwe.

- Giant Mine. Most of the gold recovery at this mine was during the 1910s and 1920s. Recorded production was 17 474 kg from ores grading 8,2 g/t Au. The ore body is a north—south-striking banded iron formation with interbedded chloritic schist and sulphide-rich layers up to 5 mm thick.

- Sherwood Star Mine. From sulphide ores grading 8,0 g/t Au, 14 942 kg have been recovered. The ore body, located 13 km north of Kwekwe, is a breccia pipe in jaspilite, mined to a depth of 600 m along a strike of 20-55 m. The plunge of the pipe was vertical to a depth of 330 m, below which it varied between vertical and 50° northeast. The ore con¬sisted of banded red jasper, brecciated and veined by quartz and carbonate, and permeated by pyrite and arsenopyrite, and disseminated irregularly through the whole rock (Foster et al., 1986).

- Pickstone Mine. Mineralisation occurs as sulphide-replacement bodies in a banded iron formation hosted in an east—west-trending shear zone in greenstones (Bartholomew, 1992). Cumulative production was 11 703 kg. Ores averaged 6,4 g/t Au.

- Kanyemba Mine. The ore body consists of a folded quartz reef, striking about 135°, on the crest of a southwest-plunging anticline in chloritic schists. Average width of the vein is 0,45 m. Reported production is 7 623 kg, grading 16,3 g/t Au.

- Eiffel Blue Mine. A quartz-filled fissure, striking north—south and dipping 70° to the west, occurs in a large lens of metasediments in greenstones (Bartholomew, 1992). The vein is about 0,6 m wide and contains pyrite and arsenopyrite. From ore with an average recovery grade of 16,1 g/t Au, 7 156 kg were produced.

- Jena Mines. Ownership: Trillion Resources Ltd 50 per cent Zimbabwe Mining Development Corporation 50 per cent. Six past producers (Leopard, Lion, Python, Hornet, Octopus and Unicorn) and three current producers (Leopardess-Lioness, Stump and Termite) constitute the known gold deposits on the Jena mining lease. The mines were operated by a number of private companies until 1981, when the Zimbabwe Mining Development Corporation consolidated the properties into Jena Mines. It sold a 50 per cent interest in the project to Trillion Resources in 1992. Trillion became operator and increased production from 75 000 t/a to 180 000 t/a in 1996 (Resource Information Unit, 1999), making the mine profitable. In 1998 plans were underway to further increase mine production and mill capacities. Host rocks are mafic basalt, gabbro, agglomerates and tuff of the Maliyami Formation intruded by rhyolite dykes (Elevatorski, 1995). Gold is contained in sulfides. Mineable reserves are 1,73 M t, grading 4,11 g/t Au.

- Camperdown Mine. Camperdown produced 5 997 kg Au. Ores are hosted in a banded iron formation which achieves a thickness of 700 m and is folded into an open antiform (Bartholomew, 1992). High-grade gold values are found in vertical quartz stringers cutting the banded iron formation.

- Bell Riverlea Mine. Ownership in 2001: Delta Gold Ltd 100 per cent. At Bell Riverlea, located 8 km west of Kwekwe, the structurally controlled ore body dips 57° to the north and strikes east obliquely across the host conglomerates (Resource Information Unit, 1999). Most of the production came from the Bell section of the mine, a breccia of conglomerate fragments in a soft chlorite schist veined by quartz containing disseminated sulphide. The sulphides present are pyrite, arsenopyrite, stibnite, jamesonite and tetrahedrite. A resource of 1,5 Mt, grading 3,7 g/t Au, is reported (Resource Information Unit, 1999).

- Surprise Mine. Sulphide-free ores were mined mostly in the early 1900s, and about 5 287 kg were recovered, averaging 11,4 g/t Au. Gold is contained in quartz veins, striking north—south and dipping steeply to the east, in a shear zone hosted in gneiss and granitic host rocks.

- Eileen Alannah Mine. The ore body is a long east-southeast-striking carbonated shear zone in basaltic greenstones. Mineralisation is mainly in the form of discontinuous sulphide replacement, but a few gold-bearing quartz veins also occur. Cumulative production is reported to be 4 646 kg, grading 8,8 g/t Au.

- Venice Mine. Ownership in 2001: Falcon Gold Zimbabwe Ltd 100 per cent The deposit is found in a shear zone striking east-north¬east and dipping between 30° and 40° to the south. Reported gold production was 4 443 kg, grading 5,7 g/t Au. Steeply dipping quartz veins containing finely disseminated pyrite and arsenopyrite occur in a tholeiitic basalt of the Upper Bulawayan Group (Elevatorski, 1995). Stibnite and scheelite also occur.

- Invincible Mine. About 4 322 kg Au were recovered from a quartz vein striking 150° and dipping 40° to the southwest (Bartholo¬mew, 1992), hosted in a shear zone. Host rocks are felsic tuffs and conglomerates of the Shamvaian Group. The vein is heavily mineralised with pyrite and galena.

- Bonsor Mine. Two quartz reefs in an en echelon relationship, striking north—south and dipping steeply to the east, are hosted in altered and carbonated arkose and greywacke (Bartholomew, 1992). Reported production is 4 025 kg, grading 9,0 g/t Au.

- Turkoise Mine. From a shear zone in mafic lavas of the Upper Bulawayan Group, 2 946 kg Au were recovered, grading at 12,1 g/t. Mineralisation includes pyrite, arsenopyrite and chalcopyrite.

- Seigneury Mine. Quartz reefs along the contact of granite with epidiorite have yielded 2 520 kg Au, grading 7,1 g/t (Bartholomew, 1992). Mineralisation includes galena, chalcopyrite, molybdenite and arsenopyrite.

- Veracity Mine. The ore body is a quartz vein, striking northeast and dipping steeply northwest, and has yielded 2 400 kg Au with average recovery grade of 10,4 g/t (Bartholomew, 1992). Country rocks are greenstones and banded iron formation. Main production is from the section where the vein cuts the banded iron formation.

- Dunraven Mine. Ownership in 2001: Consolidated African Mining Corporation option to acquire 100 per cent. The Dunraven Mine was operated intermittently from 1897-1953, producing 2 124 kg Au, and was developed to 90 m below surface during this period. Gold occurs in iron-stained quartz veins, striking east-northeast, with minor pyrite and arsenopyrite. Host rocks are siltstone and phyllite. Trenching done by Consolidated African Mining in 1998 indicated continuity of gold mineralisation along strike, over a length of 350 m.

- Anzac Mine. The mine had an accumulated production of 2 048 kg Au grading at 5 g/t, to the end of 1984. The main reef of this deposit is a fissure, striking east—west and dipping 24°, in a host of carbonated greenstones (Resource Information Unit, 1999). A secondary reef of north—south-striking shears, dips east at low angles. A later generation of stibnite-carbonate veins is present in some areas. The major sulfide minerals present are pyrite, arsenopyrite, loellingite and stibnite. The Anzac Mine has also produced 973 t of stibnite.

- Csardas Mine. A series of parallel east-northeast-striking quartz veins and stringers with an arcuate trend, concave to the south, and dipping 80° to the north, yielded 2 021 kg Au, with an average recovery grade of 30,0 g/t (Bartholomew, 1992). Host rocks are sheared gritty conglomerates, sedimentary and basaltic greenstone schist.

- Bay Horse Mine. Most of the reported 1 935 kg Au produced was from a quartz vein, dipping between 40° and 50° to the north, and hosted in greenstones, banded iron formation and other sediments contorted by minor folds and cut by north—south faults.

- Regent Mine.. The ore body is a faulted quartz vein, with a curved north-northwest strike, hosted in greenstones intruded by granitic prophyritic bodies (Bartholomew, 1992). North of the fault the reef dips between 30° and 45° to the east, while south of the fault it dips between 60° and 80° to the east. About 1 663 kg Au has been recovered.

- Glencairn Mine. Gold production of 1 615 kg has come from two north¬east-striking, flatly northwest-dipping quartz veins fill¬ing thrust zones in greenstones with minor sedimentary intercalations (Bartholomew, 1992).

- Concession Hill. The reef is a cherty band striking east—west in banded iron formation, much veined with quartz stringers and calcite (Bartholomew, 1992). The majority of gold is contained within the quartz veins, with some in mineralised parts of the country rock. Production amounted to almost 1 603 kg, grading 7,5 g/t Au.

- Turtle Mine. The ore body comprises a quartz vein, striking north- northeast and dipping between 10° and 45° to the east, hosted in greenstone and agglomerate. Reported production is 1 499 kg, with average recovery grade of 6,4 g/t Au (Bartholomew, 1992).

- Tiger Reef Mine. At the Tiger Reef ore body, 10 km northwest of Kwekwe, disseminated gold occurs in a feldspathic greywacke of the Shamvaian Group near a contact with granite. Ore minerals are pyrite, arsenopyrite, sphalerite, minor chalcopyrite and some free gold. The ore body, striking northeast, has an average width of 6 m (Foster et al., 1986) and an average gold content of 3,4 g/t. About 1 181 kg Au were recovered

- Washington Mine. The deposit comprised two subvertical quartz veins, striking north-northeast, on the margin of a highly sheared and brecciated zone enclosed by granite and greenstone country rocks. The gold distribution was very erratic, with occasional extremely rich pockets (Resource Information Unit, 1999). An accumulated gold-production figure of 1 600 kg, grading at 21,7 g/t was reported. Falcon Gold Zimbabwe relinquished its interest in the property in 1995.

- Butterfly Mine. The ore body consists of a quartz vein dipping steeply southeast along a contact of granite and epidiorite. Sulphide minerals present are pyrite, galena and scheelite. Reported gold production is 1 314 kg, grading at 12,3 g/t.

- B.D. Mine. A quartz-stibnite vein, striking about 075° and dipping 65° to the north, occurs in carbonated greenstones, and yielded about 1 299 kg Au and 500 t of stibnite (Bartholomew, 1992).

- Beehive Mine. African Gold bought the operation in 1996 and started production at Beehive in September 1997. The area is characterised by an east—west-striking mineralised shear zone dipping about 30° south and passing from hydrothermally altered tonalite into greenstones. Two mineralised north—south-striking banded iron-formation horizons are also present. Mineralisation includes arsenopyrite, pyrite and stibnite.

- Brilliant Mine. Quartz veins in greenstones, with an average recovery grade of 20,6 g/t, yielded about 1 125 kg Au (Bartholomew, 1992). The main reef strikes 40° and dips 70° to the west.

- Masterpiece Mine. About 1 061 kg Au were recovered from two quartz reefs. Most of the production came from the Old Master-piece Reef, a lenticular quartz shoot striking east—west and dipping steeply north (Bartholomew, 1992). The New Masterpiece Reef is an irregular shoot striking north and dipping between 30° and 40° to the west.

- Commoner Mine, Commoner Mine, 50 km west-southwest of Kadoma, was re-opened in 1990 after being intermittently worked since the 1900s. The ore body is a shallow-dipping quartz-calcite vein, hosted in tuff and carbonaceous siltstone of the Upper Bulawayan Group. Shears, fractures and faulting control the mineralisation. Ore mineralogy is dominated by tetrahedrite which carries native gold and hessite, together with galena, chalcopyrite, pyrite, arsenopyrite, sphalerite and minor amounts of chalcostibite.

- Patchway Mine. Ownership in 2001: Rio Tonto Zimbabwe Ltd 100 per cent The main quartz reef at this underground mine strikes north—south, and dips between 30° and 35° to the west. The deposit is closely associated with a felsic dyke in greenstones. Sulphide minerals present include pyrite, pyrrhotite, sphalerite, galena and scheelite.

- Elvington Mine. Zimbabwe Mining and Development Corporation reopened the mine in 1991. It is located about 12 km northwest of Gadzema. Former production was 565 kg Au. Mineralisation occurs in a 3-m-wide shear zone of an oxide-facies banded iron-formation unit intercalated with biotite-chlorite schist (Elevatorski, 1995). Most of the gold is contained in pyrrhotite, although some gold is visible in quartz.

- Step Lively Mine. The ore body at this old underground mine lies along an intrusion of schist just within the margin of the granite and close to its contact with sediments. It comprises a quartz reef striking approximately northwest, parallel to the granite sediment contact. The mine first produced in 1936 and was worked until 1951, yielding an average of 8 g/t Au from 60 000 t of ore. Since that time it changed hands several times and continued to operate on a small scale. Trillion Resources obtained the option to purchase the mine in 1977. After an intensive drilling programme, Trillion decided not to exercise the option and by mid- 1998 had no remaining interest in the property.

- Oceana Mine. Ownership in 2001: Amalia Gold Mining & Exploration Company Ltd 100 per cent. Quartz veins, striking east-northeast and dipping 70° northwest, occur in recrystallised arkosic grits and granite dykes of the Archaean Mont d'Or Granite (Resource Information Unit, 1999). Mineralisation includes pyrite, galena, sphalerite, chalcopyrite and molybdenite. The future of the mine was in doubt in late 1998, as Amalia Gold had been liquidated and was undergoing complete restructuring.

- Pompeii Mine. Ownership in 2001: Amalia Gold Mining & Exploration Company Ltd 100 per cent. The reef consists of small glassy quartz lenses in a narrow, silicified, ferruginous quartzite body in sericitic quartzite and greenstone (Resource Information Unit, 1999). Quartz lenses are in tensional fissures developed along fold crests. Lenses elongated northeast along plunge of fold axes are also present. Mineralisation includes pyrite and pyrrhotite. In late 1998 Amalia Gold was liquidated and the future of the mine was in doubt. Ores averaged 13,0 g/t Au.

- What Cheer Mine. Native gold and disseminated sulfides occur in quartz carbonate shears and breccias. Host rocks are andesite and felsic agglomerate. Sulphides present are arsenopy¬rite, pyrite and galena. Ore grade averaged 7,2 g/t Au.

- Yankee Doodle Mine, A heavily mineralised quartz vein occupies a faulted, irregular fissure, striking on average 070° and dipping steeply to the south (Bartholomew, 1992). Host rocks are fine-grained arkoses.

The Bubi Greenstone Belt is situated about 70 km north of Bulawayo and most of the gold deposits within this belt are in mafic basalt.

- Lonely Mine. Ownership in 2001: Casmyn Corporation 100 per cent When the mine was closed in 1947, it had produced a total of 36,7 t Au, at an average grade of 15,8 g/t. Mineralisation is hosted in a quartz reef, striking north—south and dipping 60-80° to the east, and consists of both pyritic gold and native gold alloyed with silver, closely associated with chalcopyrite. Host rocks are mafic basalts. Casmyn Mining retreated dump material at a rate of 1 500 t/d, producing 13 kg Au per month in 2001. (Mining in Southern Africa, 1998b).

- Turk Mine. Ownership in 2001: Casmyn Corporation 100 per cent. Ore bodies up to 20 m thick, were mined in the past, producing 12,62 t Au at an average grade of 4,2 g/t. The Turk Mine is located 25 km south of Lonely Mine. Mining reached a depth of 800 m below surface. Casmyn Mining re-opened the Turk Mine and in 1996 poured its first gold from this mine Gold production averages 60 kg/m (Mining in Southern Africa, 1998b). In 1998 proven and probable accessible resources were 10 t of ore at 5,07 g/t Au, and proven and probable resources from the dumps were 2 056 t at 1,08 g/t Au (Resource Information Unit, 1999). The gold deposit at the Turk Mine is situated in a sequence of highly sheared and recrystallised metabasalt several hundered metres thick (Dziggel et al., 1998). Gold occurs as inclusions in pyrite within quartz veins and stringers. Chloritisation and carbonatisation can be observed on a regional scale, while sericitisation is restricted to local structures with¬in the highly deformed metabasalts. A new ore body (Eli Khulu) has been found at the Turk Mine. It has an aver¬age width of 10-15 m and has been defined over a length of 150 m. This open-pittable ore body has a 184 000-t reserve at 2,89 g/t Au.

- Queens Group Mines. Mining began in 1896 at the site of ancient workings. The Queens Group, located 30 km northeast of Bulawayo, included three mines. the Barberton, Czarina and Dawn. A quartz vein, striking northeast and dipping 82° northwest, occurs in a well-defined fissure within hornblendic carbonated greenstone. Associated minerals include pyrite, minor galena and sphalerite. The deposits yielded 10,6 t Au (Resource Information Unit, 1999) at an average grade of 14,9 g/t.

- B 8 S (Motapa) Mine. Ownership in 2001: AngloGold Ltd 100 per cent. The brecciated ore zone, cemented by quartz and impregnated by sulphides, is S-shaped in plan and the main ore shoots are associated with the shallowly dipping, north¬east-striking short limb. Host rock is greenstone. Production was about 9 467 kg from ores grading 4,3 g/t Au (Bartholomew, 1992). Some arsenic was also produced. Anglo American recently purchased these claims.

- Sunace Mine. The reef comprises multiple quartz veins in a thrust zone that dips at shallow angles (typically 15-20°) to the south (Pitfield and Campbell, 1996). Mineralisation varies from replacement-style stringers to substantial shear veins that are parallel or slightly oblique to the shear zone. Host rocks are mafic basalts. Recorded production from ores grading 12,9 g/t Au was 8 155 kg (Bartholomew, 1992). In addition, 0,97 t of scheelite were produced.

- Isabella (Calcite) Mine. Ownership in 2001: AngloGold Ltd 100 per cent. The Isabella Mine, located 80 km north of Bulawayo, started production in 1989. This opencast heap-leach operation is operated by Anglo American. Mineralised zones are in silicified shears of felsic schist in contact with mafic greenstone and phyllitic sediments (Elevatorski, 1995). Oxidised ores extend to a depth of approximately 25 m. Pyrite and arsenopyrite are the dominant sulfide minerals. Reserves are estimated at 700 000 t, grading 2,2 g/t Au. In 1998 it was producing at full capacity: 622 kg per annum (Resource Information Unit, 1999).

- MacCay Mine. Ownership in 2001: AngloGold Ltd 100 per cent. Anglo American opened the new MacCay Mine in August 1999. It is expected to produce 373 kg (12 000 oz) per year (Mining in Southern Africa, 1999e).

- Bubi Mine. Ownership in 2001: AngloGold Ltd 100 per cent. Anglo American opened the opencast Bibi Mine in mid- 1998. Gold is hosted in a shear zone. It is a low-grade deposit, averaging only 1 g/t from the oxide ore and less than 3 g/t from the more costly refractory sulphides. Mine life has been put at between two and three years, while the oxide ores are being processed, but should mining be extended to the sulfide ores, which are amenable to heap leaching, the mine's life could be extended by a further two years (Mining Mirror, 1998).

- Charliesona Mine. The Charliesona Mine had produced 1,49 t Au up to 1992. The four main ore bodies form an en echelon array within a well-defined, 70-m-wide, easterly dipping shear zone of intense carbonatisation (Pitfield and Campbell, 1996), striking north—south.

- Durban Mine. Most of the Durban Mine's production (1,47 t Au) has been derived from the near-vertical, northeast to east-northeast-striking Durban Reef. This reef, and subparallel reefs in the general vicinity, dip to the north-northwest on surface, and to the south-southeast with increasing depth. Host rocks are arkosic sandstone and greywacke.

- Morven Mine. Gold mineralisation is contained in lenticular quartz veins striking 095°, with steep dips to both the north and south. Host rocks are epidiorite. The principal sul¬phide mineral is pyrite. Total production is reported to be 1 421 kg with an average recovery grade of 16,7 g/t Au (Bartholomew, 1992).

- Cecil Mine. The Cecil Mine exploited quartz-hosted gold from two subparallel, northeast-striking, northwest-dipping (60°) shear zones that converge at depth. Host rocks are graphitic schist. A cumulative production of 1 207 kg Au has been recorded with an average recovery rate of 7,9 g/t.

Chipuriro Greenstone Belt

The Chipuriro Belt is near Chinhoyi in north- central Zimbabwe. One of the oldest mines in the coun¬try, Eldorado, occurs in this greenstone belt.

- Eureka Mine. Ownership in 2001: Delta Gold Ltd 100 per cent. Delta Gold's Eureka Mine produced its first gold on 6 June 1999 (Mining in Southern Africa, 1999c). The Eureka gold project is located on the site of an old under-ground mine 150 km north of Harare. Delta began exploring the property in January 1996 and completed a feasibility study in April 1998. Construction began in August 1998. At full production, the Eureka Gold Mine will be the second largest gold producer in Zimbabwe. The mine is expected to have a life of at least five years, based on current reserves and resources. Mineralisation occurs within three broad shear envelopes contained within a granodiorite body. The three main mineralised vein systems strike east—west and dip to the south at 45-50° (Mining in Southern Africa, 1999c). The mineralised vein systems converge into the highly silicified and mineralised nose of the granodiorite. The strike of the ore body is up to 300 m. Eureka has a total resource of 16,4 Mt at 2,3 g/t Au, and a probable reserve of 6,9 Mt grading 2,01 g/t Au (Resource Information Unit, 1999).

- Muriel Mine. Ownership in 2001: Coronation Syndicate, a subsidiary of Lonrho The Muriel Mine, named after the wife of its discoverer, has produced gold continuously since 1934. Quartz veins, striking east—west and dipping steeply south, are hosted within hornblende schist. Sulphide minerals present are chalcopyrite, pyrrhotite, pyrite, pentlandite and sphalerite. The veins are affected by isoclinal folding. In addition to 25 885 kg Au, 13 759 t of copper were also produced (Bartholomew, 1992) up to 1991

- .Eldorado Mine. Ancient workings were discovered by European settlers in 1894. Eldorado, located 10 km northeast of Chinhoyi, was a major producer from 1905-1919. Disseminated gold occurs in two shear zones, striking northeast and dipping steeply northwest, in conglomerates of the Shamvaian Group. One shear zone along footwall is in contact with sericite schist. Total production was 15 141 kg from ores grading 17,7 g/t Au (Bartholomew, 1992).

- Ayrshire Mine. This mine re-opened in 1993, but is currently dormant. Former production was 4 458 kg. The Ayrshire deposit is hosted in hornblende and chlorite schist. The host schist appears to be part of a large xenolith within and near to the western edge of a porphyritic granite. The ore body itself is a diorite which is auriferous over a thickness of between 3-30 m (Bartholomew, 1992). Shearing is intense. Gold occurs as low-grade disseminations in the diorite while higher-grade ores are in silicified zones within the chloritic shears (Elevatorski, 1995). It has been reported that 65 per cent of the gold recovered was in the form of fine native gold.

- Golden Kopje Mine. Ownership in 2001: Kinross Gold Corporation 100 per cent Mining began in 1982. Golden Kopje is located 19 km southwest of Chinhoyi. Ore bodies consist of a series of quartz-ankerite lenses, 1-3 m wide and 2-30 m long (Elevatorski, 1995). They occur within a fractured and contorted banded iron formation which strikes northeast and dips steeply northwest, enclosed between talcose schist and chlorite schist. Gold is associated with pyrite, pyrrhotite and chalcopyrite. In 1996 proven and proba¬ble reserves were 258 000 t, averaging 4,46 g/t Au (Resource Information Unit, 1999).

Harare (Shamva) Greenstone Belt

Known formerly as the Salisbury Greenstone Belt, this arcuate belt extends northerly from Harare to Mazoe, Bindura and Shamva

- Freda-Rebecca Mine. Ownership in 2001: Ashanti Goldfields Company Ltd 100 per cent. The deposit was first worked in 1912, but production ceased in 1917. Cluff Mineral Exploration re-opened the mine as an opencast operation in 1986 and the first gold was poured in mid-1988. From January 1996 the mine became part of the international Ashanti Goldfields Corporation. It produces 2 955 kg Au a year. Average grade is about 3 g/t Au. The ore occurs in two miner-alised shear zones (the Freda ore body and the Rebecca ore body), within a diorite host rock in a kidney-shaped body on the southwestern flank of a granodiorite stock which intruded into metasediments (Mining in Southern Africa, 1997d). The Freda shear zone, with a width of 20-80 m, strikes northeast—southwest and dips towards the southeast at about 25°. The Rebecca shear zone, with a width of 30-60 m, strikes northwest—southeast and dips towards the southwest at 35°. The two shears con¬verge towards the south and the mineralised shear zone extends about 50 m into the metasediments. The total strike length of the mineralisation from the eastern end of the Rebecca shear to the western end of the Freda shear is about 1,2 km. The dominant sulphides are pyrite, chalcopyrite, pyrrhotite and arsenopyrite. The oxidised ores are now depleted and the mining of sulfide ores is accomplished by combined open-pit and underground mining Total proven reserves in 1997 were 7,1 Mt of ore grading at 3,3 g/t Au, and total probable reserves 2,1 Mt grading at 3 g/t (Resource Information Unit, 1999).

- Shamva Mine. Ownership: Lonmin PLC (previously Lornho PLC) Mining at this deposit, located about 70 km northeast of Harare, commenced in 1909 and Shamva was one of the largest gold producers in Zimbabwe. It was still active in 1997. Annual gold production was in the 622-kg range. The high-grade ore of the upper levels has been mined out and extensive exploration is being conducted looking for open-pit and depth-extension potential in the area around the mine (Mining in Southern Africa, 1999d). The gold occurs within pyrite (54 per cent) and as free grains in quartz stringers (46 per cent), and is hosted within volcaniclastics of the Shamvaian Group (Elevatorski, 1995). Ores also contain some sphalerite and arsenopyrite. Mineralisation is controlled by fractures related to folding, and fracture intersections are particularly favourable for enhanced gold values.

- Phoenix Prince (Prince of Wales) Mine. About 1,5 km southeast of the Freda-Rebecca Mine is the Phoenix Prince shear. This deposit has been worked in the past, but operations ceased in 1962. This mine recovered 15,5 t Au. Host rocks are fractured diorite. Oxide ore reserves are estimated at about 1 Mt, with an average grade of 1 g/t Au (Mining in Southern Africa, 1997d). The oxide ore could be exploited by a heap- leach operation and there is also potential to delineate a sulphide ore body below the oxide cap. Mineralisation consists of pyrite and arsenopyrite, with minor galena, pyrrhotite and scheelite.

- Tafuna Hill. Tafuna Hill occupies an area of approximately 14 km2 and is located 5 km southeast of the Shamva Mine. The Tafuna Hill group of mines included the Alliance, Euchered, Forbes 19, Ilex, Joking, Top, Trio, Queens Gift, Tip Top and Teviot Mines. This topographic feature is well known for its remarkable concentration of auriferous veins and is the most extensively mineralised area within this greenstone belt. The ore bodies have variable strike and most dip between 30 and 50°. Tafuna Hill exists as a mafic 'island', entirely enclosed within Shamvaian sediments, comprising metabasaltic and metadoleritic greenstones and agglomerates/breccias assigned to the Tafuna Formation (Mugumbate, 1990). Total group production up to 1984 was 7 473 kg Au (average grade 13,8 g/t) and 15,45 t of scheelite.

- Gladstone Mine. Quartz veins and disseminations in a wide shear zone, that extends from the Arcturus Mine , were the sources of gold mined here and yielded about 5 487 kg. The Gladstone Mine is approximately 30 km east of Harare. The high-grade veins contained 26,8 g/t Au. Mineralisation occurs intermittently over a strike length of 12 km. Host rocks are actinolite schists.

- Kimberley Mine. Recorded production was 5 225 kg, from ores grading at 7,8 g/t Au. The deposit is located about 3 km east of Bindura. Quartz stringers and veins occur in a shear zone trending from 060° to 065°. Host rocks are hornblende schist and greywackes of the Shamvaian Group.

- Bernheim Mine. Approximately 6 km southwest of Mazoe, quartz veins occupy well-defined fissures which mainly strike east— west and dip steeply to the south. Host rocks are meta- basalt and metatuff. Production totalled about 3 484 kg from ores with an average grade of 7,2 g/t Au.

- Golden Quarry Mine. Ownership in 2001: Falcon Gold Zimbabwe Ltd 100 per cent Prior to Falcon Gold commencing open-pit mining in 1991, this mine had accumulated production of 289 kg of gold, grading at 6 g/t. The area is characterised by a rhyolite of the Upper Bulawayan Group with some small quartz veins striking south and southwest. The main quartz reef worked dipped 45-50° to the southeast, with widths of up to 1 m (Resource Information Unit, 1999). Reserves are estimated at 1 Mt, grading 2,5 g/t Au.

- Epsom Mine. A lenticular quartz vein, striking 170° and dipping 45-50° to the east, is hosted in strongly foliated actinolite-talc schist near a granite contact (Bartholomew, 1992). Reported gold production is 1 701 kg.

- Promoter Mine. Northwest-striking mineralised shears hosted in granite yielded 1 595 kg, grading 2,7 g/t Au (Bartholomew, 1992).

- Botha Mine. This low-grade deposit yielded 1 260 kg Au, grading at 2,1 g/t. Short gold shoots occur in east-southeast-striking fissures in granite.