Egypt

3 Salah Salem Road, Abbasiya, 11517, Cairo

Phone: +20-2-6828013/6855660

Fax: +20-2-4820128

egsma@idsc.gov.eg

http://www.egsma.gov.eg/

Phone: +20-2-6828013/6855660

Fax: +20-2-4820128

egsma@idsc.gov.eg

http://www.egsma.gov.eg/

Travel and accommodation

The contribution of mining to total exports in 2010 amounted to 9.9%

Egypt Mining News

The contribution of mining to total exports in 2010 amounted to 9.9%

Egypt Mining News

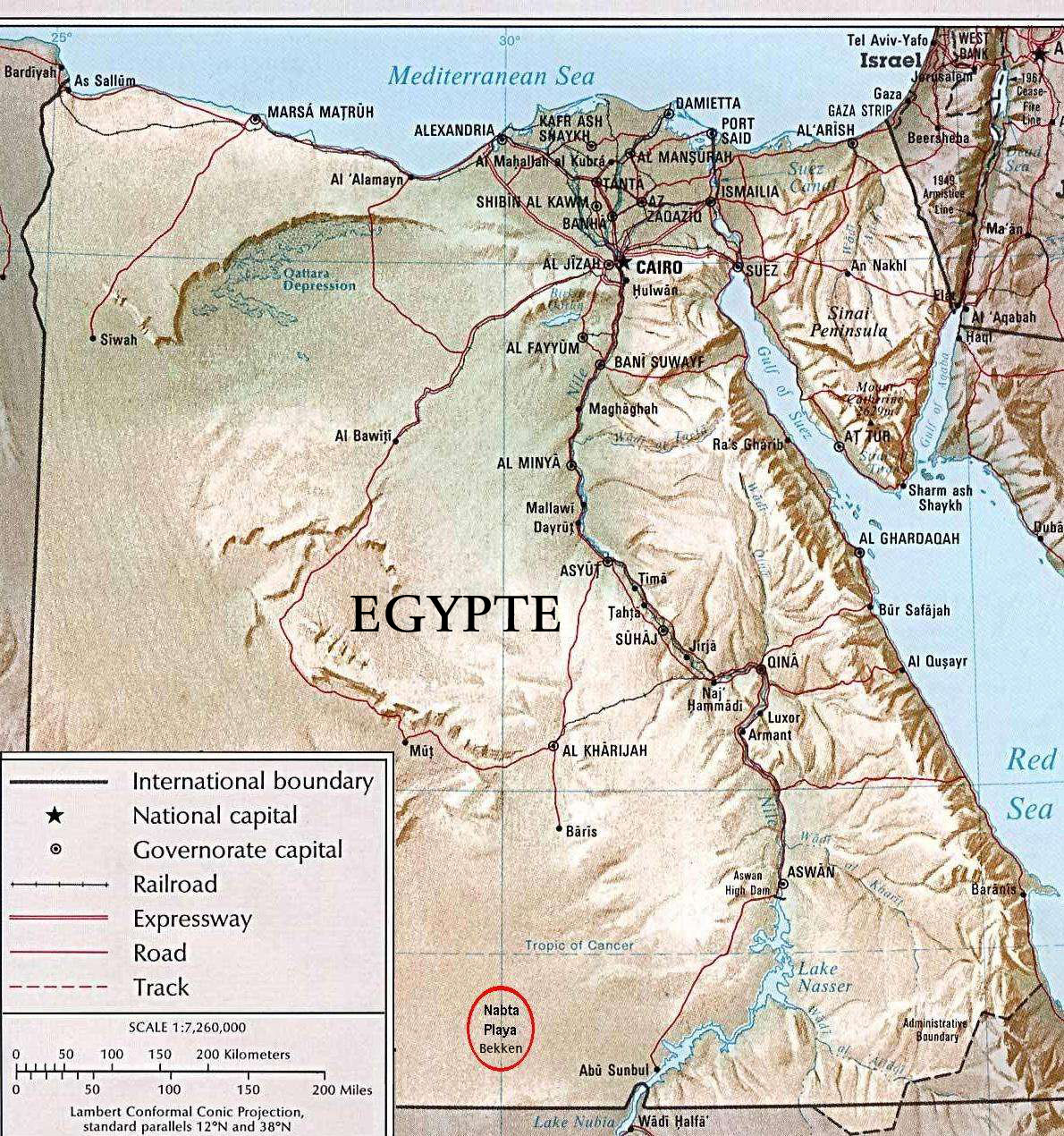

Source: CIA Factbook

Geology

The oldest rocks in Egypt are high-grade crystalline basement units that occur as isolated Archean (- early Proterozoic) inliers in the Western Desert; no other definite pre-Pan-African rocks have been identified elsewhere in Egypt, suggesting that much of the region was a stable craton between approximately 1800-800 Ma . The Eastern Desert corresponds to the Egyptian part of the Arabian-Nubian Shield along the coastal Red Sea region and is almost exclusively made up of accreted sequences of Neoproterozoic Pan African rocks. Thick Palaeozoic sedimentary strata mantle the basement rocks throughout Egypt in common with much of northeast Africa. Following a Hercynian hiatus, Cretaceous sediments are well exposed in various parts of the country. The Cenozoic history is characterised by a series of transgressions and regressions and their respective sediment types.

Mining

Gold and copper mineralisation occurs in Egypt but not generally of sufficient grade to be economically viable. Gold production from the Sukari Hills (current reserve of 10.29 Moz) started at the end of 2009. Mining of tin, tantalum and feldspar at Abu Dabbab (44.5 Mt) and Nuweibi (98 Mt) is expected to commence in 2012.

Non fuel mineral resources include gold, tin, tantalum, iron ore, phosphates, manganese, limestone, gypsum, talc, asbestos, lead and zinc. Egypt is Africa’s leading producer of talc (84.7%) and gypsum (up to 42%), the second largest producer salt (20.4%), third largest producer of phosphate (7.7%) and vermiculite (3.4%), 4th for iron ore (2.8%), 5th largest for fluorspar and 7th largest for manganese. Vermiculite, phosphate and talc production increased by 27, 31 and 8.4 per cent respectively whilst gypsum, ilmenite and iron ore output declined by 22.2, 18.5 and 17.1 per cent. Egypt is also a significant producer of metals in Africa being ranked second for pig iron (28.7%) and steel (35.9%), third for ferroalloys (3.4%) and aluminium (15%), and fifth for smelted copper (2.4%). Pig iron and ferroalloy production decreased in 2008

Oil & Gas

Natural gas, petroleum and petroleum products continue to be main mineral commodities produced by Egypt accounting for 12 per cent of GDP. Egypt is the second largest producer of natural gas and fifth largest petroleum producer in Africa accounting for 28.3% and 7.0% respectively of total output. Natural gas production continued to increase (5.7% in 2008). Crude petroleum output also increased (1.5% in 2008) but this is against an overall steady decline since its peak in 1993 and in 2008-09 Egypt became a net importer of oil. Proven reserves at the beginning of 2009 stood at 504.7 Mt of crude oil and 1.656 trillion m3 of natural gas.

Maps and images

- Egypt Google Satellite Maps

- Egypt Cities,Towns, Airports, Maps, Images

- Egypt Geology

- Egypt Geological Survey

- Egypt Image-1

- Egypt Image-2

- Egypt Image-3 Sukari Hill gold project, 25 km south-west of Marsa Alam

- Egypt Minerals

- Gulf of Aqaba / Sinai Peninsula.

- Spaceborne Imaging Radar image of the Safsaf Oasis (near Sudanese border.)

- Geological maps, Egypt.

- Shuttle Images: Desert Agriculture, Sand dunes West Central Egypt, Safsaf Oasis, Giza, Sinai,Dakhla Oasis.

Copper

- Gippsland Limited (Australian) is exploring the Abu Swayel copper-nickel prospect.

Gold in Egypt

Gold Home

Egypt has a long history of gold mining with the

earliest references to gold mining in the pre-4,000 BC period. It is estimated

that up to 3,000t of gold could have been mined by the Pharaohs from lands held

under their control. Within the Wadi Allaqi region the earliest reference to

mining is the Twelfth Dynasty of the Middle Kingdom (1991-1786 BC) when the

area was known as the region of Akita in the Land of Wawat. Mining probably

continued in episodes during the Pharaonic period. Further mining took place

during the Roman era from 181 BC to 5 AD and then again during Islamic times

from the ninth century up until the fourteenth century. In the early 1900s the

area was explored and mined by British and South African companies, principally

the Nile Valley Company Ltd at Um Garayat and Haimur, through to the 1920s.

Some small time mining continued through to the early 1950s.

Apart from limited regional exploration during the

1960s and 70s under the auspices of the United Nations there has been no

significant exploration or mining since the early 1950s when Egypt became a republic.

Geology

Porphyry granite, part of the Neoproterozoic (1000-542Ma) Arabian-Nubian Shield, hosts the gold mineralization at Sukari Hill.

Porphyry granite, part of the Neoproterozoic (1000-542Ma) Arabian-Nubian Shield, hosts the gold mineralization at Sukari Hill.

- Centamin Egypt Limited (AIM:CEY; ASX:CNT) is developing the Sukari Hill gold deposit, 25 km south-west of Marsa Alam, which had a resource of 167,18 million t @ 1,43 g/t Au or 7,70 million oz of gold, at a 0,5 g/t cut-off grade, based on data from 771 diamond and RC holes or approximately 156 000 meters of drilling. In May, 2007, the estimate increased to 194,42 million t at 1,44 g/t gold, using a 0,5 g/t cut-off grade or 9,01 million contained oz of gold. There were 10 drills on the site, with 9 working to expand resources. Discovery cost is low at about $4/oz, as energy costs come in around 0,14 cents per litre of diesel fuel. The company moved to the development stage without a bankable feasibility study, but plans to secure project financing early this year. Producing is forecast to commence in Q3 of 2008 at a rate of 4 million tonnes per annum – 200,000 oz per annum. A feasibility study to upgrade the project to a 4-5 million tonne per year operation is currently in progress. Centamin announced in August, 2007, that it had intersected a further high-grade zone of gold during its drilling programme at the Sukari project. This mineralized intersection sits outside the current optimized pit shell and also outside the upgraded 9,79-million oz JORC compliant resource of 2,5-million oz measured, four-million oz indicated and 3,3-million oz inferred, which was announced earlier that month. The drilling intersected a wide high grade zone of mineralisation of 65 m at 18,31 g/t gold and within this was a higher grade zone of 5 m at 209,43 g/t gold. In September, 2007, the resource stood at at 212,83 million tonnes grading 1.53 g/t Au which included 2.6 million oz in the measured category. Further drilling upgraded the mineral resource to 7.46 million oz measured and indicated, plus 3.7 million oz inferred by December, 2007. Geological sampling and mapping at several other regional prospects close to the main Sukari gold mine also returned strongly gold anomalous results requiring follow up. Production at dual-listed Centamin’s Eqypt-based Sukari gold mine increased by 39% year-on-year to a record 93 624 oz for the three months ended June 30 2013, as the processing plant continues to see improvements in productivity and availability. The higher output, which was an 8% improvement on that of the first quarter of the year, came on the back of a 4% quarter-on-quarter increase in openpit material movement to 11.02-million tonnes. Quarterly throughput at the Sukari process plant was a record 1.42-million tonnes, a 12% increase on the prior year period and a 1% increase on that of the first quarter. As a result, the plant exceeded its nameplate annualised rate of five-million tonnes for the second successive quarter. Similarly, openpit ore production increased by 39% quarter-on-quarter to 2.96-million tonnes, which led to an increase in the run-of-mine ore stockpile balance from 432 000 t to 1.19-million tonnes at the end of the period. In addition, the underground mine delivered 142 000 t, up 19% on the first quarter. The latest guidance figure for 2014 is to produce 420,000 ounces of gold at a cash cost of around US$700/ounce which makes it a significant-sized gold mining operation by any standards. This represents an 18% increase on 2013's production of 356,943 ounces and will be yet another year of output growth which has been achieved each year since the mine started up. Centamin reported on !3 May 2015 a 55% year-on-year increase in earnings before interest, taxes, depreciation and amortisation (Ebitda) to $53-million for the quarter ended March 31. This was owing to a 6% year-on-year drop in the realised gold price to $1 216/oz being offset by a 41% increase in gold sales to 111 249 oz and a 4% decrease in cash cost of production to $717/oz. The all-in sustaining cost (AISC) for the quarter was $858/oz. CEO Andrew Pardey commented in a statement to shareholders that the financial performance for the quarter reflected efficiency improvements at the expanded Sukari operation, as well as a reduction in the fuel price. “Our full year production forecast remains 420 000 oz at a cash cost of production of $700/oz and an AISC of $950/oz,” he added. Further, the gold miner reiterated that grade improvements from the openpit and underground operations at its Sukari mine would enable the company to achieve production rates of 450 000 oz/y to 500 000 oz/y from the second half of this year. The Sukari mine produced 108 233 oz of gold in the quarter under review, a 46% increase on the 74 241 oz produced in the first quarter of 2014

- Gippsland Ltd (Australian) is exploring the ancient gold workings of the Wadi Allaqi area, located to the south-east of Aswan, south-eastern Egypt.

- AngloGold Ashanti’s exploration in the Middle East and North Africa is conducted through a regional strategic alliance with Dubai based Thani Investments. Since the inception of the alliance in mid-2009, significant progress has been made on advancing exploration projects on the Wadi Kareem and Hodine concessions in Egypt. The Hutite project, located on the Hodine concession, is an orogenic gold deposit where the alliance has to date completed 54 diamond holes for a total of 12,352m. Visible gold and significant intercepts have been returned from many of the completed diamond holes. Mineralisation extends over a strike length greater than 1.6km.

- The Dungash gold mine is located in the Eastern Desert of Egypt, 200 km NE of Aswan, between the River Nile and the Red Sea.

Mineralisation is hosted by an ENE-WSW-trending boudinaged quartz veins along a shear zone in altered greenschist facies andesitic meta-volcanic and meta-sedimentary host rocks of Pan-African Proterozoic age.

Ore mineralogy includes pyrite, arsenopyrite ± pyrrhotite ± chalcopyrite ± galena. Au is disseminated in the alteration haloes, but also occurs in the veins as needles or blebs in fractures in altered arsenopyrite ± pyrrhotite, usually next to fragments of altered country rocks.

The principal hydrothermal alteration minerals comprise chlorite, sericite, carbonate and silica accompanied by the gold-sulphide, mineralisation is associated with both the quartz veins, but also occurs as disseminations in the wall rocks controlled by the foliation, fracturing and shearing of those wall rocks.

Oil and Natural Gas

Proven

reserves

Oil:

4 400mmbbls

Gas:

77.2Tcf

The national oil company is Egyptian General Petroleum Corporation(EGPC)

The key players are

Caracal

Energy

Kuwait

Energy

Dana

Gas

Shell

BP

Eni

Transglobe

Energy

Highlights

in 2014

• Egypt is the largest non-OPEC oil

producer in Africa and the second-largest dry natural gas producer on the

continent.

• Egypt plays a vital role in international

energy markets through the operation of

the Suez Canal and Sumed (Suez-Mediterranean) pipeline.

• One of Egypt’s challenges is to

satisfy increasing domestic demand for oil amid falling domestic production.

• Egypt is in a serious energy crisis

due to the in adequacy of its energy delivery infrastructure as it is unable to

handle the energy demand of the country.

• Egypt has the largest refinery capacity

in Africa and holds 23% of the continent’s total refinery capacity.

• Egypt is a significant oil producer

in North Africa and a rapidly growing natural gas producer.

Recent developments

• Egypt’s refinery capacity is

planned to increase in 2015 when a new 96000-bbl/d refinery next to the Mostorod

refinery in Cairo begins operation. Construction of the facility began in 2012.

• Improved Petroleum Recovery (IPR)

announced the discovery of a new oil well in the field of Yidma in Alamein,

located in the Western Desert.

• Apache announced two gas and condensate discoveries in Egypt’s

Western Desert.

• Caracal Energy is acquiring fellow North Africa-focused TransGlobe Energy Corporation for

CAD695 million. The companies said the merger would create one of the largest

independent Africa-focused oil producers, poised for strong growth in oil

production and reserves from development and exploration in Chad and Egypt.

• IPR announced an oil & gas discovery by its first well in its

Southwest Gebel El Zeit concession located offshore in the Gulf of Suez.

Click HERE for an overview

Overview Egyptian oil and gas industry by EIA

Egypt Déjà Vu - Thina Margarethe Saltvelt, Ph.D

Oil & Gas companies

Egypt Déjà Vu - Thina Margarethe Saltvelt, Ph.D

Oil & Gas companies

- Egyptian General Petroleum Corporation (EGPC, State Oil Company).

- BG.

- Agip (ENI).

- Gulf of Suez Petroleum Company (GUPCO).

- BP Amoco.

- Centurion Energy International Inc. Projects in Egypt.

- Tullow Oil (details of exploration and development activities in Egypt).

- Melrose Resources Plc (a UK based oil and gas exploration, development and production company with interests in Egypt, Bulgaria and the United States).

- Veba Oil and Gas: activities in Egypt.

- OilEgypt.com: Egypt portal for oil, gas and hydrocarbon industries.

Though Egypt’s net exports of crude oil and petroleum products have declined in recent years, higher prices on world markets have pushed Egypt's oil revenues upward. The country also began exports of liquefied natural gas (LNG) in January 2005, adding to its hydrocarbon revenues.

According to the Oil and Gas Journal, Egypt’s estimated proven oil reserves stand at 3.7 billon barrels, or 0.3 percent of world reserves, while crude oil production averaged 579,000 bbl/d in 2005, less than 1 percent of world production. Egypt is hoping that exploration activity, particularly in new areas, will discover sufficient oil in the coming years to slow recent annual declines in output. Egyptian oil production comes from four main areas: the Gulf of Suez (about 50 percent), the Western Desert, the Eastern Desert, and the Sinai Peninsula.

- Oil production: 700,000 bbl/day (2005 est.)

- Oil exports: 134,000 bbl/day (2004 est.)

- Oil proved reserves: 2.6 billion bbl (2006 est.)

- Natural gas production: 32.56 billion cu m (2004 est.)

- Natural gas exports: 1.1 billion cu m (2004 est.)

- Natural gas proved reserves: 1.657 trillion cu m (1 January 2005 est.)

- Oil from the Gulf of Suez basin is produced mainly by Gupco (Gulf of Suez Petroleum Company) under a Production Sharing Agreement (PSA) between BP and the Egyptian General Petroleum Corporation (EGPC). Production in the Gupco fields, with most wells in operation since the 1960s and 1970s, has fallen in recent years. Gupco is attempting to slow the natural decline in its fields through significant investments in enhanced oil recovery (EOR) as well as in increased exploration. In May 2003, BP announced a large new find, the Saqqara field, which represents the largest new crude oil discovery in Egypt since 1989. Located offshore adjacent to the existing El-Morgan field, it is expected to begin commercial production in 2007. With estimated peak production of around 40,000 to 50,000 bbl/d this find may stem the decline in overall Gulf of Suez production.

- Egypt's second largest oil producer is Petrobel, which is a joint venture between EGPC and Eni of Italy. Petrobel operates the Belayim fields near the Gulf of Suez and also is undertaking an EOR program to stem declining production. A joint venture between EGPC and Eni also is producing about 40,000 bbl/d from an area in the Qattara Depression in the Western Desert, in the Meleiha and West Razzaq blocks.

- Other major companies in the Egyptian oil industry include Badr el-Din Petroleum Company (EGPC and Shell); Suez Oil Company (EGPC and Deminex); and El Zaafarana Oil Company (EGPC and British Gas).

- Egypt's overall oil production has been declining more slowly than in the Gulf of Suez fields, due to new output from independent producers like Apache Corporation and Seagull Energy Corporation at smaller fields, especially in the Western Desert and Upper Egypt. Since 2000, Western Desert production has risen substantially, accounting for roughly 27 percent of total oil production, more than double 2000 levels. Of additional significance is that oil in this area is on average cheaper to produce and lighter than other domestic crudes. Apache and Seagull also have developed the Wadi El-Sahl field in the South Hurghada block, which is producing around 20,000 bbl/d. Khalda Petroleum, a joint venture between Apache and EGPC, produces around 50,000 bbl/d in the Western Desert in the Khalda and East Bahariyya areas.

- Firms are beginning to explore offshore oil production possibilities in the Mediterranean. The largest concession was awarded to Shell in February 1999 for a large deepwater area off Egypt's Mediterranean coast. Shell reportedly is optimistic about the prospects for its North East Mediterranean Deepwater (NEMED) concession, but drilling so far has yielded natural gas rather than significant quantities of oil.

- A smaller offshore concession was awarded to Eni. While most offshore discoveries in the Nile Delta have been natural gas, it is believed that there may also be significant quantities of oil in the area.

- EGPC awarded five exploration contracts in July 2004 to a newly-formed, state-owned upstream oil firm, Tharwa Oil. Four of the five concessions cover unexplored areas of the Western Desert, with the fifth covering an offshore block in the Mediterranean.

- Burren Energy of the UK also was awarded two blocks in the Gulf of Suez under the 2004 licensing round, which closed in January 2005. Other awards under the 2004 licensing round are still pending.

Tantalum

The Ta-Nb-Sn mineralization of Abu Dabbab is represented by disseminated cassiterite and niobio-tantalite, hosted in a stock of aplogranite. The aplogranite at Abu Dabbab is leucocratic, holocrystalline, white grey to greenish blue and with manganese oxide spots and dendrites. It is mostly fine to medium grained and occasionally has a porphyritic texture.

- Gippsland Limited (Australian) is developing and exploring the 40 million tonne Abu Dabbab and the 98 million tonne Nuweibi tantalum-tin projects located in the Central Eastern Desert of Egypt, adjacent to the western shore of the Red Sea.The Abu Dabbab deposit is covered by two Exploitation Leases granted in the name of Tantalum Egypt JSC, a company incorporated in Egypt and owned 50% by the Egyptian Government via the Egyptian Mineral Resources Authority (EMRA) and 50% by Tantalum International Pty Ltd which is a 100% owned subsidiary of Gippsland Ltd. Measured, indicated and inferred resources are 39, 9 million tonnes at a 0,01% Ta2O5 cut-off and a grade of 0,0252% Ta2O5, 0,0116% Nb2O5 and 0,089% Sn. The board of ASX-listed Gippsland approved the expansion of theprocessing plant at the Abu Dabbab alluvial tin project, in October 2012. The company said that it the board had approved the immediate purchase of a demountable modular gravity separation plant with a nominal treatment capacity of 50 t/h of minus 2 mm alluvial material. The spiral plant was scheduled for delivery in early January 2013, and would be in full production by the end of that month. It was expected that a total capital investment of around $550 000 would be required, with the payment of $440 000 deferred until March 2013. Gippsland said in a statement that the combined production capacity and improved recovery was expected to increase cassiterite production from the then current rate of between ten t/m and 12 t/m to around 145 t/m. It was expected that a total of around 640 t of tin, contained in 55% tin cassiterite concentrate, would be recovered over a project life of around eight months after the start of the spiral plant production. Revenue from tin concentrate sales over this period would reach some $12.4-million, assuming a tin price of $20 000/t.

References

Geoscience Societies and Authorities

Geoscience Societies and Authorities

Academic Geological Studies

- Palaeogeographic maps Carboniferous-Pliocene Egypt (IGCP 369).

- North Africa-Arabia Working Group at the University of Bremen, studying the Cretaceous-Early Tertiary of Egypt.

- Controls on Oligo- Miocene syn-rift sedimentation, Gulf of Suez, Sinai, Egypt (Prof. J. R. Underhill, Seismic and Sequence Stratigraphy Group, University of Edinburgh).

- Miocene Syn-rift development in the Gulf of Suez (Basin and Stratigraphic Studies Group, University of Manchester).

- Short note in Bild der Wissenschaft (in German) about Late Paleocene Thermal Maximum in Egypt(based on research by Dr. Robert Speijer and Dr. Tom Wagner, Univ. Bremen).

- Environmental impacts on the geomorphological and hydrogeological aspects of north Sinai, Egypt (Mohamed El Alfy, Freiberg University / Germany and Mansoura University / Egypt).

- Neogene climate reconstructions NE Africa (Prof. Pachur, Free University, Berlin).

- The Red Sea Basin Province: Sudr-Nubia and Magna Petroleum Province. By S. Lindquist (USGS Open File Report).

- The Mangrove Coast of Florida as a Modern Analogue for the Cretaceous Paralic Environments of Egypt (abstract by Kenneth Lacovara, Drexel University).

- Geology and Geography of the Nile Basin.

- Bahariya Dinosaur Project. A new web site with information on paleoecological research being undertaken in the Egyptian Sahara.

- Bahariya Dinosaur Project, Great Western Desert, Egypt (Kenneth Lacovara, Drexel University).

- Bahariya Dinosaur Project, Great Western Desert, Egypt (Department of Earth and Environmental Science, University of Pennsylvania).

- West's Geology Directory (Egypt).

- Homepage of Associate Professor Abdeldayem (paleomagnetist) at Tanta University, Egypt.

- DinoData Egypt: information on dinosaur fossils found in Egypt.

- Geology of Sinai.

- Geology of Egypt: webpage on the AAPG website.

- Geology of Egypt: webpage of Professor A. Allam, Faculty of Science, Helwan University, Cairo, Egypt. Contains abstracts and results from a number of papers relating to the geology of Egypt.

- Geology of Abu Zeneima's surroundings (Western Sinai, Egypt): webpage covering the geology of the area and relevant links. Produced by Daniel Marty-El Bokeili, a member of the Paleontology Group of the Geological and Paleontological Institute, Basel, Switzerland, following an internship at the Sinai Manganese Company in Abu Zeneima, Egypt.

- FrOGTech Egypt report, focus on tectonostratigraphic framework

- Geocomp (Cairo): Sedimentological and Biostratigraphical services for the petroleum industry in Egypt

- Earth Resources Exploration (EREX) - Petroleum Consultants, based in Cairo. Products and services include a multiclient Gulf of Suez study, biostratigraphy, sedimentology, courses, field seminars etc.

- Eastern Mediterranean seep-seismic study, by Infoterra (formerly NRSC).

- Satellite structural interpretation for hydrocarbon exploration (Red Sea, Sinai), by NPA.

- Exploration data / reports offered by First Exchange.

- Geochemistry data Egypt (by the British Geological Survey).

- Hydrocarbon potential Gulf of Suez (by MEGE).

- TGS-NOPEC is a global provider of non-exclusive seismic data and associated products to the oil and gas industry. NDD-AM-97 Nile Delta Deep Aeromagnetic Survey 1997 Blocks B and C - offshore Egypt.